The world is experiencing a multitude of macro issues today. For example, inflation is running at a multi-decade high in several major economies, including the US and Europe. In addition, a global energy shortage has made energy very expensive, and the ongoing war between Russia and Ukraine causes significant uncertainties and supply chain disruptions. Last but not least, rising interest rates could topple economic growth.

In an environment like this, many investors are still trying to figure out where they can get safe and reliable income. Treasury yields have risen, but treasuries generally offer weak inflation protection. Moreover, when it comes to high-yielding equities, it’s far from guaranteed that they all will be able to maintain their dividends during an economic downturn.

Real estate investment trusts, or REITs, could be a good choice in this environment. Their “real asset” business protects investors against inflation, and tax laws demand that they pay out most of their (taxable) income, which is why many REITs offer above-average dividend yields. In this article, we will showcase three REITs with very reliable and safe dividends that have managed to grow their payouts to shareholders for decades, making them crisis-resistant and suitable as sleep-well-at-night investments.

Affiliate

Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more.

3 Best REITs for Safe Dividend Income

1: Federal Realty Trust

The first such REIT is Federal Realty Trust (FRT), a retail REIT. The company’s footprint is centered on major coastal urban centers with high population density, which results in high demand for retail space. Federal Realty Trust primarily invests in smaller properties in contrast to malls, which is a good thing, as these properties are more resilient versus the e-commerce megatrend, as they are rented out to grocers, dollar stores, pharmacies, and similar resilient businesses.

Federal Realty Trust has shown excellent resilience versus economic downturns in the past. That can be explained by the business model not experiencing significant headwinds during economic downturns. Even in bad times, consumers need to visit pharmacies, for example. In addition, with long-term contracts in place with its tenants, and those tenants doing okay even during tough times, Federal Realty Trust has been able to generate very reliable funds from operations in the past.

Dividend Analysis

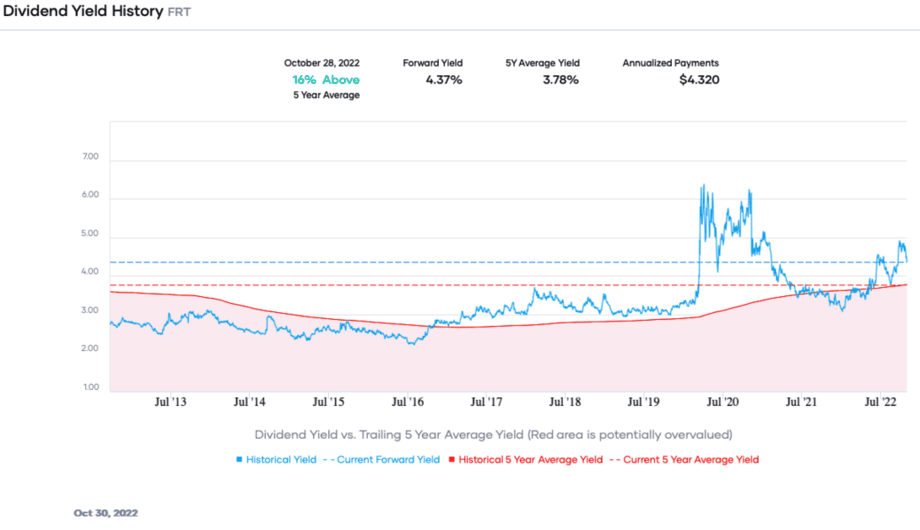

As a result of that, Federal Realty has managed to achieve Dividend King status. The company has increased its dividend for an impressive 55 years in a row. No matter what the macro environment looked like, Federal Realty has increased its dividends like clockwork — including during the Great Recession, the pandemic, etc.

We believe the dividend cut risk remains exceptionally low when one invests in Federal Realty Trust. The company’s dividend payout ratio is slightly below 70%, looking at dividends versus funds from operations. REITs frequently have considerably higher dividend payout ratios without problems; thus, investors don’t have to fear a dividend cut. The dividend yield Federal Realty offers today stands at 4.5% right now, which is on the higher end of the historical range, as Federal Realty Trust’s dividend was mainly in the 3% – 4% range over the last decade.

Related Article About Federal Realty Trust (FRT) on Dividend Power

2: Realty Income

The following safe income REIT is Realty Income (O). Realty Income is a retail REIT that operates with a triple net lease structure. With these, the tenant is responsible for all operating expenses, including taxes, insurance, maintenance, etc. This is why Realty Income’s costs are low, which allows the company to operate with above-average margins that protect it from downturns. In addition, in a high-inflation environment, the fact that Realty Income is not responsible for these operating costs is another advantage.

Realty Income primarily owns standalone properties that it rents to companies such as grocers, dollar stores, fitness centers/health clubs, etc. These businesses are relatively safe from the e-commerce trend, which is why Realty Income has maintained high occupancy rates in the recent past. In fact, the company’s occupancy rate hit a new 10-year high this summer, showcasing that demand for its properties is remarkably resilient.

Realty Income’s above-average resilience is also showcased by the fact that the company managed to grow its funds from operations-per-share, a REIT’s earnings-per-share equivalent, during every single year over the last ten years, even during the pandemic years of 2020 and 2021.

Dividend Analysis

Realty Income has increased its dividend for 26 years, making it a Dividend Aristocrat. That’s not quite as outstanding as being a Dividend King, but still a substantial feat. It should be noted that Realty Income has not been trading publicly for much longer than 26 years. Hence the company has a strong record of growing dividends in its history as a publicly traded REIT.

Today, Realty Income trades with a dividend yield of 5.0%. In addition, its dividend payments are made monthly, which is unusual for REITs and equities. With a dividend payout ratio of 74%, Realty Income’s dividend seems safe. Moreover, the dividend payout ratio has declined over the last decade, meaning that the company was able to make its dividend safer even while it continued to offer annual dividend increases to its owners.

Related Article About Realty Income on Dividend Power

3: Essex Property Trust

The last REIT on this list is Essex Property (ESS). ESS primarily owns multifamily residential units, most located in urban centers on the West Coast. Essex Property is one of the largest apartment REITs, owning more than 60,000 units.

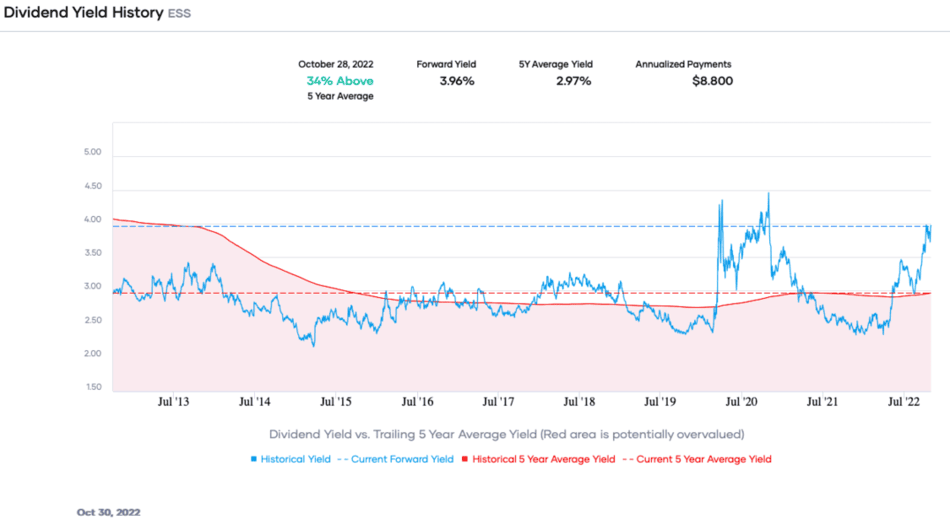

Essex Property has grown its dividend for 27 consecutive years, making it a Dividend Aristocrat, like Realty Income. This was possible thanks to the fact that Essex Property’s business model is resilient. Demand for housing doesn’t depend solely on the economy’s strength, as everyone needs a place to live, whether in a recession or an economic boom.

As a result, Essex Property has shown excellent resilience in the past. During the pandemic, despite rent moratoriums that had a negative impact, Essex Property saw its funds from operations-per-share decline by just 5%, for example, which was by far not meaningful enough to endanger the REIT’s dividend.

In the past, Essex Property has delivered reliable FFO growth via organic rent increases at existing properties, while acquisitions and new projects also played a role. As a result, there is a greater likelihood that Essex Property will continue to deliver solid growth in the long run.

Essex Property currently offers a dividend yield of 3.8%. With a payout ratio of just 61%, Essex Property has one of the lowest dividend payout ratios among major REITs. Combine the low dividend payout ratio with the REIT’s proven resilience and strong dividend track record, and ESS looks like a low-risk pick for safe income.

Related Article About Essex Property Trust on Dividend Power

Disclosure: Members of the Sure Dividend team are long FRT, O, and ESS

Related Articles on Dividend Power

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more. It is an excellent resource for DIY dividend growth investors and retirees.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

- Portfolio Insight is the newest and most complete portfolio management tool with built-in stock screeners. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Jonathon Weber

Jonathons Weber writes about value, dividend Investing, growth, and growth at a reasonable price equities. He writes extensively on Seeking Alpha and is also a member of the Sure Dividend team. According to TipRanks, Jonathan is among the top 1% of bloggers (as of July 24, 2022).