Warren Buffett, the Chairman and CEO of Berkshire Hathaway Inc (BRK.A) and (BRK.B) published his annual shareholder letter for 2020 to his shareholders a few months ago. I usually provide the highlights soon after it is published but I am a little bit late this year. In any case, as usual Warren Buffett’s annual shareholder letter still makes for good reading. As a historical note, the first annual letter is from 1977. There is a book with unedited letters between 1965 and 2014. Below are some highlights that I view as important from the annual newsletter.

Affiliate

Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more.

Highlights from Warren Buffett’s Annual Letter for 2020

Warren Buffett’s 2020 Returns Were Not Great

CEO Warren Buffett’s annual shareholder letter leads with a list of annual gains for Berkshire Hathaway compared to the S&P 500 (SPY) since 1965. An investment in 1965 in Berkshire Hathaway would have returned a compounded annualized gain of 20.0% and an overall gain of 2,810,526%.

Pretty much anyone who started investing with Buffett in 1965 would be very wealthy by this point. Over the same time period, the S&P 500 had a compound annualized gain of 10.2% and an overall gain of 23,454% with dividends included. Notably, not all years were gains for Berkshire Hathaway. There were 10 down years, and the worst year was a (48.7%) decline in 1975. Interestingly, the S&P 500 did much better in 1975 with a loss of only (26.4%). But in most years Warren Buffett’s Berkshire Hathaway outperformed the S&P 500 by a wide margin. In turn this has led to outsized total returns.

The S&P 500 did much better than Buffett in 2020 with a gain of 18.4% versus 2.4% for Berkshire. At one point Buffett was sitting on $50 billion in unrealized losses. This is the third year in a row that Buffett underperformed the S&P 500. I attribute this largely to a lack of exposure to tech stocks with the exception of Apple (AAPL) in the investment portfolio and a focus on industrial companies.

Operating Earnings

But with that said, Berkshire Hathaway earned $42.5 billion in 2020. This is more than the market capitalization of most companies. This amount was comprised of $21.9 billion in operating earnings, $4.9 billion in realized capital gains, and $26.7 billion from an increase in the net unrealized capital gains of stock holdings.

Operating earnings are earnings from company operations, which arguably what counts the most. The $26.7 billion in operating earnings resulted from a new generally accepted accounting principles (aka ‘GAAP”) rule that requires including net change in unrealized gains and losses of stock holdings. This fluctuates quite a bit on year-to-year basis. Berkshire also lost $11 billion on write downs in value of a few subsidiaries and affiliate business that Berkshire owns. This was mostly due to a write down for Precision Cast Parts. Buffett wrote that he overpaid for the company since he was too optimistic about its normalized profit potential. Precision Castparts counts as aerospace manufacturers as major customers. The travails of Boeing (BA) and other aerospace companies during the COVID-19 pandemic in 2020 are well documented. Aircraft and part orders plummeted.

Berkshire Hathaway’s Stock Holdings

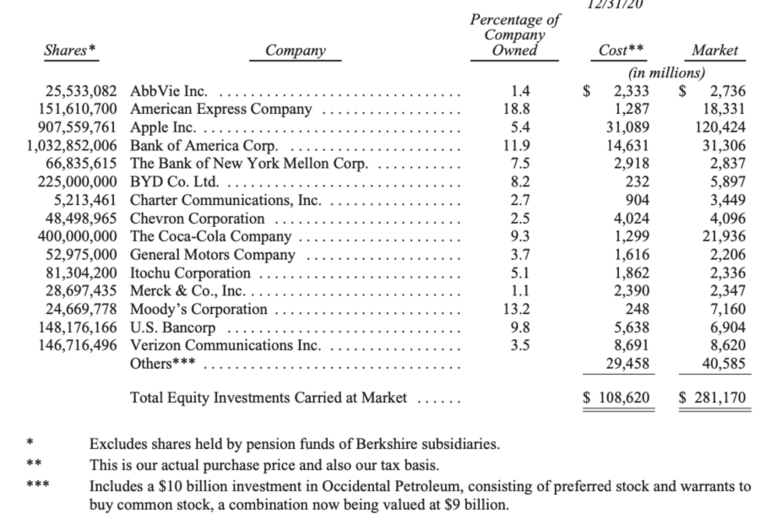

Berkshire Hathaway’s stock holdings continue to grow in value over time. The market value of company’s stocks at the time the annual letter was published was $281,170M with a cost basis of $108,6230M. The market value rose from $248,027 million in 2019 and interestingly the costs basis declined from $110,340 million in 2019.

Note that Berkshire Hathaway’s stock holdings have a market value greater than almost all US companies except a handful. Berkshire is a major and often the largest shareholder for some of these companies. For instance, it owns over 18% of American Express Company (AXP) as well as 11.9% of Bank of America Corp (BAC), and 13.2% of Moody’s Corporation (MCO).

Note that Berkshire’s ownership percentage tends to rise each year due to share buybacks by the individual companies. Since Warren Buffett does not sell the shares that Berkshire owns the percentage rises each year. For example, eleven years ago, at end of 2010 Berkshire owned only 12.6% of American Express. The ownership stake is about 50% greater since then and is now 18.7%.

Largest Holdings

Below is the list of Berkshire’s 15 largest holdings of common stock. This excluded Kraft Heinz (KHC) of which Berkshire owns 325,442,152 shares. The carrying value of these shares is $13.3 billion. But at end of 2020, the market value was only $11.3 billion. KHC’s stock price is up over 18% year-to-date in 2021 so clearly the market value is now roughly about the carrying value.

The other major change is that Berkshire exited its three large positions in airline stocks during 2020. The company owned 11.0% of Delta Airlines (DAL), 9.0% of Southwest Airlines (LUV), and 8.7% of United Continental Holdings (UAL). Perhaps he viewed these stocks as mistakes and these stocks are no longer in the top 15. Buffett’s view on airline stocks has changed earlier in 2020 stating, “The airline business, and I may be wrong, and I hope I’m wrong, changed in a major way…” Berkshire has added large positions in pharma companies including AbbVie (ABBV) and Merck (MRK). The company also lists BYD Co, Chevron (CVX), General Motors (GM), Itochu, and Verizon (VZ) in the top 15. These companies were not in the top 15 in 2019.

Berkshire Hathaway’s Family Jewels

Berkshire owns and controls a large and growing list of companies. In some cases, these companies have little-to-no connection to each other. For instance, Berkshire owns See’s Candies, Dairy Queen, GEICO, and Burlington Northern Santa Fe (BNSF), McLane, and others. Berkshire’s reach has become vast, and it is likely that you are buying something that Berkshire had a role in. You can check the 10-K for the list of major companies. However, they are largely organized into five business units: Insurance and Reinsurance Businesses, Railroad Business – Burlington Northern Santa Fe, Utilities and Energy Business – Berkshire Hathaway Energy (BHE), and Manufacturing Businesses, and Service and Retailing Businesses.

Warren Buffett defines four businesses as the family jewels. Three are owned and one is large investment.

Insurance

The largest business in terms of value is the property and casualty insurance business. This is run by Ajit Jain, who has been with Berkshire since 1986. The insurance business gives Berkshire its float that was $138 billion when the annual letter was published. The float does not belong to Berkshire, but it can be invested either in bonds or equities, in the case of Berkshire. Most insurers must invest in bonds due to regulatory and credit-rating reasons. Berkshire’s financial strength allows it to invest in equities.

The next business that is a family jewel is also fully owned by Berkshire. The non-insurance business is run by Greg Abel. Those are BNSF, which is the largest railroad measured by freight volume. The railroad carries 15% of all non-local ton-miles of goods in the U.S. Warren Buffett lists its 5.4% ownership stake in Apple as its third family jewel. The fourth and last family jewel is the 91% stake in Berkshire Hathaway Energy. In 21 years, earnings have grown organically and by M&A from $122 million to $3.4 billion.

Share Buybacks Are in Vogue

Berkshire has not been too active on the share buyback front until recently. The company is generating a growing pile of cash. Since, paying down operating debt is not an issue, and Buffett is very selective on acquisitions, something must be done with the cash. Interest rates are very low so Buffett must do something with the retained earnings. Berkshire does not pay a dividend, so the only real option is Berkshire share repurchases. Berkshire bought back 80,998 of its class “A” shares last year, spending about $24.7 billion. As both Warren Buffett and vice chairman Charlie Munger have previously indicated they will not buyback Berkshire’s shares at any price. Instead, they both look for purchases when it would increase intrinsic value for shareholders.

Final Thoughts on Highlights from Warren Buffet’s Annual Letter for 2020

There is more to Warren Buffett’s annual shareholder letter. Buffett writes about See’s Candy, National Indemnity, Clayton Homes, and Pilot Travel Centers. It makes for an interesting read. Warren Buffett discusses these stories to make his main point, which is that there has been no incubator for unleashing human potential like America. He concludes this section by stating “Never bet against America.”

Buffett uses up quite a bit of text to discussing the Berkshire Partnership as well as how Charlie Munger got started with his partnership and how they merged their operations. Warren Buffett then moves onto the five types of owners of Berkshire stock. These are founders, index funds, managed funds, individual shareholders, and individual investors. These sections are worth reading as well and I recommend that you take a look. Before discussing the annual meeting of shareholders, Buffett mentioned that Berkshire owns $154 billion in fixed assets in the U.S. A big part of this from BNSF and BHE.

Prior Year Highlights

Related Articles on Dividend Power

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more. It is an excellent resource for DIY dividend growth investors and retirees.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

- Portfolio Insight is the newest and most complete portfolio management tool with built-in stock screeners. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor, analyst, and writer on dividend growth stocks and financial independence. His writings can be found on Seeking Alpha, InvestorPlace, Business Insider, Nasdaq, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial sites. In addition, he is part of the Portfolio Insight and Sure Dividend teams. He was recently in the top 1.0% and 100 (73 out of over 13,450) financial bloggers, as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.

Love the blog Dividend Power! The S&P did outperform Buffett for exactly what you indicated: lack of exposure to tech stocks. But we can’t predict the future. The market is cyclical so it’s only a matter of a time until other sectors pick up the pace. Keep up the great work!

Thanks! Agreed, but Buffett really is focused dividends and cash flow to Berkshire. He want to increase his net cash balance for the next acquisition.