This article provides an updated list of the Dividend Challengers in 2024, select financial data and analysis. The list and data are updated quarterly and located at the bottom of the article.

The Dividend Challengers 2024 stocks have grown dividends for 5 to 9 consecutive years. The list is a relatively exclusive despite taking only five years of dividend growth to get on the list. There are only 185 companies on the Dividend Challengers 2024 list. The total is from the nearly 6,000 companies listed on the New York Stock Exchange (NYSE) and Nasdaq. This number implies a success rate of roughly 3.08%.

It is appreciably more difficult for a company to become a Dividend King, Dividend Aristocrat, or Dividend Champion. However, the success rate of becoming a Dividend Challenger is lower than the Dividend Contenders.

Note that the number of companies on the Dividend Challengers list is down quite a bit from 463 at the beginning of 2020 because of the effect of the COVID-19 pandemic and high-interest rates on many companies. In addition, the amount of dividend cuts and suspensions resulting from COVID-19 significantly impacted the Dividend Challengers list.

Some of the Dividend Challengers 2024 will become Dividend Contenders and eventually Dividend Champions, and a few will become Dividend Kings. However, many will also drop off the list when the economy slows down or due to a merger. This point was apparent during the COVID-19 pandemic.

Affiliate

Try the Simply Investing Report & Analysis Platform to pick the best stocks.

- Analyzes 6,000+ stocks with 120 metrics and financial data.

- Tracking portfolios, watch lists, dividend income, e-mail alerts, undervalued and overvalued stocks, etc.

- List of top ranked stocks based on the 12 Rules of Simply Investing.

- Simply Investing Coupon Code – DIVPOWER15.

Market Update for the Dividend Challengers 2024

The Dividend Challengers 2024 are currently trading at an elevated valuation of a trailing average price-to-earnings ratio of about 24.47X.

The current average dividend yield is about 2.81%. The trailing average 5-year dividend growth rate is approximately 15.67%. The average dividend payout ratio is approximately 25.06%. The average market cap is currently $17,257 million.

Currently, the Dividend Challenger with the highest yield is Community Healthcare (CHCT), and the one trading with the lowest earnings multiple is GeoPark (GPRK).

The updated, selected financial data and the dividend earnings calendar for each stock in the Dividend Challengers list are in the tables at the end of the article. The most recent dividend increases are also available to search.

According to Stock Rover*, in the trailing 1-year, the Dividend Challengers 2024 has returned +41.5% compared to +42.7% for the S&P 500 Index, as seen in the chart below. Over the trailing 5-years, the Dividend Challengers have returned +122.4%, and the S&P 500 has returned +108.2%.

Affiliate

Stock Rover is an award winning investment research platform.

- The site has 8,500+ stocks, 4,000 ETFs, and 40,000 mutual funds.

- Access to 650+ metrics, financial data, market news, stock and fund ratings, fair value, margin of safety, etc.

- Includes brokerage integration, portfolio tracking, rebalancing, watchlists, alerts, future income forecasts, etc.

Click here to try Stock Rover for free (14-day free trial).

Promotions of the Dividend Challengers in 2024

Many stocks on the Dividend Challengers 2023 were promoted to the Dividend Contenders list. These stocks reached the 10-year mark for consecutive annual increases. However, we will not list all the stocks here, but you can check the Dividend Contenders 2024 list and see which ones have ten consecutive annual years of dividend increases.

Additions and Deletions to the Dividend Challengers 2024

There were many additions at the bottom of the Dividend Challengers 2024 list. We will not list all the stocks here, but you can scroll down and look at some of the newer stocks with 5-years of consecutive dividend growth.

Some stocks are dropped from the list each year after failing to increase their dividend. In many cases, these stocks run into operational challenges. In some cases, the economy slows down or experiences a recession. As a result, the dividend is often frozen or cut when revenue or earnings decline.

Other Dividend Stock Lists

We have also written articles with several other lists and analyses on U.S. dividend growth stocks, including:

- List of Dividend Kings in 2024

- List of Dividend Champions in 2024

- List of Dividend Aristocrats in 2024

- List of Dividend Contenders in 2024

- Dogs of the Dow in 2024

For Canadian stocks, we have written about

For UK stocks, we have written about

Other dividend stock lists

Some Details on the Dividend Challengers 2024

Dividend Challengers Sector Breakdown

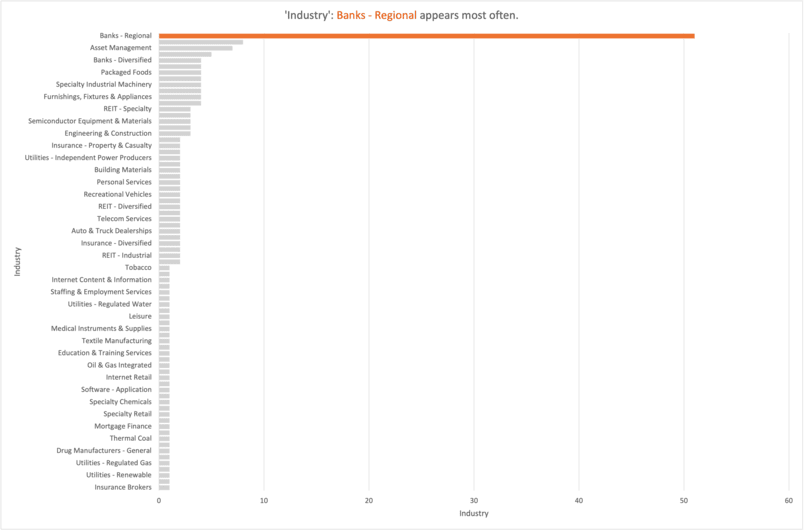

Financial Services sector companies have the most significant representation on the Dividend Contenders 2024 list, with 93 companies. Industrials follow this sector with 21 companies, Real Estate with 20 companies, and Consumer Cyclical with 20 firms. The top two sectors stayed the same in the past few years.

Financials tend to have stable and generally rising earnings over time, except for recessions. Many financial companies cut, froze, or suspended dividends during the Great Recession. But many also restarted dividend growth a few years later. Like the Dividend Contenders list, regional banks are the number one industry on the Dividend Challengers list.

Industrial companies tend to have more volatile earnings and cash flows, but many have low payout ratios, letting them grow the dividends during recessions and economic downturns.

Real Estate companies on the list tend to be REITs. Commercial real estate REITs could have done better during the COVID-19 pandemic, but others have held up better. For instance, industrial, specialty, and residential REITs have done well. That said, 2023 has been less kind to REITs, and several have cut their dividends, especially Office REITs.

Market Size of the Dividend Challengers 2024

The largest of the Dividend Challengers by market capitalization used to be Apple (APPL). However, Apple was promoted to the Dividend Contenders list in 2022.

The Dividend Challengers 2024 list also includes enormous companies such as Applied Materials (AMAT), Lam Research (LRCX), and ConocoPhillips (COP). Hence, the list sometimes includes established companies that only recently started paying dividends or had an interruption in their dividend growth streak. For instance, many banks cut or omitted their dividend during the subprime mortgage crisis. The largest Dividend Challenger is now Applied Materials, with over $150 billion in market capitalization.

However, the list is not dominated by large-cap companies but includes many mid-cap companies ($2 billion – $10 billion), small-cap companies ($300 million – $2 billion), and even micro-cap companies. Micro-cap companies have a market size of less than $100 million and are often traded on the over-the-counter (OTC) market. Therefore, investors should be wary when investing in companies with small market capitalization due to the associated risks.

Micro-cap companies have added risk compared to larger companies because of fewer shares and lower liquidity. Micro-caps also tend to be newer companies without long track records. As a result, micro-cap companies are only suited to some investors interested in dividend growth investing.

What Do I Like About the Dividend Challengers 2024?

The Dividend Challengers 2024 list serves as a screen for further investigating a stock for a dividend growth portfolio. However, only some Dividend Challengers are suitable for most investors since they have not raised the dividend for an extended period.

In general, dividend growth investors should prefer stocks that have raised their dividends for at least ten years or more. There are some exceptions, though. For instance, several mega-cap and large-cap stocks are on the list and can make suitable investments.

List of Dividend Challengers in 2024

Stock Rover* and Portfolio Insight* were used to create this table.

| Ticker | Compny Name | No. Years | Dividend Yield (%) | 5-yr Dividend Growth Rate (%) | Payout Ratio (%) | TTM P/E Ratio | Market Cap (millions) |

|---|---|---|---|---|---|---|---|

| ACNB | ACNB | 7 | 3.00 | 5.10 | 5.40 | 12.3 | $359 |

| AIN | Albany Intl | 7 | 1.40 | 7.60 | 5.00 | 20.7 | $2,256 |

| ALSN | Allison Transmission | 5 | 1.00 | 10.80 | 7.60 | 13 | $8,700 |

| AMAT | Applied Mat | 7 | 0.90 | 13.80 | 14.90 | 20.8 | $152,794 |

| AMCR | Amcor | 5 | 4.50 | n/a | 67.19 | 21.9 | $16,013 |

| AME | AMETEK | 5 | 0.70 | 14.90 | 12.00 | 29.3 | $39,742 |

| ARES | Ares Management | 5 | 2.20 | 23.80 | 24.40 | 88.5 | $34,507 |

| ASH | Ashland | 6 | 1.90 | 8.00 | 1.80 | 25 | $4,177 |

| AWI | Armstrong World Indus | 7 | 0.90 | 42.88 | 19.59 | 25.1 | $5,999 |

| AY | Atlantica Sustainable | 7 | 8.10 | 2.20 | 19.60 | 73 | $2,548 |

| BAX | Baxter Intl | 7 | 3.20 | 5.70 | -5.70 | n/a | $18,371 |

| BCC | Boise Cascade | 6 | 0.60 | 18.50 | 5.78 | 12.1 | $5,381 |

| BFST | Business First Bancshares | 6 | 2.10 | 7.00 | 19.08 | 11.4 | $779 |

| BKU | BankUnited | 5 | 3.20 | 6.70 | 3.30 | 14.7 | $2,677 |

| BOTJ | Bank of the James Finl Gr | 5 | 3.10 | 12.90 | 11.40 | 6.9 | $58 |

| BPRN | Princeton Bancorp | 5 | 3.30 | 109.13 | 25.29 | 10.4 | $248 |

| BRKL | Brookline Bancorp | 6 | 4.80 | 4.20 | 4.70 | 13.6 | $1,002 |

| BRT | BRT Apartments | 6 | 6.00 | 2.60 | n/a | n/a | $296 |

| BSVN | Bank7 | 5 | 2.00 | n/a | 16.23 | 11.5 | $405 |

| BWXT | BWX Technologies | 9 | 0.80 | 7.10 | 9.10 | 42.4 | $11,313 |

| CABO | Cable One | 9 | 3.40 | 5.60 | 25.03 | 7.5 | $1,933 |

| CAG | Conagra Brands | 5 | 4.70 | 10.50 | 3.40 | 29.1 | $14,203 |

| CARR | Carrier Global | 5 | 1.00 | n/a | 27.29 | 44.4 | $67,883 |

| CBAN | Colony Bankcorp | 8 | 3.00 | 8.40 | 34.11 | 11.8 | $262 |

| CGNX | Cognex | 9 | 0.80 | 8.40 | 39.04 | 87.1 | $6,726 |

| CHCT | Community Healthcare | 9 | 10.50 | 2.30 | n/a | n/a | $497 |

| CNA | CNA Financial | 8 | 3.60 | 4.70 | 5.80 | 10.5 | $13,297 |

| CNOB | ConnectOne Bancorp | 6 | 2.90 | 14.90 | 9.10 | 14.4 | $953 |

| COP | ConocoPhillips | 8 | 3.00 | 27.50 | 0.90 | 11.5 | $119,910 |

| CQP | Cheniere Energy Partners | 8 | 7.10 | 5.80 | 6.70 | 10.3 | $23,558 |

| CRAI | CRA Intl | 8 | 0.90 | 16.00 | 27.47 | 33.5 | $1,303 |

| CSWC | Capital Southwest | 9 | 10.00 | 9.90 | 20.40 | 14.9 | $1,205 |

| CSWI | CSW Industrials | 5 | 0.30 | n/a | 11.94 | 52.2 | $6,083 |

| CTRA | Coterra Energy | 8 | 3.50 | 18.50 | 26.50 | 13.7 | $17,564 |

| CTSH | Cognizant Tech Solns | 5 | 1.60 | 8.40 | 25.49 | 17.1 | $37,274 |

| CTVA | Corteva | 5 | 1.10 | n/a | 23.05 | 48.5 | $42,316 |

| CUZ | Cousins Props | 6 | 4.10 | 2.00 | 0.60 | 91.4 | $4,737 |

| CW | Curtiss-Wright | 8 | 0.20 | 4.30 | 4.90 | 34.3 | $13,388 |

| CWEN | Clearway Energy | 5 | 6.40 | 15.80 | 248.66 | 34.5 | $3,007 |

| CZWI | Citizens Community | 5 | 2.30 | 9.90 | 23.10 | 10.6 | $145 |

| DG | Dollar Gen | 9 | 2.90 | 13.00 | 23.44 | 12.6 | $17,834 |

| DVN | Devon Energy | 7 | 5.20 | 37.40 | 6.20 | 7 | $25,402 |

| EBAY | eBay | 6 | 1.70 | n/a | 23.58 | 12.3 | $30,801 |

| EOG | EOG Resources | 7 | 3.00 | 25.90 | 18.40 | 9.4 | $69,408 |

| EPRT | Essential Props Realty | 6 | 3.60 | 20.58 | 89.54 | 28.5 | $5,697 |

| EQH | Equitable Hldgs | 6 | 2.10 | 27.03 | 18.74 | 18.3 | $14,529 |

| EQR | Equity Residential | 7 | 3.60 | 3.50 | 3.00 | 30.6 | $28,438 |

| ERIC | Telefonaktiebolaget L M | 5 | 3.00 | 16.32 | 73.77 | n/a | $28,453 |

| ESNT | Essent Group | 5 | 1.80 | n/a | 15.38 | 8.8 | $6,489 |

| ESSA | ESSA Bancorp | 6 | 3.20 | 8.40 | 7.90 | 10.7 | $192 |

| ETD | Ethan Allen Interiors | 5 | 5.20 | 15.50 | 14.60 | 12 | $756 |

| EWBC | East West Bancorp | 7 | 2.20 | 14.90 | 11.80 | 12.5 | $13,699 |

| FANG | Diamondback Energy | 6 | 6.00 | 65.70 | 18.21 | 9.2 | $52,162 |

| FBK | FB Financial | 6 | 1.30 | 16.30 | 19.93 | 21.8 | $2,339 |

| FBMS | First Bancshares | 7 | 2.90 | 25.60 | 20.90 | 15.5 | $1,068 |

| FBNC | First Bancorp | 6 | 2.10 | 12.90 | 10.60 | 17.2 | $1,763 |

| FBP | First BanCorp | 6 | 3.30 | 79.56 | 32.75 | 10.8 | $3,209 |

| FCF | First Commonwealth | 8 | 3.00 | 5.40 | 6.40 | 11 | $1,749 |

| FCNCA | First Citizens BancShares | 8 | 0.40 | 32.60 | 18.50 | 11 | $27,117 |

| FCPT | Four Corners Prop | 9 | 4.90 | 3.70 | 126.74 | 26.8 | $2,625 |

| FDP | Fresh Del Monte Produce | 5 | 3.40 | 33.00 | 7.20 | n/a | $1,402 |

| FFNW | First Financial Northwest | 7 | 2.30 | 10.90 | 10.00 | 65.1 | $208 |

| FMC | FMC | 6 | 3.80 | 7.70 | 14.50 | 5.3 | $7,681 |

| FMNB | Farmers National Banc | 8 | 4.80 | 11.20 | 18.90 | 11.5 | $529 |

| FOX | Fox | 5 | 1.40 | n/a | 14.53 | 12.4 | $18,476 |

| FSV | FirstService | 9 | 0.50 | 10.80 | 19.31 | 78.2 | $8,513 |

| FUNC | First United | 7 | 2.80 | 11.10 | 27.86 | 13.9 | $200 |

| FXNC | First Ntl | 9 | 2.90 | 10.80 | 23.10 | 16.7 | $187 |

| G | Genpact | 8 | 1.60 | 12.40 | 18.46 | 10.8 | $6,823 |

| GHC | Graham Hldgs | 8 | 0.90 | 4.40 | -3.90 | 25.7 | $3,425 |

| GIC | Global Industrial | 8 | 3.00 | 15.80 | 43.48 | 18.6 | $1,270 |

| GILD | Gilead Sciences | 9 | 3.50 | 4.10 | 44.64 | n/a | $110,505 |

| GIS | General Mills | 5 | 3.50 | 4.10 | 3.90 | 16.3 | $37,900 |

| GNTY | Guaranty Bancshares | 7 | 2.90 | 8.00 | 35.94 | 14.7 | $382 |

| GOLF | Acushnet Hldgs | 7 | 1.40 | 8.45 | 25.26 | 20.4 | $3,724 |

| GPRK | GeoPark | 5 | 7.20 | n/a | n/a | 4.2 | $449 |

| GRMN | Garmin | 7 | 1.80 | 5.60 | 4.60 | 23.3 | $31,962 |

| GWRS | Global Water Resources | 7 | 2.40 | 1.00 | 124.12 | 50.1 | $301 |

| HBB | Hamilton Beach Brands | 7 | 1.50 | 5.00 | n/a | 12.2 | $418 |

| HESM | Hess Midstream | 7 | 7.70 | 11.00 | 114.10 | 15.2 | $3,630 |

| HLI | Houlihan Lokey | 9 | 1.40 | 13.00 | 48.02 | 37.2 | $11,683 |

| HLNE | Hamilton Lane | 7 | 1.10 | 12.20 | 51.95 | 41.9 | $7,627 |

| HOFT | Hooker Furnishings | 9 | 5.70 | 8.90 | 8.70 | n/a | $171 |

| HRB | H&R Block | 9 | 2.50 | 7.60 | 6.50 | 14.4 | $8,272 |

| HTBI | HomeTrust Bancshares | 6 | 1.50 | 46.87 | 13.24 | 10.7 | $577 |

| HTGC | Hercules Capital | 6 | 9.50 | 8.40 | 4.50 | 11.3 | $3,269 |

| HTH | Hilltop Hldgs | 8 | 2.20 | 16.30 | 37.87 | 17.9 | $2,033 |

| HTLF | Heartland Financial USA | 9 | 2.10 | 10.80 | 11.60 | 41.3 | $2,490 |

| IIPR | Innovative Ind Props | 7 | 5.70 | 19.50 | 124.11 | 23.5 | $3,781 |

| INVH | Invitation Homes | 6 | 3.30 | 16.60 | 155.70 | 43.1 | $20,558 |

| IROQ | IF Bancorp | 8 | 1.80 | 5.90 | 14.90 | 38.4 | $69 |

| J | Jacobs Solutions | 6 | 0.80 | 11.30 | 14.44 | 27.8 | $21,011 |

| JBSS | John B Sanfilippo & Son | 8 | 0.90 | 7.20 | n/a | 18.2 | $1,083 |

| KBR | KBR | 5 | 0.90 | 13.40 | 6.50 | 28.4 | $8,952 |

| KFRC | Kforce | 7 | 2.70 | 16.10 | 14.00 | 20.7 | $1,078 |

| KKR | KKR | 5 | 0.50 | 7.00 | -12.60 | 33.3 | $124,908 |

| KLIC | Kulicke & Soffa Indus | 6 | 1.70 | 10.80 | 42.31 | n/a | $2,513 |

| KMI | Kinder Morgan | 7 | 4.60 | 2.80 | -3.90 | 22 | $55,095 |

| KNSL | Kinsale Cap Gr | 8 | 0.10 | 13.40 | 4.48 | 25 | $10,205 |

| KNX | Knight-Swift | 5 | 1.20 | 21.70 | 6.70 | n/a | $8,707 |

| KRC | Kilroy Realty | 6 | 5.20 | 2.20 | 4.40 | 24.8 | $4,885 |

| KRNY | Kearny Financial | 9 | 6.30 | 12.90 | 56.41 | n/a | $450 |

| KTB | Kontoor Brands | 5 | 2.70 | n/a | 45.44 | 18.4 | $4,319 |

| LCII | LCI Indus | 8 | 3.60 | 10.10 | 166.67 | 24.4 | $2,960 |

| LCNB | LCNB | 7 | 5.80 | 5.30 | 3.20 | 32.3 | $213 |

| LDOS | Leidos Holdings | 6 | 0.90 | 2.20 | 1.70 | 53.2 | $22,864 |

| LPX | Louisiana-Pacific | 7 | 1.00 | 14.00 | 29.81 | 16.6 | $7,180 |

| LW | Lamb Weston Hldgs | 8 | 1.90 | 12.50 | 23.9. | 18.2 | $11,072 |

| LXP | LXP Industrial Trust | 5 | 5.50 | 4.90 | -2.60 | n/a | $2,780 |

| MBCN | Middlefield Banc | 6 | 2.90 | 7.40 | 4.40 | 16 | $225 |

| MBIN | Merchants Bancorp | 7 | 0.80 | 14.00 | 5.67 | 6.7 | $2,007 |

| MLM | Martin Marietta Materials | 9 | 0.60 | 7.50 | 7.00 | 17.4 | $35,341 |

| MOS | Mosaic | 6 | 3.10 | 33.20 | -1.70 | 36.4 | $8,682 |

| MPWR | Monolithic Power Systems | 7 | 0.60 | 25.60 | 27.20 | n/a | $43,411 |

| MSBI | Midland States Bancorp | 8 | 5.00 | 5.00 | 35.19 | 12.3 | $527 |

| MTB | M&T Bank | 8 | 2.70 | 6.20 | 6.80 | 14.6 | $32,770 |

| MTG | MGIC Investment | 5 | 2.10 | n/a | 17.00 | 9.3 | $6,521 |

| MUSA | Murphy USA | 5 | 0.40 | n/a | 6.05 | 19.5 | $9,888 |

| NBHC | National Bank Holdings | 9 | 2.60 | 8.10 | 18.80 | 14.1 | $1,727 |

| NC | NACCO Industries | 6 | 3.30 | 3.70 | -1.20 | n/a | $201 |

| NI | NiSource | 8 | 3.00 | 5.80 | 0.20 | 21.6 | $15,760 |

| NRG | NRG Energy | 5 | 1.80 | 68.50 | 11.30 | 9.7 | $18,311 |

| NSA | National Storage | 9 | 5.20 | 11.80 | 140.76 | 24.3 | $3,267 |

| NSC | Norfolk Southern | 7 | 2.10 | 7.50 | 9.00 | 23.8 | $57,371 |

| NVS | Novartis | 5 | 3.30 | 5.90 | 3.30 | 23.6 | $233,751 |

| NXPI | NXP Semiconductors | 5 | 1.60 | 51.99 | 28.95 | 23.4 | $63,605 |

| NXRT | NexPoint Residential | 9 | 4.30 | 11.00 | 99.83 | 12.7 | $1,092 |

| NYT | New York Times | 6 | 0.90 | 21.10 | 12.50 | 34.3 | $9,107 |

| OBK | Origin Bancorp | 5 | 1.90 | 10.20 | 22.73 | 13.1 | $992 |

| ODFL | Old Dominion Freight Line | 8 | 0.50 | 35.60 | 14.21 | 35.1 | $43,047 |

| OFLX | Omega Flex | 7 | 2.70 | 4.00 | n/a | 26.3 | $503 |

| OLED | Universal Display | 8 | 0.80 | 32.00 | 33.02 | 43.7 | $9,687 |

| OMF | OneMain Holdings | 6 | 8.70 | n/a | 73.66 | 9.9 | $5,760 |

| OPBK | OP Bancorp | 5 | 3.30 | n/a | 30.97 | 10.3 | $212 |

| ORRF | Orrstown Finl Servs | 9 | 2.40 | 8.90 | 22.79 | 27.7 | $730 |

| OVV | Ovintiv | 6 | 3.10 | 26.20 | -1.50 | 5.5 | $10,317 |

| PATK | Patrick Industries | 5 | 1.60 | n/a | 28.32 | 19.5 | $3,039 |

| PCB | PCB Bancorp | 6 | 3.80 | 24.60 | 32.55 | 11.3 | $270 |

| PEBO | Peoples Bancorp | 9 | 5.10 | 3.30 | 10.30 | 9 | $1,120 |

| PFIS | Peoples Financial Servs | 8 | 5.20 | 12.70 | 7.10 | 19.7 | $471 |

| PHM | PulteGroup | 7 | 0.60 | 12.70 | 14.90 | 9.9 | $27,456 |

| PINE | Alpine Income Prop Trust | 5 | 6.30 | n/a | n/a | 77.1 | $252 |

| PKBK | Parke Bancorp | 9 | 3.40 | 4.40 | 26.60 | 9.1 | $254 |

| PNR | Pentair | 5 | 0.90 | 5.00 | -2.60 | 24.8 | $16,355 |

| PRK | Park Ntl | 7 | 2.50 | 1.00 | 1.20 | 20.6 | $2,791 |

| PSTL | Postal Realty Trust | 6 | 6.60 | n/a | 88.79 | n/a | $336 |

| PWR | Quanta Services | 6 | 0.10 | 52.51 | 4.61 | 59.1 | $46,166 |

| RDN | Radian Group | 5 | 2.90 | 150.20 | 58.20 | 8.9 | $5,130 |

| RICK | RCI Hospitality Hldgs | 6 | 0.60 | 11.80 | 4.90 | 85.7 | $400 |

| RUSHA | Rush Enterprises | 6 | 1.30 | 42.21 | 14.94 | 14.7 | $4,238 |

| SAH | Sonic Automotive | 9 | 2.40 | 24.60 | 28.20 | 10.6 | $2,039 |

| SAMG | Silvercrest Asset Mgmt Gr | 7 | 4.60 | 5.90 | 5.20 | 19.5 | $166 |

| SBAC | SBA Comms | 5 | 1.60 | n/a | 25.99 | 50.6 | $25,786 |

| SF | Stifel Financial | 7 | 1.60 | 33.20 | 30.77 | 19 | $10,756 |

| SNDR | Schneider National | 7 | 1.30 | 9.60 | 26.28 | 42.4 | $4,968 |

| SONY | Sony Gr | 9 | 0.70 | 9.40 | 8.90 | 17 | $106,391 |

| SPFI | South Plains Financial | 5 | 1.70 | n/a | 14.36 | 13.2 | $567 |

| SSNC | SS&C Techs Hldgs | 8 | 1.40 | 20.10 | 32.00 | 25.2 | $17,211 |

| SSTK | Shutterstock | 5 | 4.10 | n/a | 24.83 | 22.6 | $1,045 |

| STX | Seagate Tech Hldgs | 5 | 2.80 | 2.10 | 2.60 | 26.2 | $21,378 |

| STZ | Constellation Brands | 9 | 1.70 | 6.10 | 32.58 | 75.7 | $43,122 |

| SUI | Sun Communities | 8 | 2.90 | 4.60 | 3.80 | n/a | $16,450 |

| TAIT | Taitron Components | 7 | 7.00 | 10.80 | n/a | 11.4 | $16 |

| TFC | Truist Finl | 9 | 4.80 | 2.90 | 8.00 | n/a | $57,970 |

| TFII | TFI International | 9 | 1.30 | 18.10 | 14.30 | 24.8 | $11,543 |

| TLK | Telkom Indonesia | 5 | 6.00 | 7.70 | 4.60 | 12.2 | $18,286 |

| TMO | Thermo Fisher Scientific | 7 | 0.30 | 15.50 | 10.00 | 34.6 | $211,067 |

| TPB | Turning Point Brands | 7 | 0.60 | 9.20 | 8.93 | 19.7 | $827 |

| UNF | UniFirst | 7 | 0.70 | 24.00 | 24.30 | 24 | $3,459 |

| VCTR | Victory Capital Holdings | 5 | 2.70 | n/a | 28.38 | 17 | $3,929 |

| VICI | VICI Props | 7 | 5.40 | 7.80 | 64.98 | 12.7 | $33,886 |

| VOYA | Voya Financial | 6 | 2.20 | 24.60 | 46.30 | 10.6 | $7,930 |

| VRSK | Verisk Analytics | 6 | 0.60 | n/a | 23.82 | 42.3 | $37,437 |

| VRTS | Virtus Inv | 7 | 4.00 | 28.10 | 25.90 | 13.7 | $1,595 |

| VST | Vistra | 6 | 0.70 | n/a | 27.69 | 93.7 | $43,899 |

| WAL | Western Alliance | 5 | 1.80 | n/a | 18.01 | 13.1 | $9,330 |

| WD | Walker & Dunlop | 7 | 2.30 | 16.70 | 53.85 | 43.2 | $3,775 |

| WERN | Werner Enterprises | 5 | 1.50 | 9.20 | 10.80 | 38.6 | $2,358 |

| WGO | Winnebago Industries | 7 | 2.50 | 25.30 | 31.20 | n/a | $1,607 |

| WHD | Cactus | 5 | 0.90 | n/a | 14.42 | 19.8 | $3,857 |

| WING | Wingstop | 7 | 0.30 | 19.70 | 33.06 | n/a | $10,799 |

| WKC | World Kinect | 6 | 2.60 | 11.20 | 16.30 | 11.7 | $1,541 |

| WMB | Williams Companies | 7 | 3.60 | 4.60 | -1.60 | 22.5 | $63,673 |

| WTW | Willis Towers Watson | 8 | 1.20 | 6.20 | 1.00 | 28.2 | $29,665 |

| YUM | Yum Brands | 7 | 2.00 | 9.80 | 5.00 | 24.7 | $37,917 |

Dividend Calendar for the Dividend Challengers 2024

Stock Rover* was used to create this list.

| Ticker | Company | Ex-Dividend Date | Dividend Record Date | Dividend Payment Date | Dividend Frequency | Next Dividend Payment Per Share | Dividend Per Share |

|---|---|---|---|---|---|---|---|

| ACNB | ACNB | 11/29/24 | 11/29/24 | 12/13/24 | 4 | $0.32 | $1.28 |

| AIN | Albany Intl | 9/3/24 | 9/3/24 | 10/7/24 | 4 | $0.26 | $1.04 |

| ALSN | Allison Transmission | 8/19/24 | 8/19/24 | 8/30/24 | 4 | $0.25 | $1.00 |

| AMAT | Applied Mat | 11/21/24 | 11/21/24 | 12/12/24 | 4 | $0.40 | $1.60 |

| AMCR | Amcor | 9/6/24 | 9/6/24 | 9/26/24 | 4 | $0.12 | $0.50 |

| AME | AMETEK | 9/16/24 | 9/16/24 | 9/30/24 | 4 | $0.28 | $1.12 |

| ARES | Ares Management | 9/16/24 | 9/16/24 | 9/30/24 | 4 | $0.93 | $3.72 |

| ASH | Ashland | 8/30/24 | 9/1/24 | 9/15/24 | 4 | $0.41 | $1.62 |

| AWI | Armstrong World Indus | 11/7/24 | 11/7/24 | 11/21/24 | 4 | $0.31 | $1.23 |

| AY | Atlantica Sustainable | 8/30/24 | 8/30/24 | 9/16/24 | 4 | $0.44 | $1.78 |

| BAX | Baxter Intl | 8/30/24 | 8/30/24 | 10/1/24 | 4 | $0.29 | $1.16 |

| BCC | Boise Cascade | 9/3/24 | 9/3/24 | 9/16/24 | 4 | $0.21 | $0.84 |

| BFST | Business First Bancshares | 11/15/24 | 11/15/24 | 11/30/24 | 4 | $0.14 | $0.56 |

| BKU | BankUnited | 10/11/24 | 10/11/24 | 10/31/24 | 4 | $0.29 | $1.16 |

| BOTJ | Bank of the James Finl Gr | 11/22/24 | 11/22/24 | 12/6/24 | 4 | $0.10 | $0.40 |

| BPRN | Princeton Bancorp | 11/5/24 | 11/5/24 | 11/28/24 | 4 | $0.30 | $1.20 |

| BRKL | Brookline Bancorp | 11/15/24 | 11/15/24 | 11/29/24 | 4 | $0.14 | $0.54 |

| BRT | BRT Apartments | 9/24/24 | 9/24/24 | 10/2/24 | 4 | $0.25 | $1.00 |

| BSVN | Bank7 | 9/26/24 | 9/26/24 | 10/9/24 | 4 | $0.24 | $0.87 |

| BWXT | BWX Technologies | 8/16/24 | 8/16/24 | 9/5/24 | 4 | $0.24 | $0.96 |

| CABO | Cable One | 8/27/24 | 8/27/24 | 9/13/24 | 4 | $2.95 | $11.80 |

| CAG | Conagra Brands | 10/31/24 | 10/31/24 | 11/27/24 | 4 | $0.35 | $1.40 |

| CARR | Carrier Global | 10/25/24 | 10/25/24 | 11/18/24 | 4 | $0.19 | $0.76 |

| CBAN | Colony Bankcorp | 11/6/24 | 11/6/24 | 11/20/24 | 4 | $0.11 | $0.45 |

| CGNX | Cognex | 8/15/24 | 8/15/24 | 8/29/24 | 4 | $0.08 | $0.30 |

| CHCT | Community Healthcare | 11/8/24 | 11/8/24 | 11/22/24 | 4 | $0.47 | $1.86 |

| CNA | CNA Financial | 8/12/24 | 8/12/24 | 8/29/24 | 4 | $0.44 | $1.76 |

| CNOB | ConnectOne Bancorp | 11/15/24 | 11/15/24 | 12/2/24 | 4 | $0.18 | $0.72 |

| COP | ConocoPhillips | 8/12/24 | 8/12/24 | 9/3/24 | 4 | $0.78 | $3.12 |

| CQP | Cheniere Energy Partners | 11/4/24 | 11/4/24 | 11/14/24 | 4 | $0.81 | $3.46 |

| CRAI | CRA Intl | 8/27/24 | 8/27/24 | 9/13/24 | 4 | $0.42 | $1.68 |

| CSWC | Capital Southwest | 9/13/24 | 9/13/24 | 9/30/24 | 4 | $0.64 | $2.56 |

| CSWI | CSW Industrials | 10/25/24 | 10/25/24 | 11/8/24 | 4 | $0.24 | $0.96 |

| CTRA | Coterra Energy | 8/15/24 | 8/15/24 | 8/29/24 | 4 | $0.21 | $0.84 |

| CTSH | Cognizant Tech Solns | 8/20/24 | 8/20/24 | 8/28/24 | 4 | $0.30 | $1.20 |

| CTVA | Corteva | 9/3/24 | 9/3/24 | 9/17/24 | 4 | $0.17 | $0.68 |

| CUZ | Cousins Props | 10/3/24 | 10/3/24 | 10/15/24 | 4 | $0.32 | $1.28 |

| CW | Curtiss-Wright | 9/27/24 | 9/27/24 | 10/11/24 | 4 | $0.21 | $0.84 |

| CWEN | Clearway Energy | 9/3/24 | 9/3/24 | 9/16/24 | 4 | $0.42 | $1.67 |

| CZWI | Citizens Community | 2/8/24 | 2/9/24 | 2/23/24 | 1 | $0.32 | $0.32 |

| DG | Dollar Gen | 10/8/24 | 10/8/24 | 10/22/24 | 4 | $0.59 | $2.36 |

| DVN | Devon Energy | 9/13/24 | 9/13/24 | 9/30/24 | 4 | $0.44 | $2.00 |

| EBAY | eBay | 8/30/24 | 8/30/24 | 9/13/24 | 4 | $0.27 | $1.08 |

| EOG | EOG Resources | 10/17/24 | 10/17/24 | 10/31/24 | 4 | $0.91 | $3.64 |

| EPRT | Essential Props Realty | 9/30/24 | 9/30/24 | 10/11/24 | 4 | $0.29 | $1.16 |

| EQH | Equitable Hldgs | 8/6/24 | 8/6/24 | 8/13/24 | 4 | $0.24 | $0.96 |

| EQR | Equity Residential | 9/24/24 | 9/24/24 | 10/11/24 | 4 | $0.68 | $2.70 |

| ERIC | Telefonaktiebolaget L M | 10/2/24 | 10/2/24 | 2 | $0.13 | $0.26 | |

| ESNT | Essent Group | 8/30/24 | 8/30/24 | 9/10/24 | 4 | $0.28 | $1.12 |

| ESSA | ESSA Bancorp | 9/16/24 | 9/16/24 | 9/30/24 | 4 | $0.15 | $0.60 |

| ETD | Ethan Allen Interiors | 8/13/24 | 8/13/24 | 8/29/24 | 4 | $0.39 | $1.56 |

| EWBC | East West Bancorp | 11/4/24 | 11/4/24 | 11/15/24 | 4 | $0.55 | $2.20 |

| FANG | Diamondback Energy | 8/15/24 | 8/15/24 | 8/22/24 | 4 | $2.34 | $10.76 |

| FBK | FB Financial | 8/6/24 | 8/6/24 | 8/20/24 | 4 | $0.17 | $0.66 |

| FBMS | First Bancshares | 11/8/24 | 11/8/24 | 11/22/24 | 4 | $0.25 | $1.00 |

| FBNC | First Bancorp | 9/30/24 | 9/30/24 | 10/25/24 | 4 | $0.22 | $0.88 |

| FBP | First BanCorp | 8/29/24 | 8/29/24 | 9/13/24 | 4 | $0.16 | $0.64 |

| FCF | First Commonwealth | 8/2/24 | 8/2/24 | 8/16/24 | 4 | $0.13 | $0.52 |

| FCNCA | First Citizens BancShares | 11/29/24 | 11/29/24 | 12/16/24 | 4 | $1.95 | $7.80 |

| FCPT | Four Corners Prop | 9/30/24 | 9/30/24 | 10/15/24 | 4 | $0.34 | $1.38 |

| FDP | Fresh Del Monte Produce | 8/15/24 | 8/15/24 | 9/6/24 | 4 | $0.25 | $1.00 |

| FFNW | First Financial Northwest | 6/7/24 | 6/7/24 | 6/21/24 | 4 | $0.13 | $0.52 |

| FMC | FMC | 9/30/24 | 9/30/24 | 10/17/24 | 4 | $0.58 | $2.32 |

| FMNB | Farmers National Banc | 9/13/24 | 9/13/24 | 9/30/24 | 4 | $0.17 | $0.68 |

| FOX | Fox | 9/4/24 | 9/4/24 | 9/25/24 | 2 | $0.27 | $0.54 |

| FSV | FirstService | 9/30/24 | 9/30/24 | 10/7/24 | 4 | $0.25 | $1.00 |

| FUNC | First United | 10/18/24 | 10/18/24 | 11/1/24 | 4 | $0.22 | $0.88 |

| FXNC | First Ntl | 8/30/24 | 8/30/24 | 9/13/24 | 4 | $0.15 | $0.60 |

| G | Genpact | 12/9/24 | 12/9/24 | 12/23/24 | 4 | $0.15 | $0.61 |

| GHC | Graham Hldgs | 10/17/24 | 10/17/24 | 11/7/24 | 4 | $1.72 | $6.88 |

| GIC | Global Industrial | 8/12/24 | 8/12/24 | 8/19/24 | 4 | $0.25 | $1.00 |

| GILD | Gilead Sciences | 9/13/24 | 9/13/24 | 9/27/24 | 4 | $0.77 | $3.08 |

| GIS | General Mills | 10/10/24 | 10/10/24 | 11/1/24 | 4 | $0.60 | $2.40 |

| GNTY | Guaranty Bancshares | 9/30/24 | 9/30/24 | 10/9/24 | 4 | $0.24 | $0.96 |

| GOLF | Acushnet Hldgs | 9/6/24 | 9/6/24 | 9/20/24 | 4 | $0.22 | $0.86 |

| GPRK | GeoPark | 8/29/24 | 8/29/24 | 9/12/24 | 4 | $0.15 | $0.59 |

| GRMN | Garmin | 12/13/24 | 12/13/24 | 12/27/24 | 4 | $0.75 | $3.00 |

| GWRS | Global Water Resources | 10/17/24 | 10/17/24 | 10/31/24 | 12 | $0.03 | $0.30 |

| HBB | Hamilton Beach Brands | 9/3/24 | 9/3/24 | 9/13/24 | 4 | $0.12 | $0.46 |

| HESM | Hess Midstream | 8/8/24 | 8/8/24 | 8/14/24 | 4 | $0.67 | $2.67 |

| HLI | Houlihan Lokey | 9/3/24 | 9/3/24 | 9/15/24 | 4 | $0.57 | $2.28 |

| HLNE | Hamilton Lane | 9/16/24 | 9/16/24 | 10/4/24 | 4 | $0.49 | $1.96 |

| HOFT | Hooker Furnishings | 9/13/24 | 9/13/24 | 9/30/24 | 4 | $0.23 | $0.92 |

| HRB | H&R Block | 9/5/24 | 9/5/24 | 10/3/24 | 4 | $0.38 | $1.50 |

| HTBI | HomeTrust Bancshares | 11/14/24 | 11/14/24 | 11/27/24 | 4 | $0.12 | $0.48 |

| HTGC | Hercules Capital | 8/13/24 | 8/13/24 | 8/20/24 | 4 | $0.48 | $1.92 |

| HTH | Hilltop Hldgs | 11/8/24 | 11/8/24 | 11/22/24 | 4 | $0.17 | $0.68 |

| HTLF | Heartland Financial USA | 11/12/24 | 11/12/24 | 11/26/24 | 4 | $0.30 | $1.20 |

| IIPR | Innovative Ind Props | 9/30/24 | 9/30/24 | 10/15/24 | 4 | $1.90 | $7.60 |

| INVH | Invitation Homes | 9/26/24 | 9/26/24 | 10/18/24 | 4 | $0.28 | $1.12 |

| IROQ | IF Bancorp | 9/27/24 | 9/27/24 | 10/18/24 | 2 | $0.20 | $0.40 |

| J | Jacobs Solutions | 10/25/24 | 10/25/24 | 11/22/24 | 4 | $0.29 | $1.16 |

| JBSS | John B Sanfilippo & Son | 8/20/24 | 8/20/24 | 9/11/24 | 1 | $0.85 | $0.85 |

| KBR | KBR | 12/13/24 | 12/13/24 | 1/15/25 | 4 | $0.15 | $0.60 |

| KFRC | Kforce | 9/13/24 | 9/13/24 | 9/27/24 | 4 | $0.38 | $1.52 |

| KKR | KKR | 8/12/24 | 8/12/24 | 8/27/24 | 4 | $0.17 | $0.70 |

| KLIC | Kulicke & Soffa Indus | 9/19/24 | 9/19/24 | 10/8/24 | 4 | $0.20 | $0.80 |

| KMI | Kinder Morgan | 10/31/24 | 10/31/24 | 11/15/24 | 4 | $0.29 | $1.15 |

| KNSL | Kinsale Cap Gr | 8/29/24 | 8/29/24 | 9/12/24 | 4 | $0.15 | $0.60 |

| KNX | Knight-Swift | 9/6/24 | 9/6/24 | 9/23/24 | 4 | $0.16 | $0.64 |

| KRC | Kilroy Realty | 9/30/24 | 9/30/24 | 10/9/24 | 4 | $0.54 | $2.16 |

| KRNY | Kearny Financial | 11/6/24 | 11/6/24 | 11/20/24 | 4 | $0.11 | $0.44 |

| KTB | Kontoor Brands | 12/9/24 | 12/9/24 | 12/19/24 | 4 | $0.52 | $2.08 |

| LCII | LCI Indus | 8/30/24 | 8/30/24 | 9/13/24 | 4 | $1.05 | $4.20 |

| LCNB | LCNB | 9/3/24 | 9/3/24 | 9/16/24 | 4 | $0.22 | $0.88 |

| LDOS | Leidos Holdings | 9/13/24 | 9/13/24 | 9/27/24 | 4 | $0.38 | $1.52 |

| LPX | Louisiana-Pacific | 8/20/24 | 8/20/24 | 9/3/24 | 4 | $0.26 | $1.04 |

| LW | Lamb Weston Hldgs | 11/1/24 | 11/1/24 | 11/29/24 | 4 | $0.36 | $1.44 |

| LXP | LXP Industrial Trust | 9/30/24 | 9/30/24 | 10/15/24 | 4 | $0.13 | $0.52 |

| MBCN | Middlefield Banc | 8/30/24 | 8/30/24 | 9/13/24 | 4 | $0.20 | $0.80 |

| MBIN | Merchants Bancorp | 9/13/24 | 9/13/24 | 10/1/24 | 4 | $0.09 | $0.36 |

| MLM | Martin Marietta Materials | 9/3/24 | 9/3/24 | 9/30/24 | 4 | $0.79 | $3.16 |

| MOS | Mosaic | 9/5/24 | 9/5/24 | 9/19/24 | 4 | $0.21 | $0.84 |

| MPWR | Monolithic Power Systems | 9/30/24 | 9/30/24 | 10/15/24 | 4 | $1.25 | $5.00 |

| MSBI | Midland States Bancorp | 8/16/24 | 8/16/24 | 8/23/24 | 4 | $0.31 | $1.24 |

| MTB | M&T Bank | 9/3/24 | 9/3/24 | 9/30/24 | 4 | $1.35 | $5.40 |

| MTG | MGIC Investment | 11/7/24 | 11/7/24 | 11/21/24 | 4 | $0.13 | $0.52 |

| MUSA | Murphy USA | 11/4/24 | 11/4/24 | 12/2/24 | 4 | $0.48 | $1.92 |

| NBHC | National Bank Holdings | 11/29/24 | 11/29/24 | 12/13/24 | 4 | $0.29 | $1.16 |

| NC | NACCO Industries | 9/3/24 | 9/3/24 | 9/16/24 | 4 | $0.23 | $0.91 |

| NI | NiSource | 10/31/24 | 10/31/24 | 11/20/24 | 4 | $0.26 | $1.06 |

| NRG | NRG Energy | 11/1/24 | 11/1/24 | 11/15/24 | 4 | $0.41 | $1.63 |

| NSA | National Storage | 9/13/24 | 9/13/24 | 9/30/24 | 4 | $0.56 | $2.24 |

| NSC | Norfolk Southern | 11/1/24 | 11/1/24 | 11/20/24 | 4 | $1.35 | $5.40 |

| NVS | Novartis | 3/7/24 | 3/8/24 | 1 | $3.78 | $3.78 | |

| NXPI | NXP Semiconductors | 9/12/24 | 9/12/24 | 10/9/24 | 4 | $1.01 | $4.06 |

| NXRT | NexPoint Residential | 9/13/24 | 9/13/24 | 9/30/24 | 4 | $0.46 | $1.85 |

| NYT | New York Times | 10/9/24 | 10/9/24 | 10/24/24 | 4 | $0.13 | $0.52 |

| OBK | Origin Bancorp | 11/15/24 | 11/15/24 | 11/29/24 | 4 | $0.15 | $0.60 |

| ODFL | Old Dominion Freight Line | 12/4/24 | 12/4/24 | 12/18/24 | 4 | $0.26 | $1.04 |

| OFLX | Omega Flex | 9/26/24 | 9/26/24 | 10/8/24 | 4 | $0.34 | $1.36 |

| OLED | Universal Display | 9/16/24 | 9/16/24 | 9/30/24 | 4 | $0.40 | $1.60 |

| OMF | OneMain Holdings | 8/12/24 | 8/12/24 | 8/16/24 | 4 | $1.04 | $4.16 |

| OPBK | OP Bancorp | 11/7/24 | 11/7/24 | 11/21/24 | 4 | $0.12 | $0.48 |

| ORRF | Orrstown Finl Servs | 11/5/24 | 11/5/24 | 11/12/24 | 4 | $0.23 | $0.92 |

| OVV | Ovintiv | 9/13/24 | 9/13/24 | 9/27/24 | 4 | $0.30 | $1.20 |

| PATK | Patrick Industries | 8/26/24 | 8/26/24 | 9/9/24 | 4 | $0.55 | $2.20 |

| PCB | PCB Bancorp | 11/8/24 | 11/8/24 | 11/15/24 | 4 | $0.18 | $0.72 |

| PEBO | Peoples Bancorp | 11/4/24 | 11/4/24 | 11/18/24 | 4 | $0.40 | $1.60 |

| PFIS | Peoples Financial Servs | 8/30/24 | 8/30/24 | 9/13/24 | 4 | $0.62 | $2.47 |

| PHM | PulteGroup | 9/17/24 | 9/17/24 | 10/2/24 | 4 | $0.20 | $0.80 |

| PINE | Alpine Income Prop Trust | 9/12/24 | 9/12/24 | 9/30/24 | 4 | $0.28 | $1.12 |

| PKBK | Parke Bancorp | 10/4/24 | 10/4/24 | 10/18/24 | 4 | $0.18 | $0.72 |

| PNR | Pentair | 10/18/24 | 10/18/24 | 11/1/24 | 4 | $0.23 | $0.92 |

| PRK | Park Ntl | 8/16/24 | 8/16/24 | 9/10/24 | 4 | $1.06 | $4.24 |

| PSTL | Postal Realty Trust | 11/4/24 | 11/4/24 | 11/29/24 | 4 | $0.24 | $0.96 |

| PWR | Quanta Services | 10/1/24 | 10/1/24 | 10/11/24 | 4 | $0.09 | $0.36 |

| RDN | Radian Group | 8/26/24 | 8/26/24 | 9/11/24 | 4 | $0.25 | $0.98 |

| RICK | RCI Hospitality Hldgs | 9/16/24 | 9/16/24 | 9/30/24 | 4 | $0.07 | $0.28 |

| RUSHA | Rush Enterprises | 8/13/24 | 8/13/24 | 9/10/24 | 4 | $0.18 | $0.72 |

| SAH | Sonic Automotive | 12/13/24 | 12/13/24 | 1/15/25 | 4 | $0.35 | $1.40 |

| SAMG | Silvercrest Asset Mgmt Gr | 9/13/24 | 9/13/24 | 9/20/24 | 4 | $0.20 | $0.80 |

| SBAC | SBA Comms | 8/22/24 | 8/22/24 | 9/18/24 | 4 | $0.98 | $3.92 |

| SF | Stifel Financial | 9/3/24 | 9/3/24 | 9/17/24 | 4 | $0.42 | $1.68 |

| SNDR | Schneider National | 9/13/24 | 9/13/24 | 10/8/24 | 4 | $0.09 | $0.38 |

| SONY | Sony Gr | 3/27/24 | 3/28/24 | 6/17/24 | 2 | $0.06 | $0.11 |

| SPFI | South Plains Financial | 10/28/24 | 10/28/24 | 11/12/24 | 4 | $0.15 | $0.60 |

| SSNC | SS&C Techs Hldgs | 9/3/24 | 9/3/24 | 9/16/24 | 4 | $0.25 | $1.00 |

| SSTK | Shutterstock | 8/29/24 | 8/29/24 | 9/12/24 | 4 | $0.30 | $1.20 |

| STX | Seagate Tech Hldgs | 12/13/24 | 12/15/24 | 1/6/25 | 4 | $0.72 | $2.88 |

| STZ | Constellation Brands | 11/5/24 | 11/5/24 | 11/21/24 | 4 | $1.01 | $4.04 |

| SUI | Sun Communities | 9/30/24 | 9/30/24 | 10/15/24 | 4 | $0.94 | $3.76 |

| TAIT | Taitron Components | 8/16/24 | 8/16/24 | 8/30/24 | 4 | $0.05 | $0.20 |

| TFC | Truist Finl | 11/8/24 | 11/8/24 | 12/2/24 | 4 | $0.52 | $2.08 |

| TFII | TFI International | 12/31/24 | 12/31/24 | 1/15/25 | 4 | $0.45 | $1.80 |

| TLK | Telkom Indonesia | 5/17/24 | 5/20/24 | 6/10/24 | 1 | $1.10 | $1.10 |

| TMO | Thermo Fisher Scientific | 9/13/24 | 9/13/24 | 10/15/24 | 4 | $0.39 | $1.56 |

| TPB | Turning Point Brands | 9/13/24 | 9/13/24 | 10/4/24 | 4 | $0.07 | $0.28 |

| UNF | UniFirst | 9/6/24 | 9/6/24 | 9/27/24 | 4 | $0.33 | $1.32 |

| VCTR | Victory Capital Holdings | 9/10/24 | 9/10/24 | 9/25/24 | 4 | $0.41 | $1.64 |

| VICI | VICI Props | 9/18/24 | 9/18/24 | 10/3/24 | 4 | $0.43 | $1.73 |

| VOYA | Voya Financial | 8/27/24 | 8/27/24 | 9/26/24 | 4 | $0.45 | $1.80 |

| VRSK | Verisk Analytics | 9/13/24 | 9/15/24 | 9/30/24 | 4 | $0.39 | $1.56 |

| VRTS | Virtus Inv | 10/31/24 | 10/31/24 | 11/13/24 | 4 | $2.25 | $9.00 |

| VST | Vistra | 9/20/24 | 9/20/24 | 9/30/24 | 4 | $0.22 | $0.88 |

| WAL | Western Alliance | 8/16/24 | 8/16/24 | 8/30/24 | 4 | $0.37 | $1.48 |

| WD | Walker & Dunlop | 8/22/24 | 8/22/24 | 9/6/24 | 4 | $0.65 | $2.60 |

| WERN | Werner Enterprises | 10/7/24 | 10/7/24 | 10/23/24 | 4 | $0.14 | $0.56 |

| WGO | Winnebago Industries | 9/11/24 | 9/11/24 | 9/25/24 | 4 | $0.34 | $1.36 |

| WHD | Cactus | 8/26/24 | 8/26/24 | 9/12/24 | 4 | $0.13 | $0.52 |

| WING | Wingstop | 8/16/24 | 8/16/24 | 9/6/24 | 4 | $0.27 | $1.08 |

| WKC | World Kinect | 9/30/24 | 9/30/24 | 10/16/24 | 4 | $0.17 | $0.68 |

| WMB | Williams Companies | 9/13/24 | 9/13/24 | 9/30/24 | 4 | $0.47 | $1.90 |

| WTW | Willis Towers Watson | 9/30/24 | 9/30/24 | 10/15/24 | 4 | $0.88 | $3.52 |

| YUM | Yum Brands | 8/27/24 | 8/27/24 | 9/6/24 | 4 | $0.67 | $2.68 |

Prior Year Lists and Articles

- List of Dividend Challengers in 2023

- List of Dividend Challengers in 2022

- List of Dividend Challengers in 2021

- List of Dividend Challengers in 2020

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more. It is an excellent resource for DIY dividend growth investors and retirees.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

- Portfolio Insight is the newest and most complete portfolio management tool with built-in stock screeners. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor, analyst, and writer on dividend growth stocks and financial independence. His writings can be found on Seeking Alpha, InvestorPlace, Business Insider, Nasdaq, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial sites. In addition, he is part of the Portfolio Insight and Sure Dividend teams. He was recently in the top 1.0% and 100 (73 out of over 13,450) financial bloggers, as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.