This JP Morgan (JPM) post is my 4th guest post about North American banks. Links to the prior 3 posts are found at the end of this post.

All investments require the assessment of risk and potential return. Roughly 1.5 decades ago we experienced The Great Financial Crisis which acted as a ‘wake-up call’ to some investors. Regrettably, many investors either forgot that painful period or were too young to personally experience what can happen when ‘times get tough’. Judging from the experiences some investors have shared on social media, many forgot to look at the risk aspect of their investments.

Some sectors and industries carry a greater degree of risk than others. For example, the Financial Services sector and banking industry generally carry greater risk than other sectors (eg. Household & Personal Products within the Consumer Defensive sector).

Fortunately, the recent implosion of Silicon Valley Bank, Signature Bank, First Republic Bank, and Credit Suisse and the plunge in the value of Pac West, Western Alliance, Zions Bancorp, and First Horizon is serving as a stark reminder of the need to assess the risk aspect of an investment.

Affiliate

Take the Simply Investing Course to learn more about investing and dividends.

- Lifetime access with 27 self-paced lessons.

- Covers placing stock orders, building and tracking portfolios, when to sell, reducing fees and risk, etc.

- Learn the 12 Rule of Simply Investing

- Simply Investing Coupon Code – DIVPOWER15.

Avoid Most Small Regional Banks

Some investors may be tempted to invest in small regional US banks whose market cap is under $2B and whose shares are thinly traded. This is not recommended…especially in this environment. Small banks whose business is heavily concentrated in specific geographic pockets within the US do not have the same degree of diversification as JPM, Bank of America, PNC Financial, Truist Financial, and Citigroup.

What would possess an investor to invest in a bank that is in receipt of a NASDAQ Noncompliance Notice? On April 5, 2023, Arrow Financial Corporation announced that it is ‘non-compliant with the periodic filing requirements for continued listing set forth in Nasdaq Listing Rule 5250(c)(1) as a result of its failure to file its Annual Report on Form 10-K for the year ended December 31, 2022 with the Securities and Exchange Commission by the required due date’.

Bank of Marin Bancorp is another bank investors may wish to avoid. This bank has 313 full-time equivalent staff and in Q1 2023 it generated only $9.44 million of Net Income.

This tiny bank is headquartered in Novato, California and consists of 31 retail branches and 8 commercial banking offices across 10 counties.

Its top 10 depositors relationships accounted for ~8% and ~11% of its total deposit balances as of December 31, 2022 and 2021, respectively.

These are the types of banks to AVOID!

Business Overview

The US banking industry is oversaturated. According to the Federal Deposit Insurance Corporation (FDIC), there were over 7,000 insured commercial banks before The Great Financial Crisis. Now there are over 4,000 insured commercial banks. Despite this significant reduction, 4,000 strikes me as a figure that needs to be significantly reduced. I strongly suspect Arrow Financial and Bank of Marin are not the only two banks that raise eyebrows!

At the other end of the spectrum, we have JPM.

At FYE2022 (December 31, 2022), JPM had:

- over 4800 branches;

- over 290,000 employees;

- $3.7T in assets; and

- $292.3B in stockholders’ equity.

It is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management.

It serves millions of customers, predominantly in the U.S., and many of the world’s most prominent corporate, institutional and government clients globally.

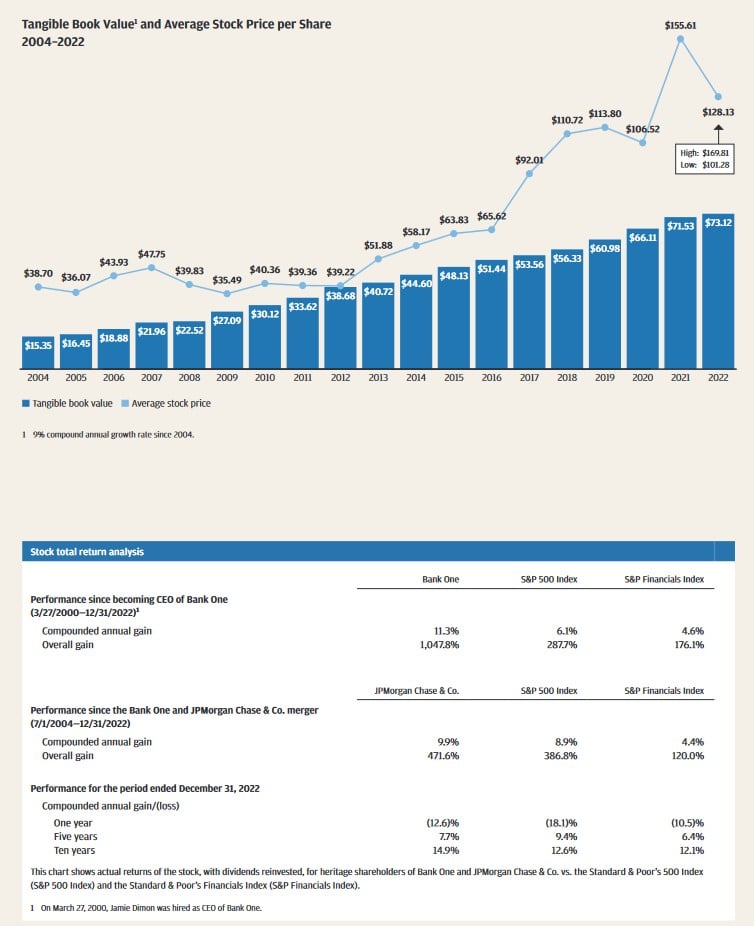

Unlike many industry participants, JPM has significantly increased its tangible book value per share over the past ~2 decades.

CEO and NEO Compensation

I am particularly interested in understanding how a company’s CEO and Named Executive Officers (NEO) are compensated; I want to see the percentage weighting of each compensation element that comprises the target Total Direct Compensation (TDC). If the long-term incentive component makes up a large percentage of the TDC, I envision that a company’s CEO and the NEOs will make decisions that are closely aligned with the interests of long-term shareholders.

A comprehensive Executive Compensation overview commences on page 47 of 122 in JPM’s 2023 Proxy Statement.

At JPM, the CEO’s pay is strongly aligned to the Firm’s short-, medium- and long-term performance, with ~85% of the CEO’s variable pay deferred into equity, of which 100% is in at-risk Performance Share Units (PSUs) for both the CEO and the President & COO. Other NEO pay is also strongly aligned to Firm and Line of Business (LOB) performance, with a majority of variable pay deferred into equity, of which 50% is in at-risk PSUs.

The following is a very high-level overview of the 2022 CEO annual compensation.

While the CEO’s and NEOs’ compensation is substantial, we need to put their compensation in perspective. These senior executives are managing North America’s largest diversified bank.

Based on my review of the executive compensation structure, I think their interests are closely aligned with those of shareholders.

JP Morgan and First Republic Bank

First Republic Bank was formed on July 1, 1985 and within 38 years, this poorly managed bank succeeded in imploding.

Looking at Item 1A – Risk Factors in the FY2022 Form 10-K, we see a host of risks that should have warned investors of the degree of risk associated with a First Republic Bank investment. These risks included but were not limited to:

- ‘Our loan portfolio is concentrated in single-family residential mortgage loans, including

non-conforming, adjustable-rate, initial interest-only period and jumbo mortgages.’ - ‘We have increased our lending to businesses and have expanded our unsecured lending, and

these loans expose us to greater risk than mortgages.’ - ‘We face competition with respect to our deposits. The inability to maintain or grow our deposits

could force us to use more expensive and less stable sources of funding.’

Once customers lose confidence in a bank, it is essentially ‘game over’; the following sequence of rating adjustments by S&P Global Ratings shows just how quickly a bank can implode.

On March 14, 2023, S&P Global Ratings placed First Republic Bank’s ‘A-‘ long-term issuer credit rating on CreditWatch with negative implications. It also placed the ratings on First Republic’s senior unsecured debt, subordinated debt, and preferred stock on CreditWatch with negative implications.

On March 15, S&P Global Ratings lowered its long-term issuer credit rating on First Republic Bank to ‘BB+’ from ‘A-‘; this is a 4-tier decline and First Republic Bank is now in ‘non-investment grade’ territory! It also lowered the senior unsecured issue rating to ‘BB+’ and the subordinated and preferred stock issue ratings to ‘BB-‘, and ‘B’, respectively. It also placed all First Republic ratings on CreditWatch with negative implications.

On March 19, S&P Global Ratings lowered its long-term issuer credit rating on First Republic Bank to ‘B+’ from ‘BB+’. It also lowered its senior unsecured issue rating to ‘B+’, the subordinated issue rating to ‘B-‘, and the preferred stock issue rating to ‘CCC’. The ratings remained on CreditWatch with negative implications.

On April 12, S&P Global Ratings lowered its issuer credit rating on First Republic Bank’s preferred stock to ‘C’ from ‘CCC’. It maintained the issuer credit rating on CreditWatch with negative implications.

On May 1, S&P Global Ratings lowered its issuer credit rating on First Republic Bank to ‘CC’ from ‘B+’. In addition, it lowered the issuer credit ratings on First Republic Bank’s subordinated debt to ‘D’ from ‘B-‘ and outstanding issues of preferred stock to ‘D’ from ‘C’; the issuer credit rating remained on CreditWatch with negative implications. S&P Global Ratings subsequently withdrew its ratings after JPM acquired a substantial majority of assets and the assumption of certain liabilities of First Republic Bank.

A transaction overview is accessible in this Presentation.

JP Morgan’s Financial Results

Q1 2023

On April 14, 2023, JPM released its Q1 2023 results. Supporting materials, which include the Q1 Form 10-Q, are accessible here.

Credit Ratings

The following table reflects JPM’s credit ratings as of May 4, 2023.

All 3 major rating agencies assign different ratings to JPM’s preferred shares with the BBB- rating assigned by S&P Global being the lowest investment grade tier; one tier below this level is BB+ which is ‘Non-investment grade speculative’. However, Moody’s assigns a rating that is one tier higher and Fitch assigns a rating that is 2 tiers higher than S&P Global’s rating. Depending on which rating you deem to be more reliable, as a common shareholder you are either accepting non-investment grade risk OR risk that is just barely investment grade.

This is not to imply that JPM is an investment to avoid but rather a recommendation that you consider whether the total potential investment return is commensurate with the credit risk.

Dividend Metrics

JPM’s dividend history following The Great Financial Crisis is in marked contrast to that prior to this major event.

In my opinion, investment decisions should not be made based on dividend metrics. Investing in companies because of an attractive dividend yield or a consecutive number of years of dividend increases should have little, if any, bearing on an investment decision. Instead, investors would be wise to invest in companies with a strong potential to generate attractive long-term TOTAL investment returns.

We, however, have our respective goals and objectives. If an investor NEEDS dividend income, then a reliable stream of steadily increasing dividends that are well covered by earnings from normal business operations will influence an investor’s decision-making process. JPM would fit the bill.

Share Repurchases

JPM has reduced its weighted average shares outstanding over the years. The share count through 2013 – 2022 (in millions of shares) is 3,815, 3,798, 3,774, 3,690, 3,577, 3,414, 3,230, 3,087, 3,027, and 2,970.

JP Morgan’s Valuation

JPM’s FY2013 – FY2022 P/E ratio is 13.17, 11.59, 11.23, 14.88, 15.43, 12.07, 13.73, 16.59, 10.02, and 11.32. While ratios in the low teens may appear attractive, they are typical for decent banks. Investors should not compare JPM’s PE levels against PE levels for high-growth companies.

The following valuations are based on JPM’s ~$135 share price at the time this post was composed.

- FY2023 – 18 brokers – mean of $14.55 and low/high of $13.45 – $16.54. Using the mean estimate, the forward adjusted diluted PE is ~9.3.

- FY2024 – 20 brokers – mean of $13.98 and low/high of $12.27 – $15.35. Using the mean estimate, the forward adjusted diluted PE is ~9.7.

- FY2025 – 7 brokers – mean of $15.41 and low/high of $13.25 – $17.39. Using the mean estimate, the forward adjusted diluted PE is ~8.8.

Based on FY2023 earnings estimates, I consider JPM’s shares to be fairly valued.

While brokers may use sophisticated models to arrive at their adjusted earnings estimates for the next few years, we see that earnings estimates can differ considerably (even for the current fiscal year). This is because every analyst uses a different set of assumptions.

While I do provide analysts’ earnings estimates for 2024 and 2025, I place no reliance on estimates beyond the current fiscal year (or the next fiscal year if the current fiscal year is almost over).

Why?

Now, let’s see….in 2020 – 2021, for example, how many 2022 and 2023 earnings estimates for the banks that have failed, which I reference at the beginning of this post, were remotely close to actual results? NONE!

Advanced valuation models have been developed over the years in an effort to more accurately determine a company’s valuation. I have seen some investors create discounted cash flow (DCF) models that use earnings estimates 10 years into the future – I have no idea how anyone can remotely know what is going to happen 2 years into the future let alone 10 years into the future.

Even Buffett and Munger warn that investors cannot come to conclusions about the future cash flows of businesses in which they invest! While Buffett accepts the principle of discounting cash flows, Charlie Munger says that he has never seen Buffett perform a formal DCF analysis.

Final Thoughts on JP Morgan

With any luck, we will witness the implosion of several more weak banks over the coming months; I do not envision JPM falling by the wayside.

If I were to invest in a US bank, JPM would be at the top of my mind. I, however, have no intention of initiating direct exposure to the US banking system.

In the universe of publicly listed companies, there are some that stand a very good probability of generating long-term total investment returns in excess of what JPM is likely to generate. These companies, however, either distribute no dividend or their dividend payout ratio is razor thin. This is because management thinks that retaining money in the company has a very reasonable probability of generating very attractive returns.

In addition, I have sufficient exposure to the banking industry through my holdings in major Canadian banks.

Based on my investor profile, I have elected to limit my exposure to the US Diversified Banking Industry through my investment in Berkshire Hathaway and New England Asset Management which is owned by Berkshire Hathaway.

Author Disclosure: I am long CM, BMO, TD, RY, and BNS. I disclose holdings held in the FFJ Portfolio and the dividend income generated from the holdings within this portfolio. I do not disclose details of holdings held in various tax-advantaged accounts for confidentiality reasons.

Author Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

Related articles on Dividend Power

- CIBC Is An Accident Waiting To Happen

- TD Bank Is A Top 10 North American Bank

- Scotiabank (BNS) Is A Terrible Long-Term Investment

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more. It is an excellent resource for DIY dividend growth investors and retirees.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

- Portfolio Insight is the newest and most complete portfolio management tool with built-in stock screeners. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

I am a self-taught investor and run the Financial Freedom is a Journey blog. I have invested in the North American equities markets for over 34 years. I retired from a career in banking and continue to invest as this is something about which I am passionate.