Nvidia’s Rise Has Been Astounding

Something happened that had not happened in years. Microsoft (MSFT) and Apple (AAPL) lost their rankings as the number one company by market capitalization to a relative newcomer. Nvidia (NVDA) overtook both before dropping to third by market close on Friday.

Nvidia’s rise has been astounding. The corporation’s market capitalization grew from roughly $12 billion in 2015 to $145 billion in 2020, a greater than tenfold increase. However, it rose 30X since then to $3.11 trillion. Currently, Nvidia is the third most valuable company.

It is well-known that Apple’s rise was due to the smartphone. Microsoft grew to prominence with its operating system, enterprise software, and cloud. Alphabet is the leader in search, advertising, and mobile phone software. Amazon revolutionized online shopping and retail. Meta Platforms rose to become the leader in social media. However, why did Nvidia become so valuable?

The firm has its roots in graphics processing units (GPU). They worked with central processing units (CPU) to accelerate graphics and image processing. GPUs have been used in high-end computers and gaming units for many years. However, increasing video demand and software advances made GPUs critical in computers, smartphones, cars, and servers. Importantly, GPUs can perform non-graphic calculations. They often conduct repetitive tasks in parallel better than a CPU. As a result, they are important for cryptocurrency mining, AI, and machine learning.

This ability gives Nvidia its edge. The other differentiator is the effective leadership of Jensen Huang. He is the CEO and one of the three founders of Nvidia. The combination of the two has resulting in Nvidia’s astounding rise.

Interestingly, Huang’s cousin is the CEO of Advanced Micro Devices (AMD).

I do not directly own Nvidia because it paid a minuscule flat dividend for many years. That said, Nvidia increased the dividend by 300%, but the yield is still meager. I do not expect Nvidia to become a dividend growth stock. The semiconductor industry is notoriously capital intensive. It takes a significant amount of money to design and manufacture chips. Also, leadership changes often. Just look at Intel (INTC). The firm lost its leadership, and eventually, Intel cut its dividend.

That said, If you are interested in dividend stocks, try the Sure Dividend Newsletter. They provide ten picks each month with easy-to-follow analysis and commentary. Click here to try the Sure Dividend Newsletter* (7-day free trial with credit card information).

Stock Market This Week

Stock Market This Week – 06/22/24

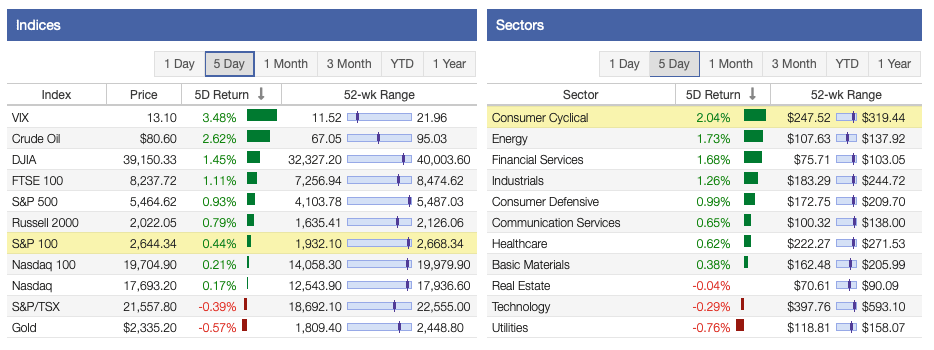

Data from Stock Rover* showed the stock market had another solid week. The Dow Jones Industrial Average (DJIA) was the top index. It was followed by the S&P 500 Index, Russell 2000, and the Nasdaq Composite.

Eight of the 11 sectors had positive returns this week. The Consumer Cyclical, Energy, and Financial Services sectors were top performers. However, the Real Estate, Technology, and Utilities sectors were the worst performers. Sentiment has seemingly turned against Technology, with many stocks struggling. In addition, for income investors seeking deals, Utilities, and regional banks remain a good place to look. Although, neither are near their lows.

Oil prices rose to ~$80.60. The VIX climbed nearly 3.5% to roughly 13.1, still well below its long-term average. Gold ended the week at ~$2,335 per ounce, lower than at the start of the month.

Affiliate

Try the Simply Investing Report & Analysis Platform to pick the best stocks.

- Analyzes 6,000+ stocks with 120 metrics and financial data.

- Tracking portfolios, watch lists, dividend income, e-mail alerts, undervalued and overvalued stocks, etc.

- List of top ranked stocks based on the 12 Rules of Simply Investing.

- Simply Investing Coupon Code – DIVPOWER15.

The American bull market continues because of the strength of its economy. Unemployment remains at 4% or below, job growth is still robust, and it seems like manufacturing has bottomed. On the downside, geopolitical situations have stabilized, especially after multiple aid packages were passed at the end of April. The bottom line is that investors are still driving share prices up.

The Nasdaq Composite leads the way, followed by the S&P 500, the DJIA, and the Russell 2000. Small-cap stocks continue to struggle in this era of large-cap tech dominance. Ten of the 11 sectors have positive returns. The top performers in 2024 have been Technology, Communication Services, and Utilities, while the Basic Materials, Consumer Cyclical, and Real Estate sectors are trailing.

The dividend growth investing strategy started the year down but has recovered. Larger market capitalization stocks are performing better than smaller ones. The table below shows their performance by category. Dividends and passive income streams continue to grow.

| Category | YTD Return (%) |

|---|---|

| Dividend Kings | +1.9% |

| Dividend Aristocrats | +3.5% |

| Dividend Champions | +0.7% |

| Dividend Contenders | +0.8% |

| Dividend Challengers | +0.9% |

Affiliate

Take the Simply Investing Course to learn more about investing and dividends.

- Lifetime access with 27 self-paced lessons.

- Covers placing stock orders, building and tracking portfolios, when to sell, reducing fees and risk, etc.

- Learn the 12 Rule of Simply Investing

- Simply Investing Coupon Code – DIVPOWER15.

Stock Market Valuation This Week

The S&P 500 Index trades at a price-to-earnings ratio of 28.40X, and the Schiller P/E Ratio is about 34.58X. These multiples are based on trailing twelve months (TTM) earnings.

The long-term means of these two ratios are approximately 16X and 17X, respectively.

Despite the recent correction, bear market, and rebound, the market is still overvalued. Based on historical data, earnings multiples of more than 30X are overvalued.

Resources

- Stock Market Holidays

- Dividend Stock Lists

- Investor Relations Guides

- Checking and Savings Account Resources

- Dividend Investing Resources

- Reviews

Curated Weekend Reading From Around The Web

Portfolio Management and Investing

- Why Are ETFs (Sometimes) More Tax-Efficient Than Mutual Funds (Oblivious Investors)

- The Stock Market Will Crash! (Darious Foroux)

- Why Stocks Are the Greatest Asset Class (Of Dollars and Data)

Retirement

- An Economic Perspective on Service Fees (Monday Morning Economist)

- Thorstein Veblen’s Theory of the Leisure Class (Rob Henderson’s Newsletter)

- More boomers prepared for retirement, but gaps persist (Vanguard)

Financial Independence

- How to be enough (Vox)

- The Five Types of Wealth (The Retirement Manifesto)

- Two Types of Money People (A Wealth of Common Sense)

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more. It is an excellent resource for DIY dividend growth investors and retirees.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

- Portfolio Insight is the newest and most complete portfolio management tool with built-in stock screeners. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor, analyst, and writer on dividend growth stocks and financial independence. His writings can be found on Seeking Alpha, InvestorPlace, Business Insider, Nasdaq, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial sites. In addition, he is part of the Portfolio Insight and Sure Dividend teams. He was recently in the top 1.0% and 100 (73 out of over 13,450) financial bloggers, as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.