A special dividend is a one-time distribution of a company’s profits to its shareholders in addition to its regular dividend payouts. Special dividends are not guaranteed and are declared at the discretion of the company’s board of directors. They can vary significantly in amount and frequency. They should be considered a bonus on top of the regular dividend. This article provides a list of companies that have issued special dividends ands answers to FAQs.

The special dividends list was created at the request of a reader. A link to this post is included in the weekly stock market news review article and the free weekly newsletter.

List of Special Dividends

| Ticker | Company Name | Special Dividend Amount | Date |

|---|---|---|---|

| SFDL | Security Federal Corporation | $0.10 | 4/15/25 |

| AFG | American Financial Group Inc. | $2.00 | 3/28/25 |

| CNA | CNA Financial Corporation | $2.00 | 3/13/25 |

| TBNK | Territorial Bancorp Inc. | $0.01 | 2/28/25 |

| F | Ford | $0.15 | 2/17/25 |

| CME | CME Group Inc. | $5.80 | 1/16/25 |

| ORI | Old Republic International Corp. | $2.00 | 1/15/25 |

| WEYS | Weyco Group | $2.00 | 11/18/24 |

| AFG | American Financial Group Inc. | $4.00 | 11/26/24 |

| TDG | TransDigm Group Incorporated | $75.00 | 10/18/24 |

| CNA | CNA Financial Corporation | $2.00 | 3/7/24 |

| AFG | American Financial Group Inc. | $2.50 | 2/28/24 |

| F | Ford | $0.18 | 2/14/24 |

| CME | CME Group Inc. | $5.25 | 1/18/24 |

| COST | Costco Wholesale Corporation | $15.00 | 1/12/24 |

| BKE | Buckle, Inc. (The) | $2.65 | 12/15/23 |

| TDG | TransDigm Group Incorporated | $35.00 | 11/27/23 |

| AFG | American Financial Group Inc. | $1.50 | 11/22/23 |

| GFF | Griffon Corp. | $2.00 | 5/19/23 |

| CNA | CNA Financial Corporation | $1.20 | 3/9/23 |

| AFG | American Financial Group Inc. | $4.00 | 2/28/23 |

| F | Ford | $0.65 | 2/9/23 |

| CME | CME Group Inc. | $4.50 | 1/18/23 |

| AFG | American Financial Group Inc. | $2.00 | 11/22/22 |

| ORI | Old Republic International Corp. | $1.00 | 9/15/22 |

| TDG | TransDigm Group Incorporated | $18.50 | 8/26/22 |

| ETD | Ethan Allen Interiors Inc. | $0.50 | 8/14/22 |

| GFF | Griffon Corp. | $2.00 | 7/20/22 |

| AFG | American Financial Group Inc. | $8.00 | 5/27/22 |

| AFG | American Financial Group Inc. | $2.00 | 3/22/22 |

| CNA | CNA Financial Corporation | $2.00 | 3/10/22 |

| CME | CME Group Inc. | $3.25 | 1/14/22 |

| AFG | American Financial Group Inc. | $2.00 | 12/30/21 |

| BKE | Buckle, Inc. (The) | $1.00 | 12/16/21 |

| AFG | American Financial Group Inc. | $4.00 | 11/22/21 |

| FULT | Fulton Financial Corporation | $0.08 | 11/19/21 |

| CNS | Cohen & Steers Inc. | $1.25 | 11/11/21 |

| ORI | Old Republic International Corp. | $1.50 | 10/6/21 |

| AFG | American Financial Group Inc. | $4.00 | 10/5/21 |

| ETD | Ethan Allen Interiors Inc. | $0.75 | 8/15/21 |

| AFG | American Financial Group Inc. | $2.00 | 8/2/21 |

| AFG | American Financial Group Inc. | $14.00 | 6/15/21 |

| ETD | Ethan Allen Interiors Inc. | $0.75 | 5/9/21 |

| CNA | CNA Financial Corporation | $0.75 | 3/11/21 |

| CWH | Camping World Holdings, Inc. | $0.14 | 2/26/21 |

| ORI | Old Republic International Corp. | $1.00 | 1/15/21 |

| CME | CME Group Inc. | $2.50 | 1/13/21 |

| BKE | Buckle, Inc. (The) | $5.65 | 1/8/21 |

| AFG | American Financial Group Inc. | $2.00 | 12/29/20 |

| COST | Costco Wholesale Corporation | $10.00 | 12/11/20 |

| CNS | Cohen & Steers Inc. | $1.00 | 11/12/20 |

| CNA | CNA Financial Corporation | $2.00 | 3/12/20 |

| GEN | Gen Digital Inc. (formerly NortonLifeLock) | $12.00 | 1/31/20 |

| TDG | TransDigm Group Incorporated | $32.50 | 1/7/20 |

| AFG | American Financial Group Inc. | $1.80 | 11/25/19 |

| ORI | Old Republic International Corp. | $1.00 | 9/16/19 |

| AFG | American Financial Group Inc. | $1.50 | 5/28/19 |

| ORI | Old Republic International Corp. | $1.00 | 1/31/18 |

Why Do Companies Pay Special Dividends?

Companies may issue special dividends for various reasons, such as:

Asset Sales

If a company sells a significant asset or business unit for a profit, it might distribute a portion of those proceeds as a special dividend. This may be part of a strategic move. If deemed in excess of immediate operational needs and strategic investments, the resulting cash may be shared with stock holders through a special dividend.

Exceptional Profits

A period of unexpectedly high profitability can also lead to special dividends. If a company achieves outstanding financial results, it might reward its investors with a one-time payout.

Excess Cash

When a company has a significant amount of cash on hand that it cannot effectively reinvest in the business or use for M&A, it might choose to return some of that cash to shareholders through a special dividend. Distributing some of that cash as a special dividend can enhance the company’s return on equity and improve overall capital efficiency. Alternatively, the board may authorize a share buyback.

Special Occasion

On occasion, a company might issue a special dividend to mark a significant milestone, such as a major anniversary.

FAQs About Special Dividends

What is the difference between a regular dividend and a special dividend?

Regular dividends are recurring payments made to shareholders on a predictable schedule, such as monthly, quarterly, semi-annually, or annually. Special dividends are one-time, non-recurring payments that are typically larger than regular dividends and are declared periodically.

The significance of the ex-dividend date

As with regular dividends, the ex-dividend date is important. To be eligible for the special distribution, investors must have purchased the stock before this date.

Are special dividends a sign of a healthy company?

Investors often view special dividends positively as they represent an immediate return of capital. However, it’s essential to consider the reasons behind a special dividend and the company’s overall financial health. A one-time payout doesn’t necessarily indicate a sustainable increase in shareholder returns.

How do special dividends affect stock prices?

The stock price will decrease on the ex-dividend date, just like a regular dividend. However, it does so by the amount of the special dividend. This reflects the fact that new buyers will not receive the immediate payout.

Are special dividends taxed differently from regular dividends?

Special dividends are usually taxed the same way as regular dividends, as ordinary income or qualified dividends, depending on the holding period and the investor’s tax bracket.

If a company issues a special dividend, will it increase its regular dividend?

No, because a special dividend is a one-time event and doesn’t automatically imply a change in the company’s regular dividend policy. Regular dividend increases are usually announced separately.

How can I find out if a company is issuing a special dividend?

Companies typically announce special dividends through press releases, quarterly earnings results, filings with the SEC, and investor relations sections of their websites.

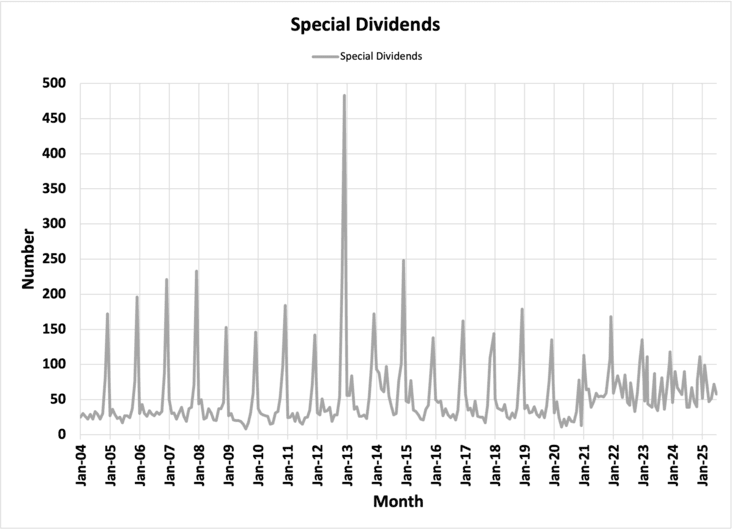

Historical Trends

Related Articles on Dividend Power

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more. It is an excellent resource for DIY dividend growth investors and retirees.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

- Portfolio Insight is the newest and most complete portfolio management tool with built-in stock screeners. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor, analyst, and writer on dividend growth stocks and financial independence. His writings can be found on Seeking Alpha, InvestorPlace, Business Insider, Nasdaq, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial sites. In addition, he is part of the Portfolio Insight and Sure Dividend teams. He was recently in the top 1.0% and 100 (73 out of over 13,450) financial bloggers, as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.