In my opinion, Scotiabank (BNS) is a terrible long-term investment.

In the recent Canadian Stocks Paying 100+ Years of Dividends post, Scotiabank (BNS) is included in this short list of companies. BNS is also a Canadian Dividend Aristocrat and is a holding within Blackrock’s iShares S&P/TSX Canadian Dividend Aristocrats Index ETF.

Relying on historical dividend metrics, however, is akin to driving while looking in the rearview mirror. Its historical dividend track record is no reason to invest in this bank.

Affiliate

Take the Simply Investing Course to learn more about investing and dividends.

- Lifetime access with 27 self-paced lessons.

- Covers placing stock orders, building and tracking portfolios, when to sell, reducing fees and risk, etc.

- Learn the 12 Rule of Simply Investing

- Simply Investing Coupon Code – DIVPOWER15.

Several companies that are holdings within the iShares S&P/TSX Canadian Dividend Aristocrats Index ETF are not rated by major rating agencies. This means investors need to closely analyze the financial statements to ascertain their degree of risk.

I have looked at the financial statements of several non-rated companies. Given my risk tolerance, I would not remotely consider investing in many of them.

Furthermore, there are a few holdings within this ETF which are rated and whose domestic unsecured long-term debt ratings fall in non-investment grade territory. Here are 3 that are Canadian Dividend Aristocrats that fall in ‘junk’ territory:

- Parkland Corporation (PKI.to)

- goeasy Ltd. (GSY.to)

- Ritchie Bros. Auctioneers Incorporated (RBA.to)

Be very, very careful if you decide to invest in companies solely based on their dividend metrics. Such metrics give you no indication of the degree of risk you are assuming.

I last reviewed Scotiabank (BNS) in my August 25, 2022 ‘Avoid Scotiabank Despite Its Attractive Valuation‘ post at Financial Freedom is a Journey. Investors who fixate on dividend metrics may disagree with my opinion. However, given the universe of investment opportunities, investors would be wise to focus on total potential long-term investment returns and risk. When doing this, I think investors may conclude that BNS should be avoided.

In the Final Thoughts segment of that August 25, 2022 post, I indicate that selling some BNS shares held in retirement accounts is at the ‘top of mind’. As it turns out, I did liquidate a sizable portion of my BNS shares. BNS was my 17th largest holding when I completed my Mid 2022 Investment Holdings Review. Now, it does not fall within my top 30 holdings.

For the record, the only reason my BNS exposure reached the level it did is that I received BNS shares as part of my compensation package when the bank employed me.

NOTE: All values expressed below are in Canadian dollars.

Overview

BNS is Canada’s 3rd largest bank by assets and is 1 of 6 Canadian banks that collectively hold ~90% of the country’s banking deposits. It is Canada’s most international bank in that it derives slightly more than 50% of its revenue from Canada, just over 40% from international operations (primarily Latin America, namely Mexico, Peru, and Chile), and a single-digit percentage from the US.

Scotiabanks’s domestic operations are more concentrated in mortgages and auto lending, with a leading market share in autos. The bank has been expanding its domestic wealth operations via organic growth and acquisitions and it is now the 3rd largest active manager in Canada.

During my tenure at the bank from which I retired in 2016, BNS had exposure to multiple countries. This was somewhat misleading in that in some countries, the bank had fewer than 5 employees. In addition, some of the country limits were so small that no business could be conducted.

In the early 2010s, the bank finally realized that it was of limited benefit to have exposure to several countries. It exited some countries and reworked its Latin America footprint in an attempt to consolidate and gain market share in core countries.

The long-term plan was for Scotiabank’s international exposure to give the bank the potential for higher growth and return opportunities compared with peers. However, along with this strategy came exposure to higher risk (see Core Markets discussion below).

Change in CEO

On September 26, 2022, BNS announced Brian Porter’s decision to retire as President and CEO, effective January 31, 2023. With this announcement, BNS’s Board of Directors appointed Scott Thomson as CEO of BNS, effective February 1, 2023.

While it is premature to say whether this change is good for the bank, the average annual total investment return when dividends are reinvested was ~2.89% during Mr. Porter’s tenure. If the dividends were not reinvested, the return was ~2.28%. How anyone can suggest BNS has been a good investment during Mr. Porter’s tenure is beyond me.

Canada’s Real Estate Market

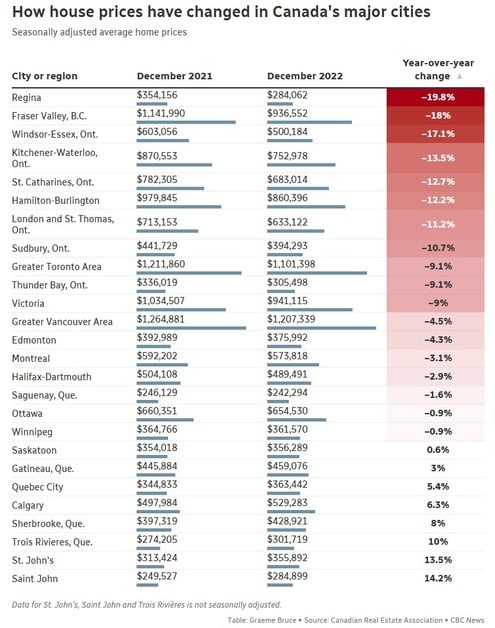

Canada is a huge country and there are significant differences in real estate markets throughout the country.

From mid-2020 to early 2022, the real estate values in some regions experienced a very rapid increase. This was fueled by a very low low-interest rate environment.

Starting in the Spring of 2022, however, the Bank of Canada initiated a series of rate increases to tame inflation. These rate increases coupled with a rapid increase in the cost of living have wreaked havoc with the finances of many families.

Recently, the Greater Vancouver Area (GVA) and Greater Toronto Area (GTA) both posted record year-over-year house price declines in Q4 2022. The aggregate price of a home in the GVA dropped by 3.5% to $1,208,900. The average cost fell by 4.6% in the GTA to $1,068,500.

However, some markets reported a jump in housing prices. The aggregate price of a home in Calgary increased by 3.9% to $599,100 on a year-over-year basis in Q4. Home prices rose by 2.2% to $544,300 in the Greater Montreal Area.

While loan and mortgage defaults are creeping higher and an increasing number of people are declaring bankruptcy or tapping into their savings to make ends meet, Canadian banks are very well managed unlike many of their U.S. counterparts (as we readily learned during the Great Financial Crisis). The risk of Canadian banks imploding under the weight of mortgage and loan defaults is low.

BNS’s Q4 2022 Investor Presentation provides a good overview of the bank’s Loans and Provisions (Mortgages, Lines of Credit, Auto Loans, and Credit Cards) for its domestic Canadian market and Loans and Provisions for its International Retail business.

Core Markets

BNS has prided itself on being Canada’s most international bank (refer to Scotiabank’s global site). It has a well-established International Banking (IB) division with a diversified franchise that serves Retail, Corporate, and Commercial customers across its footprint. Its customers are supported by more than 1,200 branches and a network of contact and business support centers.

IB provides a full range of financial products, solutions and advice to retail and commercial customers and is focused on Latin America, including the Pacific Alliance countries of Mexico, Peru, Chile and Colombia, and the Caribbean and Central America.

- In Mexico, Scotiabank Inverlat is the 5th largest bank.

- In Peru, Scotiabank Peru is the 3rd largest bank.

- Scotiabank Colpatria is the 6th largest bank in Colombia.

- Scotiabank Chile is the 5th largest bank in Chile.

Economic Outlook In Core Markets

When we compare the real GDP of Mexico, Chile, Peru, and Colombia (BNS’s 4 largest Latin American markets) relative to Canada and the United States, we see that the Real GDP of these countries is more volatile.

Corruption In Core Markets

Transparency International (TI) issues an annual Corruption Perceptions Index (CPI) in which its results are assigned on a scale of 0 (highly corrupt) to 100 (very clean). While the following are 2021 ratings, it is highly unlikely a country’s ranking will dramatically change from one year to the next. The 2022 ratings are likely the same or very similar.

The CPI ratings assigned to BNS’s core markets are:

- Canada: 74

- United States: 67

- Chile: 67

- Peru: 36

- Colombia: 39

- Mexico: 31

Mexico, Peru, and Colombia’s rankings do not instill any comfort!

Core Markets Credit Ratings

Trading Economics (TE) lists country credit ratings assigned by the major rating agencies (S&P Global, Moody’s, Fitch, and DBRS). In addition, TE’s credit rating is shown scoring the creditworthiness of a country between 100 (riskless) and 0 (likely to default). TE states on its website that unlike the ratings provided by the major credit agencies, its index is numerical because it believes it is easier to understand and more insightful when comparing multiple countries. Furthermore, TE states that its ratings are less likely to be manipulated because they are unsolicited and TE is not paid in any way to provide countries with a rating.

The creditworthiness rankings assigned by TE to BNS’s core markets are:

- Canada: 100

- United States: 98

- Chile: 75

- Peru: 61

- Colombia: 55

- Mexico: 60

The corresponding rankings assigned by the major rating agencies are also provided.

Once again, Mexico, Peru, and Colombia’s rankings do not instill any comfort!

Economic Freedom In Core Markets

The 2022 Index of Economic Freedom assigns ratings to each country based on:

- Rule of Law

- Government Size

- Regulatory Efficiency

- Open Markets

Each of these has 3 different elements by which ratings are determined.

The country with the highest overall ranking is Singapore with an overall score of 84.4. At the other end of the spectrum, we have North Korea with an overall score of 3.0.

Afghanistan, Iraq, Libya, Somalia, Yemen, and Syria receive a ‘Not Applicable’ rating since it is not possible to assign a negative rating. Liechtenstein is not graded in the 2022 Index of Economic Freedom because of the lack of adequate specific data concerning the country’s economy. Liechtenstein is closely interlocked with Switzerland and shares the Swiss currency, the Swiss franc.

The economic freedom rankings of BNS’s core markets are:

- Canada: 76.6

- United States: 72.1

- Chile: 74.4

- Peru: 66.5

- Colombia: 65.1

- Mexico: 63.7

If we drill down on each country to see the ratings assigned to the different elements that are used to arrive at the overall score for each country, we see that Mexico’s Rule of Law receives abysmal ratings:

- Property Rights: 47.7

- Judicial Effectiveness: 40.7

- Government Integrity: 32.0

Peru and Colombia do not fare much better!

And these are three countries that make up BNS’s core markets!? Good grief!

Unrest in Core Markets

Canada has certainly had its share of protests (the COVID-19 protests began in April 2020, with protests in Vancouver, Toronto, Edmonton, and Ottawa against the Government of Canada’s response to the COVID-19 pandemic and subsequent measures.) These protests, however, pale in comparison to the January 6, 2022 United States Capitol attack.

The US also has a population of ~332 million and is a country known for having more guns than people. To put this in perspective, if only ~11% of the US population were to own 1 gun, that would be roughly the equivalent of EVERY (even newborn babies) Canadian owning a gun. No wonder there is so much violence in the US.

Chile has also had its share of protests. Primarily between October 2019 and March 2020, there was a series of massive demonstrations and severe riots that originated in Santiago and spread to all regions of Chile, with a greater impact in the regional capitals.

In December 2022, Peru declared a 30-day state of emergency to quell violent demonstrations which shook the country following the ousting and arrest of President Pedro Castillo. President Castillo had been removed from office and was detained on charges of “rebellion” after he announced mere hours before he was due to face an impeachment vote that he would shutter congress and install a ‘government of exception’.

Colombia? Well…that country has been a mess for years although the situation is much improved from the 1980s.

However, more than 202,000 people in Colombia were forcibly displaced or confined in 2022, largely because of violence by illegal armed groups, according to the United Nations’ humanitarian agency OCHA.

Data released by OCHA showed that 119,000 people were confined to their homes or villages for more than a week in 2022. This is the highest number since the humanitarian agency began monitoring humanitarian crises in Colombia in 2008.

In total, 3.2 million people were somehow affected by violence in 2022, mainly in the northwest of Colombia.

Mexico? Now here is another ‘dog’s breakfast’. The drug cartels control vast regions of Mexico. Once again, this is one of BNS’s core markets?

Affiliate

Try the Simply Investing Report & Analysis Platform.

- 6,000+ stocks on the NYSE, NASDAQ, and TSX

- 120+ metrics and financial data updated daily

- Portfolios, watch lists, dividend income, e-mail alerts, etc.

- List of top ranked stocks based on the 12 Rules of Simply Investing

- 14-day free trial

Try the Simply Investing Course

- 10 modules and 27 lessons

- Access to 21-years of stock data and portfolio tracker

- 1-month free access the Report & Analysis Platform

- Lifetime access to the course and 30-day money back guarantee

Use the Simply Investing Coupon Code DIVPOWER15 for 15% off.

Summary of Core Markets

Operating in Chile, Peru, Colombia, and Mexico for several years has forced BNS to adapt to conditions that several of its Canadian competitors do not need to contend with on the same scale.

Scotiabank’s major Canadian competitors have opted to focus on expanding their presence in the United States. BNS, however, has chosen to focus on expansion in these 4 countries because it deems the US market to be saturated. In addition, BNS has had operations in Mexico for decades and has learned to adapt to less-than-ideal political and economic markets.

Does BNS’s Risk Outweigh The Potential Reward?

BNS’s Subordinated Debt – NVCC ratings are inferior to those of its larger and more profitable Canadian peers (The Royal Bank of Canada (RY) and The Toronto-Dominion Bank (TD)) despite BNS’s risk exposure to Chile, Peru, Colombia, and Mexico; investors are not being compensated for this additional risk. In fact, BNS’s total investment return over the past 15 years (January 2008 – January 2023) is well below that of RY, TD, and The Bank of Montreal (BMO).

Scotiabank’s overall investment return during this timeframe is even lower than The Canadian Imperial Bank of Commerce (CM), which is not saying much because CM has a track record for destroying shareholder value!

Most recently, CM has been ordered to pay $0.848B in damages to private equity firm Cerberus Capital Management, in a contract dispute tied to the 2008 Global Financial Crisis. In early January 2023, CM said it expects to take a C$1.16B pretax charge, or about C$0.85B after tax in Q1 2023 thereby reducing its ratio of capital to assets.

While CM ‘strongly disagrees’ with the legal and factual bases underlying the decision and intends to appeal, this is just another example of how CM has destroyed shareholder value.

In addition to the Cerberus legal issue, CM also destroyed shareholder value with its exposure and legal expenses related to Global Crossing and Enron from the dot.com era.

If that isn’t enough, after 15 years of contested litigation (the class action was launched in 2007), retail branch employees alleging systemic unpaid overtime have agreed with CM that CM will pay a total of $0.153B to compensate ~30,000 current and former front-line retail staff for unpaid overtime and to pay for legal fees and for the cost of distributing the settlement funds.

National Bank of Canada (NA.to) has produced strong total shareholder returns over the years (definitely well above BNS’s returns) but I do not follow it.

Laurentian Bank of Canada’s market cap is ~$1.5B and is most certainly not a bank in which I would remotely consider investing. Its Subordinated Debt – NVCC (see an explanation of term) rating assigned by S&P Global is currently BB+. This rating is non-investment grade and if you are a Laurentian Bank shareholder, your risk is even greater than that of subordinated debt holders.

Scotiabank’s Financial Results

Q4 and FY2022

Scotiabank’s fiscal year end is the last business day of October. Given this, the Q4 and FY2022 results are the most current; Q1 ends the last business day of January.

While the most recent financial information available for review is accessible here, the following provides a quick overview of BNS’s performance in F2022.

The Q4 2022 Investor Fact Sheet is another quick source of high-level information.

Credit Ratings

Investment decisions based solely on ‘potential return’ can sometimes lead to heartache. Ask anybody who invested in some of the ‘junk’ companies or cryptocurrencies that have imploded over the past year.

When gauging a bank’s degree of risk, I always look at the Capital Ratios. Looking at the BNS’s most recent results, we see a deterioration in some of the ratios. Despite this deterioration, the CET1, Tier 1, Total capital, Leverage, TLAC and TLAC Leverage ratios at the end of Q4 2022 were above the minimum capital ratios set by the Office of the Superintendent of Financial Institutions (OSFI).

BNS’s current credit ratings are accessible here.

I look at the credit ratings and outlook assigned to a company’s subordinated debt by the major rating agencies. I then account for my higher risk since I am merely a shareholder.

When the subordinated debt ratings are the bottom tier of the lower medium investment grade category, my risk level as a common shareholder is ‘non-investment grade – speculative’. This risk might be acceptable to some but in my FFJ Portfolio – June 2022 Interim Report, I disclosed 4 positions I exited because I deemed the risk to be unacceptable; I received shares in these companies as a result of spin-offs from existing holdings.

BNS’s credit ratings and outlook are acceptable for my purposes.

- Moody’s and S&P Global rate BNS’s Subordinated Debt (NVCC) at the top tier of the lower medium grade;

- Fitch’s rating is the middle tier of the upper medium grade; and

- DBRS’ rating is the bottom tier of the upper medium grade.

The ratings assigned by Moody’s and S&P Global define BNS as having an adequate capacity to meet its financial commitments. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitments.

Fitch and DBRS define BNS as having a strong capacity to meet its financial commitments. It is, however, somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

NOTE: Non-viability contingent capital (NVCC) subordinated debt and preferred shares are products that offer higher yields than government bonds and most high-quality corporate bonds, but also have unique risks. NVCC securities are hybrid financial securities that have elements of both debt and equity.

Dividend Metrics

The bank’s current policy is to pay common share dividends quarterly. The amount of the dividend is announced each quarter and is based on a percentage of net income after tax and takes into consideration the preference of preferred shares with respect to dividend payments and the capital adequacy, liquidity and other regulatory directives issued under the Bank Act (Canada).

Investing based solely on dividend metrics is a fundamentally flawed way of investing and BNS is a perfect example of this. Investors will look at the current ~5.95% dividend yield and think this makes BNS a worthwhile investment. The problem with this is that no consideration is given to risk or potential capital appreciation.

While growth in BNS’s earnings has resulted in dividend increases in 43 of the last 45 years, we see that growth in BNS’s dividend has not been consistent in recent years.

As noted earlier, BNS’s total investment return over the past ~9.2 years is ~2.89% when dividends are reinvested and ~2.28% when dividends are not reinvested. Compare these returns to Canada’s annual inflation rate of 6.8% in November of 2022! Now, what do you think about those sub-3% returns?

Share Repurchases

While BNS does repurchase shares annually, the weighted average number of issued and outstanding shares in FY2013 – FY2022 is (millions of shares): 1,209, 1,222, 1,232, 1,226, 1,223, 1,229, 1,251, 1,243, 1,225, and 1,208. The increase in the number of shares within this timeframe is attributed to the issuance of shares related to several acquisitions that include MD Financial in 2018 and Jarislowsky Fraser in 2018.

Scotiabank’s Valuation

The bank’s FY2012 – FY2022 historical PE ratio levels based on diluted EPS are 11.01, 13.23, 11.72, 9.87, 12.96, 12.50, 9.98, 10.98, 12.98, 11.63, and 8.27.

On October 31, 2022 (BNS’s last day of FY2022), shares closed at $65.85. BNS ended up generating $8.02 and $8.50 in diluted EPS and adjusted diluted EPS in FY2022. Using this data, the diluted PE and adjusted diluted PE ratio levels were ~8.21 and ~7.75.

As I compose this post, BNS shares trade at ~$69.20. Using the current adjusted diluted EPS broker estimates, BNS’s valuation is:

- FY2023 – 13 brokers – mean of $8.32 and low/high of $8.00 – $8.59. Using the mean estimate, the forward adjusted diluted PE is ~8.32.

- FY2024 – 13 brokers – mean of $8.60 and low/high of $7.47 – $9.18. Using the mean estimate, the forward adjusted diluted PE is ~8.05.

I think BNS’s FY2023 diluted earnings will fall short of the adjusted diluted EPS estimates. FY2023 is likely to be a challenging year so if we err on the side of caution and BNS generates $8.12 in diluted EPS and the PE ratio retraces to ~9.25, we would be looking at a share price of ~$75.10. In addition, investors can likely expect at least a $1.03/quarterly dividend over the next few quarters.

The $5.90 capital appreciation and the $4.12 in dividend income amounts to $10.02 which is a ~14.5% return when we use the current $69.20 share price.

I caution you that these figures are purely speculative. Secondly, there is a significant variance in the estimated forward-adjusted diluted EPS estimates from the brokers which cover BNS. Thirdly, there is some debate as to whether the global economy will slip into a mild recession in 2023. In just about every earnings call transcript I read, senior management expresses some reservations as to how 2023 will unfold. I suggest, therefore, that we err on the side of caution when analyzing any potential investment.

Final Thoughts on Scotiabank (BNS)

It remains to be seen whether BNS’s total investment returns will be much better during Mr. Thomson’s tenure than during Mr. Porter’s tenure. However, I am not ‘holding my breath’ and consider Scotiabank to be a terrible long-term investment which is why I have significantly reduced my exposure.

Investors who overlook risk and fixate on dividend metrics might consider BNS to be a worthwhile investment because its valuation is attractive. Sometimes a company’s valuation is attractive because its outlook is less favourable than that of its peers. Such appears to be the case with BNS.

In my opinion, in the universe of potential investments, BNS is not the horse I would bet on.

I prefer to invest in great companies that have temporarily fallen out of favour. Therefore, I have been adding to my exposure in other companies for which I provide updates at Financial Freedom Is A Journey.

Author Disclosure: I am long BNS. I disclose holdings held in the FFJ Portfolio and the dividend income generated from this holding. I do not disclose details of holdings held in various tax-advantaged accounts for confidentiality reasons.

Author Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

Related Articles on Dividend Power

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more. It is an excellent resource for DIY dividend growth investors and retirees.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

- Portfolio Insight is the newest and most complete portfolio management tool with built-in stock screeners. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

I am a self-taught investor and run the Financial Freedom is a Journey blog. I have invested in the North American equities markets for over 34 years. I retired from a career in banking and continue to invest as this is something about which I am passionate.