It would appear that some irrational investors piled into UPS immediately following its February 1, 2022 announcement of record results, strong FY2022 guidance, and a ~49% increase in the quarterly dividend; the share price surged from ~$202 to ~$231. At the time this post is being composed, the share price has retraced slightly to ~$225. Despite this marginal pullback UPS is unattractively valued.

Affiliate

Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more.

Overview

Most people are undoubtedly familiar to some extent with United Parcel Service, Inc. (UPS).

Founded in 1907, it has grown to be the world’s largest package delivery company and is a premier provider of global supply chain management solutions.

It offers a broad range of industry-leading products and services through its extensive presence in North America, Europe, the Indian sub-continent, the Middle East and Africa (“ISMEA”), Asia Pacific and Latin America.

Its services include transportation, distribution, contract logistics, ground freight, ocean freight, air freight, customs brokerage and insurance.

UPS also operates one of the largest airlines in the world and also has the world’s largest fleet of alternative fuel vehicles.

A comprehensive overview of the company is found in Part 1 of the FY2020 Form 10-K and several fact sheets found on the UPS website.

Barriers to Entry

This is a highly capital-intensive business with high entry barriers. Scale leads to cost advantages in that significant fixed costs are spread over millions of packages.

UPS has an immense network of processing facilities and because of the substantial number of packages processed, it has considerably lower unit and marginal costs than a potential new entrant.

Any other company that attempts to replicate UPS’s global parcel shipping network will incur significant financial losses; a new entrant would be required to make a massive investment (ie. planes, sorting facilities, trucks and all other infrastructure elements) before it could win a critical volume of customers from entrenched incumbents.

DHL Express learned this the hard way when in 2009 it decided to exit the U.S. domestic package market following 6 years of sizable losses.

NOTE: UPS has Class A and Class B common stock. Class A shares are restricted to eligible employees. All references to UPS shares in this post relate to the publicly listed Class B stock.

Financial Review

Q4 and FY2021 Results

The Form 10-K is not yet released. Investors, however, are encouraged to review the latest results which are accessible here.

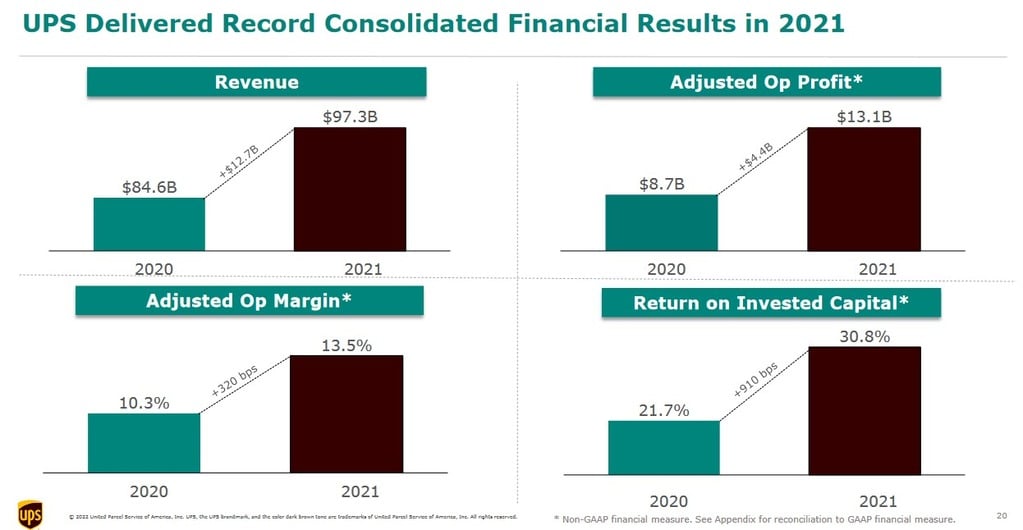

The following images from UPS’s Q4 and FY2021 earnings presentation show the extent of its strong financial performance in FY2021.

Free Cash Flow (FCF)

In FY2021, UPS generated ~$15B in cash flows from operating activities and incurred ~$4B of CapEx resulting in ~$11B of FCF. This compares favourably with ~$5.1B and ~$4.1B in FY2020 and FY2019.

FY2022 Outlook

As noted earlier, this is a highly capital-intensive business that discourages new entrants. In FY2022, UPS is projecting ~$5.5B of CapEx. Add in the ~$9B in projected FCF and cash flows from operating activities should be ~$14.5B.

Credit Ratings

Equity investors rank last in order of priority in the event a company defaults on its debt obligations. This is why I look at the debt ratings assigned to a company’s unsecured long-term debt. If this form of debt is non-investment grade then investors must factor into their investment decision-making process their willingness to invest in speculative, highly speculative (or worse) companies!

Before December 2007, UPS’s domestic unsecured long-term debt was assigned Aaa and AAA ratings by Moody’s and S&P Global.

UPS’s domestic unsecured long-term debt ratings are now:

- Moody’s: A2 (this is the middle tier of the upper medium grade investment-grade category);

- S&P Global: A- (this is the bottom tier of the upper medium grade investment-grade category).

The rating assigned by Moody’s is 5 tiers lower than Aaa and the rating assigned by S&P Global is 6 tiers lower than AAA.

These ratings define UPS as having a strong capacity to meet its financial commitments. It is, however, somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

The deterioration in UPS’s credit ratings over ~15 years certainly raises eyebrows. The ratings, however, are still investment-grade. Fortunately, both Moody’s and S&P Global assign a stable outlook and it appears UPS is making progress in reducing its leverage. I do not, therefore, expect UPS to default on its obligations any time soon.

Dividends and Share Repurchases

Dividends and Dividend Yield

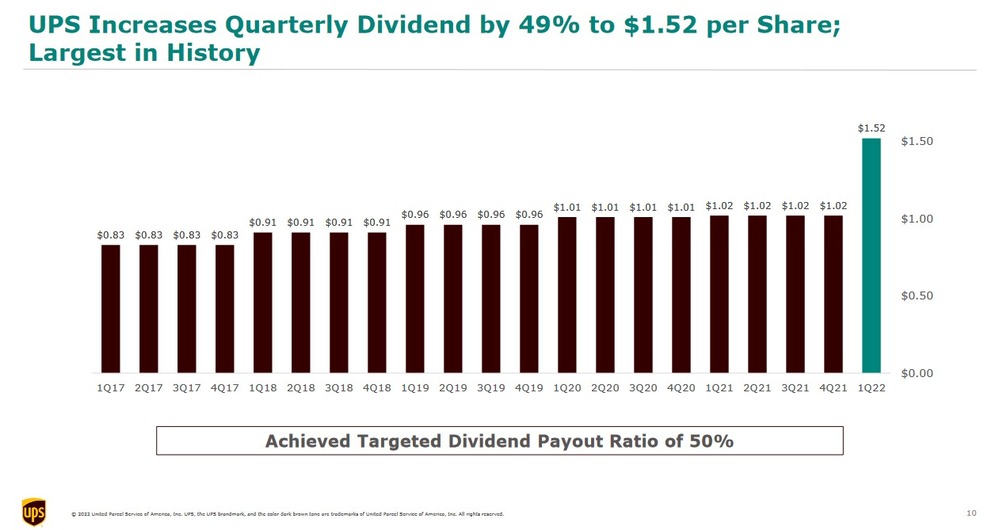

On February 1, 2022, UPS declared that it will pay a dividend of $1.52/share on March 10, 2022 to shareowners of record on February 22, 2022. Based on this quarterly dividend, UPS projects ~$5.2B in FY2022’s dividend distribution.

This ~49% increase from the previous $1.02 quarterly dividend is a welcome increase for long-term UPS investors. Although UPS is a Dividend Contender, having increased its dividend for 13 consecutive years, its dividend history reflects a couple of instances where the quarterly dividend was held constant for several consecutive quarters.

UPS distributed a $0.19/share quarterly dividend during the February 2001 – November 2002 timeframe and a $0.45/share quarterly dividend during the February 2008 – November 2009 timeframe.

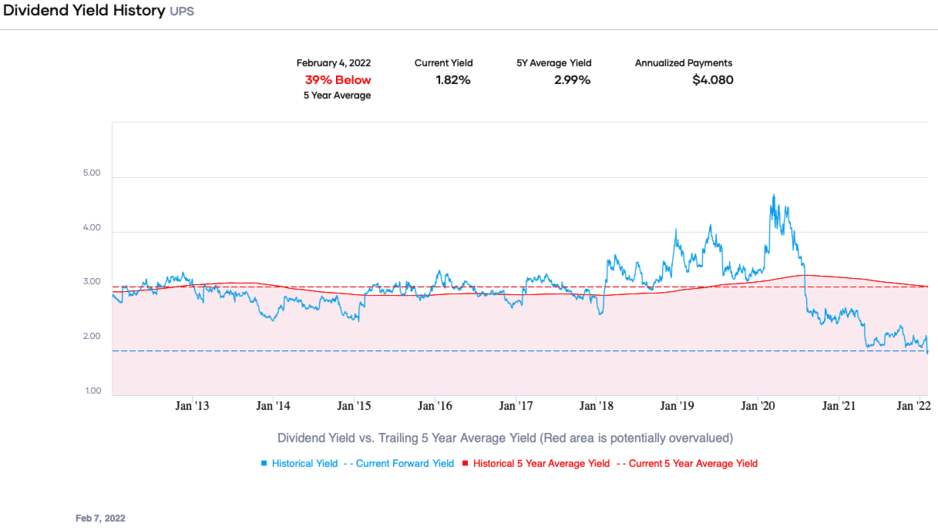

Before the release of FY2021 results, UPS’s forward dividend yield was ~2%. With the increase in the quarterly dividend, the forward dividend yield is ~2.7% using the current ~$225 share price.

Making investment decisions primarily based on a company’s consecutive years of dividend increases and the dividend yield is a fundamentally flawed way by which to invest. Investors would be better served by assessing a company’s potential to generate attractive TOTAL long-term returns.

It makes little sense to invest in UPS for a 2.7% dividend yield if the current valuation is likely to lead to muted capital appreciation.

Share Repurchases

UPS’s weighted average diluted shares outstanding in FY2010 – FY2021 (in millions of shares) is 1,003, 991, 969, 948, 924, 906, 887, 875, 870, 869, 871, and 878.

In August 2021, UPS’s Board of Directors approved a new share repurchase authorization for $5.0B. UPS repurchased 2.6 million shares of Class B common stock for $0.5B under an accelerated stock repurchase transaction during the 3 and 9 months ended September 30, 2021. As of September 30, 2021, UPS had $4.5B of available share repurchase authorization.

UPS is Unattractively Valued

UPS’s diluted EPS during 2010 – 2021 has been all over the map:

$3.33, $3.84, $0.83, $4.61, $3.28, $5.35, $3.86, $5.61, $5.51, $5.11, $1.54, and $14.68.

This has led to wild swings in its valuation over the same timeframe:

20.86, 17.30, 88.83, 66.93, 27.65, 22.02, 20.43, 29.20, 15.60, 20.36, and 31.95.

UPS has now reported $14.68 for FY2021. Shares are currently trading at ~$225 thus giving us a diluted PE of ~15.3.

UPS repeatedly has adjustments to its GAAP earnings (eg. Transformation Strategy Costs, Impact of the Tax Cuts and Jobs Act, Benefits Plans – Mark to Market Charges, Legal Contingencies and Expenses) which can result in adjusted earnings being very different from GAAP earnings.

UPS’s adjusted diluted EPS during 2010 – 2021 is:

$3.48. $4.35, $4.53, $4.57, $4.75, $5.43, $5.75, $6.01, $7.24, $7.53, $8.23, and $12.13.

Based on FY2021 adjusted diluted earnings of $12.13 and the current share price, the adjusted diluted PE is ~18.5.

I last reviewed UPS in this April 28, 2021 post at which time I stated:

The sudden surge in UPS’ share price from ~$176 to ~$194 on April 27, 2021, seems overdone to me and reinforces my opinion that many investors are being irrational.

By early October 2021, UPS’s share price had retraced to ~$178.

While past performance does not have any bearing on future performance, I think we are currently experiencing another period of ‘irrational exuberance’.

Affiliate

Stock Rover is an award winning investment research platform.

- The site has 8,500+ stocks, 4,000 ETFs, and 40,000 mutual funds.

- Access to 650+ metrics, financial data, market news, stock and fund ratings, fair value, margin of safety, etc.

- Includes brokerage integration, portfolio tracking, rebalancing, watchlists, alerts, future income forecasts, etc.

Click here to try Stock Rover for free (14-day free trial).

The earnings estimates reflected in the 2 online trading platforms I use and the current ~$225 share price results in the following:

- FY2022: mean of $12.75 and a low/high range of $11.26 – $13.40 from 30 brokers. The forward adjusted diluted PE using the mean estimate is ~17.6.

- FY2023: mean of $13.39 and a low/high range of $11.03 – $14.50 from 29 brokers. The forward adjusted diluted PE using the mean estimate is ~16.8.

- FY2024: mean of $13.74 and a low/high range of $10.37 – $15.68 from 8 brokers. The forward adjusted diluted PE using the mean estimate is ~16.4.

I am reluctant to use FY2024 estimates since so few brokers have provided input. In addition, much can happen over two years.

Final Thoughts on UPS is Unattractively Valued

UPS’s valuation is somewhat rich and is susceptible to a further pullback.

I have held UPS shares in a tax-efficient account (no dividend withholding tax is incurred) since at least January 2006. NEVER have I seen UPS generate GAAP and non-GAAP results like those reported for FY2021; these results are well in excess of the norm.

In early January 2022, I completed an Investment Holdings Review at which time UPS was my 20th largest holding; it was my 25th largest holding in mid-April 2021 and 21st largest holding in mid-August 2020.

I endeavour to regularly increase exposure to high-quality companies. As much as I would like to increase my exposure to UPS, I think shares are unattractive valued and I will look for other opportunities.

I think investors would be wise to invest in great companies when they temporarily fall out of favour and not when they are in the ‘limelight’. Jumping on the UPS ‘bandwagon’ now is akin to driving while looking in the rearview mirror.

Having said this, it is not my intention to sell my UPS shares just because I think its valuation is unattractive. I invest for the very long term and do not exit a position unless there is a significant deterioration in the company’s long-term outlook.

Thanks or reading UPS is unattractively valued!

Disclosure: I am long UPS.

Author Disclosure: I disclose holdings held in the FFJ Portfolio and the dividend income generated from these holdings. I do not disclose details of holdings held in various tax-advantaged accounts for confidentiality reasons.

Author Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

Related Articles on Dividend Power

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more. It is an excellent resource for DIY dividend growth investors and retirees.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

- Portfolio Insight is the newest and most complete portfolio management tool with built-in stock screeners. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

I am a self-taught investor and run the Financial Freedom is a Journey blog. I have invested in the North American equities markets for over 34 years. I retired from a career in banking and continue to invest as this is something about which I am passionate.