The First $100000 Is the Hardest

The first $100000 is the hardest. This is especially true if you are coming out of school with little money to start and maybe have a decent amount of debt. Granted, it is possible to earn your bachelor’s degree with no debt, but I will leave that for another article. The only real assets that you have is your skill, education, and maybe a job. Getting to $100000 or even 100,000 GBP in savings and investing seems daunting. But it can be done with some disciple, persistence, and consistency. Now, let’s talk about why I think that in the process of building wealth the first $100000 is the hardest.

Charlie Munger is a billionaire. He is Warren Buffet’s business partner at Berkshire Hathaway. He is also a lawyer, and investor. But he is probably most known for changing Buffet’s investment philosophy from one focused on fundamentally cheap stocks to one focused on high quality businesses that compound over time. There are some good books on Charlie Munger including one called “Damn Right: Behind the Scenes with Berkshire Hathaway Billionaire Charlie Munger.” There is a paragraph from the book that is very insightful:

Munger has said that accumulating the first $100000 from a standing start, with no seed money, is the most difficult part of building wealth. Making the first million was the next big hurdle. To do that a person must consistently underspend his income. Getting wealthy, he explains, is like rolling a snowball. It helps to start on top of a long hill—start early and try to roll that snowball for a very long time. It helps to live a long life.

Here is another version of the same quote attributed to Munger:

The first $100000 is a bitch, but you gotta do it. I don’t care what you have to do—if it means walking everywhere and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on $100000. After that, you can ease off the gas a little bit.

Munger pretty much identifies the three key points that I make in this blog to build wealth: spend less than you earn, invest, and compound. These are also the three key principles almost all the Secret Dividend Millionaires followed.

The First $100000 is the Hardest Since You Spend More Than You Earn

For some people the first $100000 is the hardest because they never figure out how to spend less than they earn. It takes planning a budget and paying off debt, creating an emergency fund, and then investing. I would argue that this is not hard, it just takes discipline, persistence, and consistency.

The important part is that the amount you save early on in your journey to financial independence matters far more than your investment returns. Let’s run some numbers using a handy investment calculator. If you save $1,000 per year (assuming an annual investment) at 8% return means that it takes 28.62 years to build that first $100000. But if you save $5,000 per year then the time drops to 12.68 years, and if you save $10,000 per year the time drops even further to 8 years. On the other hand, if your return jumps up to 10% per year it still takes 7.55 years to attain $100000. There is one other point that come out of this example. It is never too late to start. Granted, starting early helps. But even if you are starting at age 40 you can reasonably hit your first $100,000 in about 8 years or so and be in a pretty good position by 60 or 65.

The First $100000 is the Hardest Since You Don’t Invest

Next, the first $100000 is the hardest since some people never figure out how to invest. They kind of just jump right in and make too many mistakes. In my opinion that is not a good plan since real money is at risk. If you want to educate yourself more about investing and dividends, then I suggest taking a course. The Simply Investing Course* is a good value and fairly comprehensive.

The main problem on why the first $10000 is the hardest is that people do not develop a workable plan that they can stick with. The reason that I like dividend growth investing is that it is simple and has been proven to work. If you don’t believe me take a look at my article on the Secret Dividend Millionaires. Dividend growth investing also has some advantages in that costs are low, you are in charge and have control, and you don’t need to sell investments.

The First $100000 is the Hardest Since You Don’t Stay Invested

Lastly, the first $10000 is the hardest for some people since they do not stay invested and leverage the power of compounding. They do not let their money work for them. This is an important aspect of building wealth. Once you get to $100000 the power of compounding starts to become significant. A 3% dividend yield on $100000 is $3,000. When that $3,000 is reinvested it adds to your total value and next year you have $3,090 in dividends and that does not include any new money that you add.

If you leverage the power of compounding your money grows. If done right, your second $100000 should be attained faster than your first $100000. If you have $100000 to start with there are other investing options as well. Ultimately, your saving and investing snowballs as the years pass and then you make it to the $1 million mark. It just takes time to achieve your FI number.

Dividend Increases and Reinstatements

Northwest Natural Holding (NWN) hiked the dividend by 0.5% to $0.48 per share from $0.4775 per share. This is the 65th consecutive increase placing Northwest Natural on the Dividend Kings List. It is also one of only 9 companies to have raised the dividend for 60+ years in a row.

McDonald’s (MCD) raised the dividend 3.2% to $1.29 per share from $1.25 per share. McDonald’s paid its first dividend in 1976. The current increase is the 45th consecutive one making the stock a Dividend Champion and Dividend Aristocrat.

RPM International upped its dividend 5.6% to $0.38 per share from $0.36 per share. This is the 47th consecutive increase making the stock a Dividend Champion.

KB Homes (KBH) hiked its dividend an impressive 66.7% to $0.15 per share from $0.09 per share.

In other news, International Business Machines (IBM), a newly minted Dividend Aristocrat, announced a major organizational change. IBM is spinning off its Managed Infrastructure Service Unit into a new company in a tax-free deal by end of 2021. Reportedly, the combined company will have a dividend no less than IBM’s current dividend. The new IBM will focus on hybrid cloud.

Coronavirus Dividend Cuts and Suspensions List

I updated my coronavirus dividend cuts and suspensions list this past Wednesday. The number of companies on the list has risen to 422. We are well over 10% of companies that pay dividends having cut or suspended them since the start of the COVID-19 pandemic. The number of companies on the list continues to rise each week.

One company was added to the list in the past week: Mack-Cali Realty (CLI).

I included 9 companies that I had previously missed. The 9 companies that I previously missed were Veolia Environment S.A. (VEOEY), Golar LNG Partners LP (GMLP), American Eagle Outfitters (AEO), BP Prudhoe Bay Royalty Trust (BPT), Blackbaud (BLKB), CNH Industrial N.V. (CNHI), Maxim Integrated Products (MXIM), TechnipFMC PLC (FTI), and Coty (COTY).

I added a detailed discussion of Marriott International (MAR) dividend suspension this past week. Marriott is facing unprecedented challenges as the coronavirus has reduced both leisure and business travel. I add a new article on a dividend suspension or cut almost every week.

Market Valuation – The First $100000 Is The Hardest

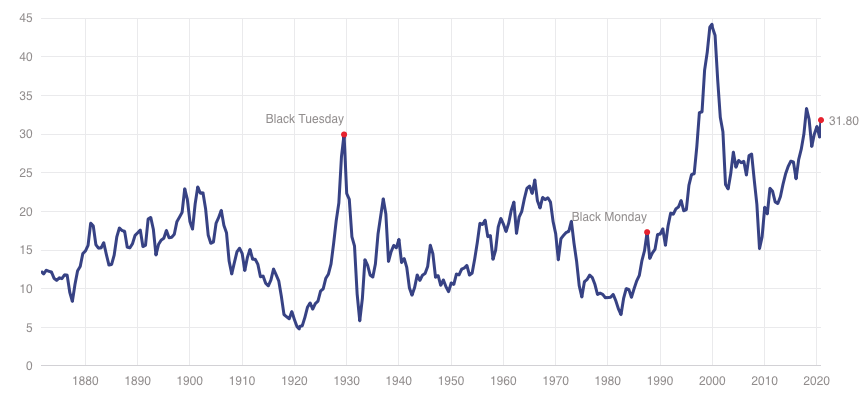

The S&P 500 is trading at a price-to-earnings ratio of 35.0X and the Schiller P/E Ratio is at about 31.8X. These went up quite a bit since last week. This is the second increase in two weeks for these valuation metrics. Note that the long-term mean of these two ratios are 15.8X and 16.7X, respectively. I continue to believe that the market is overvalued at this point. I personally view anything over 30X as overvalued.

Such a large jump in the P/E ratio is rare but stocks had a very solid week. This was likely combined with some lower forward earnings estimates.

S&P 500 PE Ratio

Shiller PE Ratio

Stock Market Volatility – CBOE VIX

The CBOE VIX measuring volatility came down over 2.5 points to 25.0. This is first real decline since late-August. The VIX still remains elevated relative to the long-term average. The long-term average is approximately 19 to 20.

Whether the decrease is sustainable or not is debatable. I think we will continue to see elevated volatility until the election. In addition, federal stimulus seems to be on the table and then off the table. But at this point it looks like we will not see anything be signed into law until after the election based on statements for Congressional leaders. In the meantime, the economy seems to be chugging along but not doing great at this juncture.

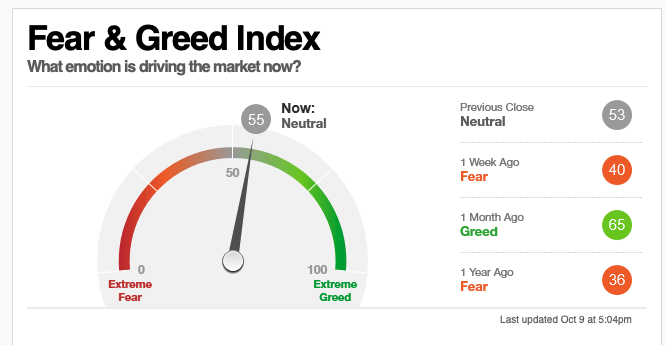

Fear & Greed Index

I also track the Fear & Greed Index. There are seven indicators in the index. They are Put and Call Options, Junk Bond Demand, Market Momentum, Market Volatility, Stock Price Strength, Stock Price Breadth, and Safe Haven Demand.

The current reading is now at 55, which is in Neutral. The index moved up 15 points from last week after a 9 week drop the week before. Five weeks ago, the index was in Extreme Greed at a reading of 77.

Less of the sub-indices are now signaling a Fear than the past two weeks. Junk Bond Demand is indicating Extreme Greed and Market Momentum is signaling Greed. Three of the sub-indices are signaling Neutral. Market Volatility is near the neutral average. For Safe Haven Demand, stocks are now outperforming bonds 5.92% over the past 20 trading days, which in the normal range. For Put and Call Options, the volume of put options is lagging the volume of call options by 50%. Both Stock Price Breadth and Stock Price Strength are indicating Fear. Market breadth is improving and there are more advancing issues than declining issues. But it is still at the lower end of the range. The number of stocks hitting 52-week highs is now trending up.

Unemployment Numbers

The number of weekly new unemployment claims were down with last week at 840,000. This is down 9,000 from last week’s revised numbers. We seem to be bouncing around between 800,000 and 1 million for now. But for some perspective, one-year ago weekly unemployment claims were only about 212,000. Currently we are 4X the normal level. The seasonally adjusted insured unemployment rate was 7/5%. The weekly revised rate is now 8.1% to 8.2%

The ten states with the highest unemployment rates were Hawaii (20.1), California (16.1), Nevada (13.7), Puerto Rico (12.2), the Virgin Islands (12.1), Louisiana (11.4), New York (11.1), Georgia (10.9), District of Columbia (10.4), and Michigan (10.2).

Economic News

The U.S. trade deficit increased by 5.9% to $67.1 billion in August. This is the highest level since August 2006. Imports rose 3.2% to $239 billion, driven by pharmaceutical ingredients, passenger cars, and crude oil. Exports rose at a slower 2.2% to $171.9 billion driven by soybean.

The number and rate of U.S. job openings stayed at 6.5 million and 4.4% respectively in August. The number of job openings dropped slightly for private (-242,000) and changed by only a small number for government. Hiring in August was about the same as in July, but a lot slower than May or June. There were about 13 million unemployed and 6.5 million job openings.

Here are my recommendations:

If you are unsure on how to invest in dividend stocks or are just getting started with dividend investing. Take a look at my Review of the Simply Investing Report. I also provide a Review of the Simply Investing Course. Note that I am an affiliate of Simply Investing.

If you are interested in an excellent resource for DIY dividend growth investors. I suggest reading my Review of The Sure Dividend Newsletter. Note that I am an affiliate of Sure Dividend.

Read my Review of Stock Rover if you want leading investment research and a portfolio management platform with all the fundamental metrics, screens, and analysis tools you need. I am an affiliate of Stock Rover.

If you would like notifications as to when my new articles are published, please sign up for my free weekly e-mail. You will receive a free spreadsheet of the Dividend Kings! You will also join thousands of other readers each month!

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor, analyst, and writer on dividend growth stocks and financial independence. His writings can be found on Seeking Alpha, InvestorPlace, Business Insider, Nasdaq, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial sites. In addition, he is part of the Portfolio Insight and Sure Dividend teams. He was recently in the top 1.0% and 100 (73 out of over 13,450) financial bloggers, as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.

Power –

$100K was easily the hardest milestone I ever crossed. Once you get through that barrier, you more than likely have built up the habits and have more things on auto pilot in regards to saving. It’s even easier/better if your investments/investing is on autopilot, as well. However, I couldn’t agree more on the first $100k!

-Lanny

Yes, I agree. Once I cleared the first $100k the next one was much easier. The main part is the habits required to get there.