Save or Invest

Save or Invest. The question of whether to save or invest is bound to come up in most discussions of financial independence. If you Google the words “Save or Invest” you get 421,000,000 hits, which is quite a bit. It also tells you that many people are thinking and writing about this topic.

Save or invest, these ideas are opposite, but they are also linked. They are opposite because the mindset for saving and investing are different. It reminds me of an article I read last year entitled, “Save Like A Pessimist, Invest Like An Optimist” by Morgan Housel. The author seemingly hit the nail on the head from the perspective that these ideas are opposite. Save or invest are, however, also linked because one must save to invest.

Save or Invest – Saving for an Uncertain Future

Saving like a pessimist accounts for your negative view of the world. You save for an emergency fund. You do this to plan for a rainy day and unexpected events. These are normal in life and often result in financial surprises that can be categorized into unexpected expenses or unexpected loss of income. Unexpected expenses can include medical or dental emergencies, unplanned home repairs, unplanned car troubles, and others. Job loss is probably near the pinnacle of financial surprises since it leads to immediate and unexpected loss of income.

Life has a way of throwing curve balls. Home repairs, car trouble, medical bills, and the like happen frequently. You have little control over this, but you save for an emergency fund because you know that they occur.

On a larger scale, recessions happen about once every four to five years on average. Recessions are defined as two consecutive quarters of negative GDP growth. They can be small, or they can be large, but there is always the risk of unexpected loss of income.

On an even grander scale, Black Swan events like the COVID-19 pandemic are rare but have about a 1 in 100 to 1 in 200 chance of happening. This means that there is about 0.5% to 1% change each year of one occurring. But the frequency of occurrence is not predictable. Nevertheless, recessions and Black Swan events can impact your life since it often results in a surge in unemployment and a contracting economy. Can you predict when the next recession or Black Swan event occurs? Probably not, but you save because a recession or Black Swan event is inevitable.

You save for retirement because the future is uncertain. Your parents or perhaps your grandparents had pensions. The concept was simple, you worked for about 30 years and the company put away money in a defined benefit plan. The company took the risk to invest. Once you retired you received a monthly pension. Today, only government workers, military, few companies, and some unionized workers have pension plans.

For the rest of us a 401(k) or other similar defined contribution plan will be one of our main sources of income in retirement. A 401(k) plan adds uncertainty. There is no way to know a priori how much you will receive each month once you retire and start receiving distributions. Hence, you save because you are a pessimist and the future is uncertain.

Save or Invest – Invest for a Hopeful Future

Investing like an optimist accounts for your positive view of the world. You invest in your 401(k) plan or dividend growth stocks because you are expecting your money to grow. This an inherently optimistic view.

Most business are optimistic too since they expect their revenue and earnings to grow by offering products people need or want. Companies improve this products and consumers pay more driving revenue and earnings. This can be basic necessities like toothpaste or cereal. Or it could be something you want like the latest iPhone that costs over $1,000. In any case, the toothpaste you are buying today costs more than the toothpaste that your parents bought two decades ago. The first iPhone cost $499 or $599 in 2007. The latest iPhone costs $799 to start and tops out at $1,099. This is progress. Today, toothpaste has new flavors, new packaging, tartar control, and teeth whitening that was not present two decades ago. The latest iPhone has more features, better graphics, better camera, etc. than in 2007.

If you had invested $10,000 in Proctor & Gamble (PG), which makes toothpaste, or Apple (AAPL) in 2007, your money grew. Your $10,000 became $32,595 in Proctor & Gamble and $512,197 in Apple with dividends reinvested. The power of dividend growth investing is apparent in the chart below. Not bad, but it takes an inherently optimistic view to invest.

Most companies grow with time and the market generates a positive return. Most stocks are not going to perform like Apple. Instead, most stocks will perform like Proctor & Gamble, slow and steady. Even a simple index fund, like SPDR S&P 500 Trust ETF (SPY), is up over 265% with dividend reinvested in the past decade.

There is no way to know though if your investment will generate positive returns. Some stocks go down for years and some companies go bankrupt, even ones that are seemingly performing well. Technological obsolescence or poor management decisions have an impact. Corrections and bear markets happen, but so do bull markets. Indeed, over longer periods of time the stock market has generated positive returns on average.

Investing is an inherently optimistic view of the world. You are taking a leap of faith to invest your money with the expectation that money will generate positive returns for you in excess of inflation and be worth more in the future.

Save or invest, the two concepts are fundamentally different, but you need to save for an uncertain future in order to invest for a hopeful future.

Dividend Increases and Reinstatements

Enterprise Products Partners LP (EPD) hiked the dividend 1.1% to $0.45 per share from $0.445 per share. The forward yield is 8.58%. This is the 22nd consecutive annual increase. Enterprise Products is a Dividend Contender.

Cigna (CI) raised the dividend a whopping 9,900% to $1.00 per share each quarter. The forward yield is 1.91%. Cigna had previously paid an annual dividend of $0.04 per share.

Jeffries Financial Group increased the dividend 33.3% to $0.20 per share from $0.15 per share. The forward yield is 3.22%.

Alamo Group (ALG) hiked the dividend 7.7% to $0.14 per share from $0.13 per share. The forward yield is 0.41%. This is 7th annual increase in a row. Alamo is a Dividend Challenger.

Bank OZK (OZK) raised the dividend 0.9% to $0.2775 per share from $0.275 per share. The forward yield is 3.52%. This is the 25th straight yearly increase in a row. Enterprise Products is now a Dividend Champion.

Coronavirus Dividend Cuts and Suspensions List

I updated my coronavirus dividend cuts and suspensions list this past Wednesday. The number of companies on the list has risen to 506. We are well over 10% of companies that pay dividends having cut or suspended them since the start of the COVID-19 pandemic.

No new companies were added to the list in the past week.

I included five companies that I had previously missed. The five companies that I previously missed were AMEN Properties (AMEN), Vector Group (VGR), Pacific Coast Oil Trust (ROYT), Jernigan Capital (JCAP), and Apollo Commercial Real Estate (ARI).

Market Indices

Dow Jones Industrial Averages (DJIA): 31,098 (+1.61%)

NASDAQ: 13,202 (+2.43%)

S&P 500: 3,825 (+1.84%)

Market Valuation – Save or Invest

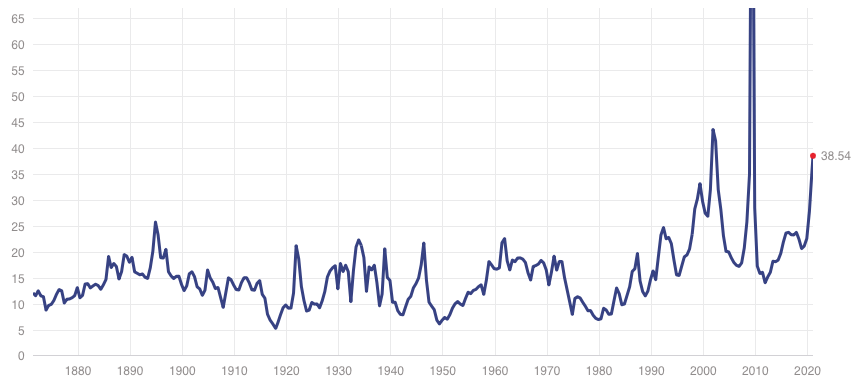

The S&P 500 is trading at a price-to-earnings ratio of 38.5X and the Schiller P/E Ratio is at about 34.8X. These two metrics are up in the past four weeks. Note that the long-term means of these two ratios are 15.8X and 16.7X, respectively. I continue to believe that the market is overvalued at this point. I personally view anything over 30X as overvalued. Note that we are starting to approach 40X and valuation levels near the top of the dot-com era.

S&P 500 PE Ratio

Shiller PE Ratio

Stock Market Volatility – CBOE VIX

The CBOE VIX measuring volatility ticked down more than a full point to 21.56 to start the year. This is above the long-term average but still a low value. The long-term average is approximately 19 to 20. So, at this point we are just above the long-term average and trending down.

Fear & Greed Index

I also track the Fear & Greed Index. The index is now in Greed at a value of 72, spiking from the past two weeks.

There are seven indicators in the index. They are Put and Call Options, Junk Bond Demand, Market Momentum, Market Volatility, Stock Price Strength, Stock Price Breadth, and Safe Haven Demand.

Market Momentum is indicating Extreme Greed. The S&P 500 is 10.28% over its 125-day average. This is on the higher end over the past two years.

Stock Price Strength is signaling Extreme Greed. The number of stocks hitting 52-week highs compared to those hitting 52-week lows is at the upper end of its range.

Safe Haven Demand is in Extreme Greed. Stocks are still outperforming bonds by 6.06% over the past 20 trading days. From last week this indicates that investors are rotating into stocks.

Put and Call Options are signaling Extreme Greed. Put option volume is lagging call option volume by 63.29%, which is amongst the lowest levels over the past 2-years.

Stock Price Breadth is indicating Greed as the advancing volume is 12.03% more than declining volume on the NYSE. This is near the higher end of its range over the past two years.

Market Volatility is set at Neutral. The CBOE VIX reading of 21.56 is a neutral reading.

Junk Bond Demand is indicating Fear. Investors are accepting 2.17% yield over investment grade corporate bonds. This is historically low but has spiked over the past few weeks.

Unemployment Numbers

The number of weekly new unemployment claims were down with last week at 787,000. This is down 3,000 from last week’s revised numbers. After falling below 800,000 for several weeks the new unemployment claims started to trend up several weeks ago. The 4-week moving average is over 800,000.

For some perspective, one-year ago weekly unemployment claims were only about 212,000. Currently we are 3X – 4X the normal level. The seasonally adjusted insured unemployment rate was 3.5%.

The ten states with the highest unemployment rates were Puerto Rico (7.8), Alaska (6.4), California (6.0), Kansas (5.9), Nevada (5.6), Illinois (5.5), New Mexico (5.5), Pennsylvania (5.2), Washington (5.1), and District of Columbia (4.6).

Economic News

The Institute for Supply Management said its manufacturing index increased to 60.7% in December, up from November’s 57.5%. December’s reading is the highest level since August 2018. The manufacturing economy is in a continued recovery with increases in production, orders, and employment. The index for new orders rose to 67.9% from 65.1%, while the production gauge increased to 64.8%. The employment number rose to 51.5%.

The Commerce Department reported new orders for U.S.-made goods rose by 1.0% in November to $487.2 billion. This is the 7th consecutive month registering an increase. Orders for durable goods increased by 1.0%. Transportation equipment led durables up 2.1%. New orders for manufactured nondurable goods rose 1.1%. Shipments of manufactured durable increased by 0.3%. Shipments of manufactured nondurable goods increased 1.1%. Inventories of manufactured goods increased by 0.7 %.

The Department of Labor reported December job losses of 140,000 as the unemployment rate remained at 6.7%. There were job gains in professional and business services, retail trade, and construction, but were offset by job losses in leisure and hospitality and in private education. Leisure and hospitality declined by 498,000, with three-quarters of the decrease coming from food services and drinking places. Employment in private education dropped by 63,000 and is down 450,000 since February. Business services added 161,000 jobs, retail trade added 121,000, and construction added 51,000.

Here are my recommendations:

If you are unsure on how to invest in dividend stocks or are just getting started with dividend investing. Take a look at my Review of the Simply Investing Report. I also provide a Review of the Simply Investing Course. Note that I am an affiliate of Simply Investing.

If you are interested in an excellent resource for DIY dividend growth investors. I suggest reading my Review of The Sure Dividend Newsletter. Note that I am an affiliate of Sure Dividend.

If you want a leading investment research and portfolio management platform with all the fundamental metrics, screens, and analysis tools that you need. Read my Review of Stock Rover. Note that I am an affiliate of Stock Rover.

If you would like notifications as to when my new articles are published, please sign up for my free weekly e-mail. You will receive a free spreadsheet of the Dividend Kings! You will also join thousands of other readers each month!

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor, analyst, and writer on dividend growth stocks and financial independence. His writings can be found on Seeking Alpha, InvestorPlace, Business Insider, Nasdaq, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial sites. In addition, he is part of the Portfolio Insight and Sure Dividend teams. He was recently in the top 1.0% and 100 (73 out of over 13,450) financial bloggers, as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.