100 Baggers – Rare but Possible Stocks

100 Baggers – Rare but Possible Stocks. Several weeks ago, I wrote about 10 bagger stocks. Peter Lynch immortalized the term 10 bagger in his 1989 book “One Up on Wall Street.” A 10 bagger is a stock in which you made ten times your money. For example, suppose you bought Home Depot (HD) somewhere between late-2003 to late-2008 and held it. You have a 10 bagger. The interesting point is that you had almost 5-years to make a buy decision after the end of the dot-com bust and the middle of the sub-prime mortgage crises. An investor dropping $10,000 into Home Depot on January 3rd, 2006, had $131,477.02 on October 22nd, 2021, assuming dividends were reinvested. The return during this time was 1,214.37%. Today, Home Depot will probably not be a 10 bagger stock going forward in the same amount of time, but that does not mean the returns will be bad.

It is likely that if you have been investing in the past two decades, you have several 10 bagger stocks in your portfolio. They are good for your overall total portfolio returns and account for stock picks that do not do as well. Of course, you can probably find more 10 bagger stocks today, but what about 100 bagger stocks.

What is a 100 Bagger Stock?

Thomas Phelps, another Boston investment manager, wrote a book called “100 to 1 in the Stock Market: A Distinguished Security Analyst Tells How to Make More of Your Investment Opportunities.” Unfortunately, Thomas Phelps died in 1992 at the age of 90. I have not yet read the book but will soon. Phelps’ book studied 100 baggers from 1932 to 1971. He lists 365 stocks in that period.

The idea of 100 baggers was revisited by Christopher Mayer, a portfolio manager and co-founder of Woodlock House Family Capital, in his 2015 book “100 Baggers: Stocks That Return 100-to-1 and How to Find Them.” Mayer’s study was on 100 baggers from 1962 to 2014 with more than $50 million starting market capitalization. Mayer’s study uncovered another list of 365 stocks that were 100 baggers. The top 10 by total return in the period are from diverse sectors, with Warren Buffett’s Berkshire Hathaway (BRK.B) leading the way.

Other stocks on the list include Kansas City Southern (KSU), McDonald’s (MCD), Comcast (CMCSA), Aflac (AFL), Dollar General (DG), ADP (ADP), Lockheed Martin (LMT), Polaris (PII), Pharmacyclics, Nexstar Media Group (NXST), Questcor Pharmaceuticals, Biogen (BIIB), Time Warner (TWX), Valeant Pharmaceuticals, Dell Technologies (DELL), L Brands, Qualcomm (QCOM), Cisco Systems (CSCO), EMC Corp, Jack Henry & Associates (JKHY), Vector Group (VGR), Edwards Lifesciences (EW), Hasbro (HAS), Monster Beverage (MNST), Home Depot (HD), NVR (NVR), Amazon (AMZN), Electronic Arts (EA), Pepsi (PEP), Gillette, and many others.

You can look at the book for the entire list. Some of these stocks have been acquired. The critical point is that many of the stocks on the list are dividend growth stocks. I am long some of these stocks.

Probability of 100 Baggers

The is about a 2.3% or 1-in-50 chance for a 100 bagger stock based on a study of Australian and New Zealand stocks over a 35-yer period. This probability is several times lower than the probability of a 10 bagger at 15% or 1-in-7 chance. There is no detailed study in the US, but similar probabilities likely occur for the US stock market.

Characteristics of 100 Baggers

Which stocks will become 100 baggers? Not all stocks become 10 bagger stocks. In some cases, the business is in a small niche. This does not mean that the stock is a poor investment; instead, it may not become a 100 bagger stock.

If we look at the list above, most of the companies were in businesses that could scale. For instance, Walmart, Home Depot, Dollar General, and TJX were all retailers who could scale around the country. Similarly, McDonald’s and Pepsi had simple products that grew globally. All of these stocks are dividend growth stocks. Finally, Dell and Qualcomm offered computers and semiconductors that are needed worldwide.

100 baggers need growth and lots of it. For a stock price to appreciate, revenue and earnings need to grow. Apple is a 100 bagger twice over because of the iPod, iPad, and iPhone. These were products that no one knew they needed, but now everyone needs. Sales of the iPhone, sales on the app store, and payment services are driving growth. Other companies on this list have grown the top and bottom lines. Monster Beverage sold more energy drinks. Southwest Airlines grew its no-frills and low-cost service around the country. Electronic Arts sold more games as more people bought gaming consoles, computers, and other devices. However, high growth for a few short years is not enough. The company must compound revenue and earnings for many years to become a 100 bagger stock.

The stock must have a wide moat. The list of stocks that are 100 baggers all have wide moats and substantial competitive advantages. In some cases, the advantages are an innovative new product that is patented, first to market, low cost, or a better business model.

Look at small caps and mid-caps to find potential 100 baggers. It is hard for a stock to become a 100 bagger if it already has a large market capitalization. For example, for Apple to become a 100 bagger stock again, it needs to go from a market capitalization of about $2.47 trillion to $247 trillion, an unlikely scenario. On the other hand, a $1 billion market capitalization can more easily become a 10 bagger at $10 billion and a 100 bagger at $100 billion market capitalizations.

Final Thoughts on 100 Baggers – Rare but Possible Stocks

Finding 100 baggers is a challenging endeavor but not impossible. These stocks are characterized by growth. There is also some luck involved. First, you need to buy a stock without knowing the long-term future. Many good businesses have been relegated to the dustbin by poor operational execution and technological advancement. Sears is an example of a retailer that faded away. Kodak is an example of a company whose core technology was disrupted. Lastly, you need to buy and hold the stocks and rarely sell. If you need actual examples of retail investors who rode 100 baggers to wealth, look at my article on the Secret Dividend Millionaires.

Chart or Table of the Week

Today I highlight Mondelez (MDLZ). Investors may not know the company, but they certainly know its products. The company owns the Nabisco, Cadbury, and LU brands. Mondelez sells Oreos, Chips Ahoy, Cadbury, LU, Tate’s, Trident, Ritz, Wheat Thins, etc. Many of the company’s products are No. 1 in its market segment worldwide. The stock is a Dividend Challenger raising the dividend at a double-digit rate. The dividend is also safe. On an earnings basis, Mondelez has been trading near the lower end of its range in the past year and 5-years. The screenshot below is from Stock Rover*.

Dividend Increases and Reinstatements

I have created a searchable list of dividend increases and reinstatements. I update this list weekly. In addition, you can search for your stocks by company name, ticker, and date.

Dividend Cuts and Suspensions List

I updated my dividend cuts and suspensions list at the end of September 2021. The number of companies on the list has risen to 531. We are well over 10% of companies that pay dividends, having cut or suspended them since the start of the COVID-19 pandemic.

There was one new company added to the list this past month. The company was Capstead Mortgage (CMO).

Market Indices

Dow Jones Industrial Averages (DJIA): 35,677 (+1.08%)

NASDAQ: 15,090 (+1.29%)

S&P 500: 4,545 (+1.64%)

Market Valuation

The S&P 500 is trading at a price-to-earnings ratio of 28.6X, and the Schiller P/E Ratio is at about 38.7X. These two metrics were down the past three weeks. Note that the long-term means of these two ratios are 15.9X and 16.8X, respectively.

I continue to believe that the market is overvalued at this point. I view anything over 30X as overvalued based on historical data. The S&P 500’s valuation came down as the index companies reported solid earnings for the second consecutive quarter.

S&P 500 PE Ratio History

Shiller PE Ratio History

Source: multpl.com

Stock Market Volatility – CBOE VIX

The CBOE VIX measuring volatility was down one point this past week to 15.43. The long-term average is approximately 19 to 20. The CBOE VIX measures the stock market’s expectation of volatility based on S&P 500 index options. It is commonly referred to as the fear index.

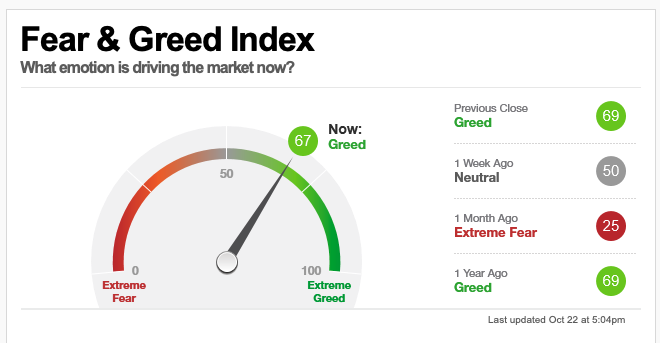

Fear & Greed Index

I also track the Fear & Greed Index. The Index is now in Fear at a value of 67. The Index is up 16 points this past week. This Index is a tool to track market sentiment. There are seven indicators in the Index that are measured on a scale of 0 to 100. The Index is calculated by taking the equally-weighted average of each indicator.

These seven indicators in the Index are Put and Call Options, Junk Bond Demand, Market Momentum, Market Volatility, Stock Price Strength, Stock Price Breadth, and Safe Haven Demand.

Safe Haven Demand is in Extreme Greed.

Junk Bond Demand indicates Extreme Greed.

Put and Call Options are signaling Extreme Greed.

Market Momentum indicates Greed.

Stock Price Breadth indicates Neutral.

Market Volatility is set at Neutral.

Stock Price Strength is signaling Extreme Fear.

Economic News

The US Census Bureau reported that new residential building permits were down 7.7% in September to a seasonally adjusted 1.589M, unchanged from the September 2020 rate. Single-family permits were down (-0.9%) from a revised August value of 1.050M, and multifamily permits fell (-21%). The number of permits issued in September was the lowest it has been since a year ago, with the Northeast reporting at (-20.0%), the West (-10.9%), and the South (-6.0%). The Midwest saw an increase in permits (+0.5%).

The Federal Open Market Committee’s (FOMC) Beige Book found that economic activity expanded at a modest to moderate pace in September and October. Some Districts noted that supply chain constraints and labor shortages slowed growth. The uncertainty over the Delta variantEmployment increased at a modest to moderate rate, as a low supply of workers hampered labor growth. Most Districts reported strong wage growth. In addition, most Districts reported significant price increases, fueled by rising demand for goods and raw materials.

The Labor Department reported a decrease in initial jobless claims for the week ending October 16th. The seasonally adjusted initial claims came in at 290,000, a 19-month low. The four-week moving average was 319,750, a decrease of 15,250 from the previous week’s revised average.

Thanks for reading Final Thoughts on 100 Baggers – Rare but Possible – Week in Review!

Here are my recommendations:

If you are unsure how to invest in dividend stocks or are just getting started with dividend investing. Take a look at my review of the Simply Investing Report. I also provide a review of the Simply Investing Course. Note that I am an affiliate of Simply Investing.

If you are interested in an excellent resource for DIY dividend growth investors. I suggest reading my Review of The Sure Dividend Newsletter. Note that I am an affiliate of Sure Dividend.

If you want a leading investment research and portfolio management platform with all the fundamental metrics, screens, and analysis tools you need. Read my Review of Stock Rover. Note that I am an affiliate of Stock Rover.

If you would like notifications about when my new articles are published, please sign up for my free weekly e-mail. You will receive a free spreadsheet of the Dividend Kings! You will also join thousands of other readers each month!

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor, analyst, and writer on dividend growth stocks and financial independence. His writings can be found on Seeking Alpha, InvestorPlace, Business Insider, Nasdaq, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial sites. In addition, he is part of the Portfolio Insight and Sure Dividend teams. He was recently in the top 1.0% and 100 (73 out of over 13,450) financial bloggers, as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.