Investors typically do not expect tech stocks to pay dividends, and for good reason. For many years, very few tech stocks paid dividends to shareholders.

However, this has changed dramatically over the past decade, and now many tech stocks offer dividend payments.

The benefit of buying tech stocks that pay dividends is the potential for both capital appreciation as well as income.

This article will discuss three tech stocks with solid dividend yields and dividend growth potential.

Affiliate

Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more.

Tech Stocks Growing Dividends at A High Rate

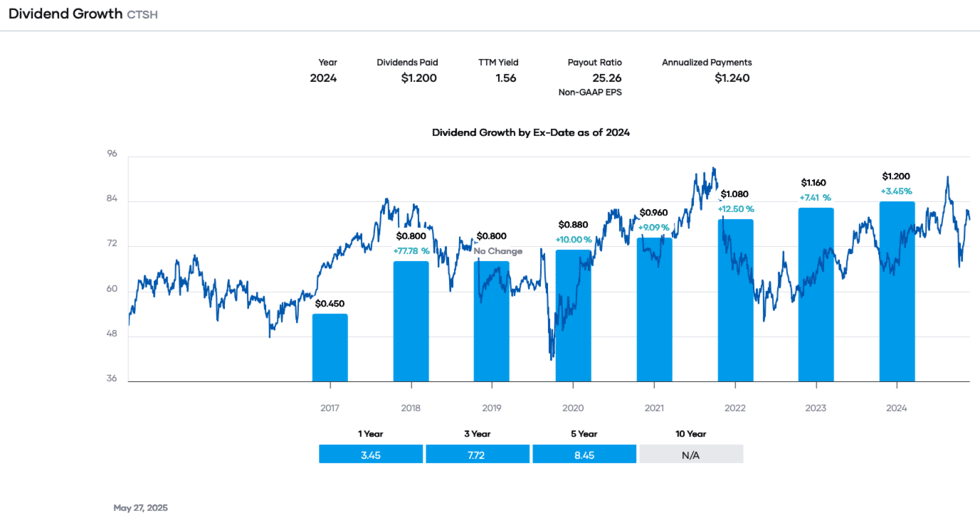

Cognizant Technology Solutions (CTSH)

Cognizant Technology Solutions is a 30-year-old company that provides information technology (IT), consulting, and business process outsourcing services in North America, Europe, and other regions.

The company operates in four segments: financial services, healthcare, products & resources and communications, media & technology. In late April, Cognizant reported (4/30/25) financial results for the first quarter of fiscal 2025. Currency-neutral revenue grew 8% over the prior year’s quarter. Adjusted earnings-per-share rose 10%, from $1.12 to $1.23, exceeding the analysts’ consensus by $0.03, thanks to higher sales, a wider operating margin, and share repurchases.

Bookings increased 3% over the prior year’s quarter to $26.7 billion, ~1.4 times annual sales. Business momentum remained solid, and hence, management raised its guidance for 2025. It expects 3.9%-6.4% growth in revenue, an expansion of the operating margin from 15.3% to 15.5%-15.7%, and adjusted earnings per share of $4.98-$5.14, implying 6.5% growth at the midpoint.

We expect 7% annual earnings-per-share growth over the next five years, above the 9-year average annual growth rate of 5.0%. Cognizant is poised to continue growing through an increasing number of customers, modest margin expansion, and tuck-in acquisitions.

The company has made a long series of tuck-in acquisitions, such as the acquisition of Belcan, an engineering R&D services provider, for $1.3 billion. The acquisition has enhanced Cognizant’s scale and helped establish a leadership position in technological services within the aerospace and defense industry.

CTSH stock currently yields 1.5%.

Universal Display Corporation (OLED)

Universal Display Corporation researches, develops, and markets organic light-emitting diode (OLED) technologies and materials for use in display and lighting applications. OLEDs are light-emitting devices that can be manufactured on both flexible and rigid substrates, making them more suitable for use in full-color displays and as lighting products.

OLED displays are used in various day products, including phones, TVs, monitors, virtual reality headsets, automobiles, and computers. Universal Display holds intellectual property rights for its technology, applicable to both displays and lighting products.

The company has two major businesses: its technology licensing business, which holds more than 6,000 issued and pending patents worldwide, and its Phosphorescent Organic Light-Emitting Diode (PHOLED) business, which develops and sells high-performance proprietary systems used in making OLED displays and lighting panels. Universal Display generates annual revenue of ~$670 million.

On May 1st, 2025, Universal Display reported first quarter results for the period ending March 31st, 2025. For the quarter, revenue increased 0.6% to $166.3 million, which was $10.2 million above expectations. GAAP earnings-per-share of $1.37 compared favorably to $1.19 in the prior year and was $0.27 above estimates.

For the quarter, revenue from material sales decreased 7.6% to $86.2 million as lower unit material volume for emitter materials more than offset positive changes in customer mix. Revenue from royalty and license fees grew 7.8% to $73.6 million. This improvement was due to higher royalty and licensing fees, offset by lower volume. Contract research services increased 77% to $6.6 million. The cost of materials declined by 0.6% to $33.9 million. The total gross margin contracted by 100 basis points to 77%.

Universal Display reaffirmed its prior guidance for the year, with the company still expecting revenue in a range of $640 million to $700 million for 2025. The company is now expected to earn $5.03 in 2025, which would represent an 8.2% increase from the prior year.

Universal Display has been a strong performer over the years, with earnings per share compounding at a rate of more than 35% over the last decade. That growth rate has slowed over the medium term, but EPS still grew at a rate of 11.8% over the previous five years. We believe that the company is capable of generating earnings growth of at least 10% annually through 2030.OLED has been growing its dividend at a high rate in recent years. On February 20th, 2025, the company announced that it was increasing its quarterly dividend by 12.5% to $0.45 per share, extending the company’s dividend growth streak to 8 consecutive years. As a result, the firm is a Dividend Challenger.

Qualcomm Inc. (QCOM)

Qualcomm develops and sells integrated circuits for use in voice and data communications. The chip maker receives royalty payments for its patents used in devices that are on 3G, 4G, and 5G networks. Qualcomm has annual sales of ~$43 billion.

On April 30th, 2025, Qualcomm announced results for the second quarter of fiscal year 2025. For the quarter, revenue grew 16.9% to $10.98 billion, which was $330 million above estimates. Adjusted earnings-per-share of $2.85 compared very favorably to $2.44 in the previous year and was $0.04 better than expected.

For the quarter, revenues for Qualcomm CDMA Technologies (QCT) grew 18% to $9.47 billion. Handset sales increased 12% to $6.93 billion, Internet of Things grew 27% to $1.58 billion, and Automotive sales improved 59% to $959 million. Qualcomm Technology Licensing, or QTL, was unchanged at $1.32 billion.

Qualcomm is projected to earn $11.77 per share in fiscal year 2025, up from $11.49 and $11.15 previously. This represents a 15.2% growth from the prior year.

Share buybacks will continue to boost earnings-per-share growth. Qualcomm repurchased 11 million shares during the quarter at an average price of ~$155. Qualcomm has ~$13 billion, or 8.5% of its market capitalization, remaining on its purchase reauthorization.

The company has grown earnings per share at a rate of 9.1% per year over the last decade. Agreements with major handset providers, a lower share count, and leadership in 5G and AI are expected to enable the company to grow in the coming years.

QCOM has a strong history of dividend growth. On April 9th, 2025, Qualcomm increased its quarterly dividend by 4.7% to $0.89, marking the company’s 23rd consecutive year of dividend growth. The firm is a Dividend Contender. QCOM stock currently yields 2.3%.

Disclosure: No positions in any stocks mentioned.

Related Articles on Dividend Power

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more. It is an excellent resource for DIY dividend growth investors and retirees.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

- Portfolio Insight is the newest and most complete portfolio management tool with built-in stock screeners. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Bob Ciura

Bob Ciura is President of Content at Sure Dividend. Bob has worked at Sure Dividend since October 2016. He oversees all content for Sure Dividend and its partner sites. Prior to joining Sure Dividend, Bob was an independent equity analyst. Bob received a bachelor’s degree in Finance from DePaul University, and an MBA with a concentration in Investments from the University of Notre Dame.