Royal Caribbean Cruises Ltd (NYSE:RCL) has been pummeled by the market downturn resulting from the coronavirus scare. The stock is down over 30% in the past month and roughly 40% year-to-date. Simultaneously, the valuation has gone down to ~8.6X based on earnings and yield has shot up to almost 4%. As Baron Rothschild famously said, “buy when there is blood on the streets”, which means pretty much going against the crowd and when the fear factor is very high. For income investors, it may be possible to get a company with leading market share and a low valuation and high dividend yield. But with that said, Royal Caribbean dividend safety is of concern since it was cut during the Great Recession and was not reinstated until 2012. In this article, I examine Royal Caribbean’s dividend safety, advantages, risks, and moat.

Affiliate

Portfolio Insight is a leading portfolio management and research platform.

- 9,000+ stocks and ETFs in its database

- Access up to dozens of metrics, 20-years of financial data from S&P Global, fair value, margin of safety, charting, etc.

- Avoid dividend cuts with the Dividend Quality Grade and screening tools.

Click here to try Portfolio Insight for free (14-day free trial).

Overview of Royal Caribbean

Royal Caribbean is a cruise company that was founded in 1968. It operates under the Royal Caribbean International, Celebrity Cruises, Azamara Club Cruises, and Silversea Cruises brands. These brands operate either globally or regionally depending on their focus. The company also owns 50% of the joint venture that operates TUI Cruises and has a 49% stake in Pullmantur. Currently, the company has approximately 61 ships with another 15 on order. In 2019, the company carried ~6.5 million passengers. The company is one of the few large players in the industry. Major competitors include Carnival Corporation (CCL) and Norwegian Cruise Line Holdings (NWL). Carnival has about 42% market share, Royal Caribbean has about 24%, and Norwegian has about 9%. Combined they effectively control the market with a total of 75% market share. In addition, there are numerous smaller niche cruise lines.

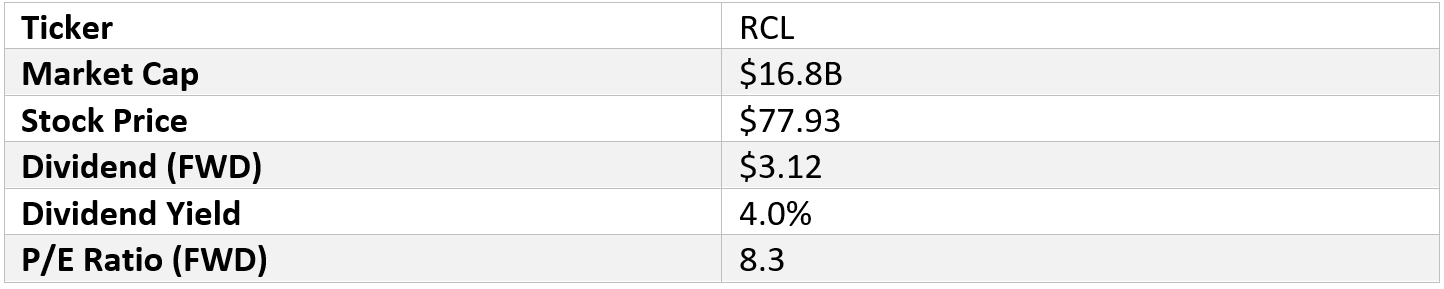

Selected Data for Royal Caribbean (NYSE)

Source: Data from Seeking Alpha

Royal Caribbean Dividend Safety

Royal Caribbean’s forward dividend is now $3.12 per share giving a forward dividend yield of about 4.0%. This is double the S&P 500’s average yield of ~2.0%, which seems to make it a good option for those seeking a high yield stock for income. The dividend has been raised for seven consecutive years making the stock a Dividend Challenger. But the full impact of the coronavirus is probably not known at this point but certainly it will affect the bottom line. If earnings drop sufficiently then the dividend may not be safe leading to a cut. Hence, one should take a closer look at dividend safety metrics.

However, from an earnings perspective the dividend is reasonably safe. The current payout ratio is roughly 33.3% based on the forward dividend and consensus 2020 earnings per share of $9.37. This is well below my threshold of 65% and suggests that the dividend is safe. The dividend has been growing at a double-digit rate for the past several years. Although the growth rate is slowing in the most recent years. The low payout ratio means that the dividend can be maintained even if earnings take a hit from an economic slowdown. With that said, it depends on the magnitude of the earnings downturn.

However, the dividend is not as well covered by free cash flow due to high capital expenditures from investing in ships. In fiscal 2019, operating cash flow was $3,716 million and capital expenditures were $3,025 million giving free cash flow of $691 million. The dividend required $603 million giving a dividend-to-FCF ratio of ~87%. This is above my threshold of 70%. If free cash flow is too high the company will need to use cash on hand, a revolving credit line, or debt to pay the dividend. The main risk is that cruising slows down due to the coronavirus leading to a drop in operating income. This would push the cash flow dividend safety metric over 100%. If cash flow does not cover the dividend for too long, then the dividend could possibly be cut.

Debt has also trended up over the past decade. Short-term debt now stands at $2,587 million and long-term debt is $8,282 million. This is offset by only $244 million in cash, equivalents, and marketable securities, which is not much. The leverage ratio is higher than desired at a little over 3X. In general, I like to see leverage ratios below 2.5X. Royal Caribbean can meet its obligations though, since interest coverage is about 5X. But this too is somewhat on the lower end of what is desired.

The dividend safety metrics are not completely encouraging, despite the high yield. In my opinion one should be wary due to the lack of coverage from free cash flow and high leverage. Both are risk factors for a dividend cut.

Royal Caribbean’s Competitive Advantages, Risks, and Moat

As one of the larger players in the cruising industry, one would think that Royal Caribbean would have a wide moat. But the industry is cyclical and there are numerous smaller players, which probably limits the moat. Cruising is categorized as consumer discretionary. During the Great Recession demand for cruises dropped. However, Royal Caribbean’s scale combined with high capital investment requirements probably gives a narrow moat. New competitors need to raise sufficient capital to buy a new or used ship. New ships costs several hundred millions dollars with the largest ships costing close to a $1 billion. The main short-term risk for Royal Caribbean is the coronavirus impact. Over a longer-term the main risk is that economic slowdowns tend to be amplified due to the discretionary nature of cruising. In addition, there are about 89 new ships coming online in the next few years that could lead to overcapacity and lower prices.

Final Thoughts

Despite the high yield and the potential as an income stock or dividend growth stock, I am not a big fan of Royal Caribbean. The main issue for me is the poor dividend safety metric from the context of free cash flow. Furthermore, the impact of the coronavirus is not yet fully known. It is likely that Royal Caribbean will be significantly affected by the coronavirus and the dividend could be cut.

This post first appeared on Value Walk as guest post on March 6, 2020.

Related Articles on Dividend Power

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more. It is an excellent resource for DIY dividend growth investors and retirees.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

- Portfolio Insight is the newest and most complete portfolio management tool with built-in stock screeners. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor, analyst, and writer on dividend growth stocks and financial independence. His writings can be found on Seeking Alpha, InvestorPlace, Business Insider, Nasdaq, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial sites. In addition, he is part of the Portfolio Insight and Sure Dividend teams. He was recently in the top 1.0% and 100 (73 out of over 13,450) financial bloggers, as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.