The Dividend Aristocrats 2020 are U.S. stocks that that have grown their dividend for 25+ years in a row. But that alone does not qualify a stock as a Dividend Aristocrat. In order to be included on the list a company must meet four criteria:

- Be a member of the S&P 500

- Have raised the regular dividend per share for 25 consecutive years

- Have a market capitalization of at least $3 billion

- Average at least $5 million in daily share trading value for the three months prior to the rebalancing date

- Minimum number of constituents must be 40 at each rebalancing date. A particular Global Industry Classification Standard or ‘GICS’ should not results in one sector comprising more than 30% of the index weight

The index is updated quarterly in January, April, July, and October.

For this reason, a Dividend Aristocrat can also be a Dividend Champion but not vice-versa. It is also the reason why there are more Dividend Champions than Dividend Aristocrats. These stocks can be found in the S&P 500 Dividend Aristocrats index. There are currently 65 constituents of the index, which is nine more than last year as of October 30, 2020.

Affiliate

Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more.

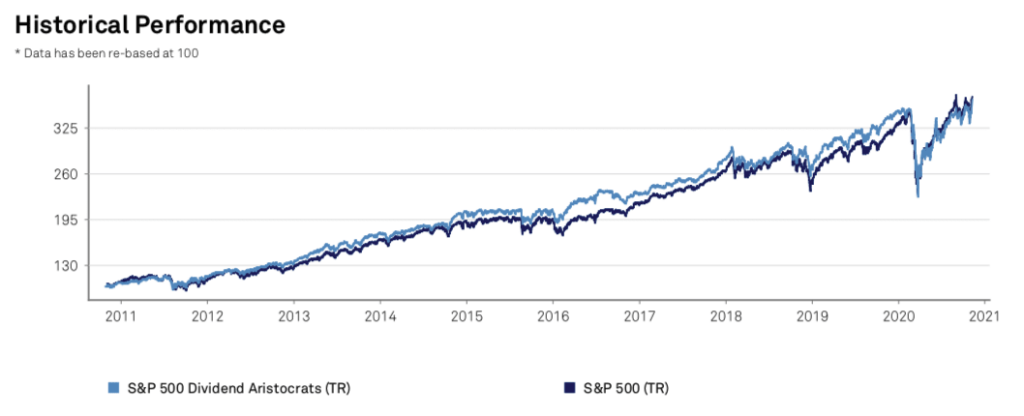

Performance of Dividend Aristocrats 2020

The Dividend Aristocrats 2020 provided a return of -1.92% in October as measured by the Dividend Aristocrat ETF (NOBL). It outperformed the S&P 500 that provided a return of -2.66% in October.

On a year-to-date basis, the Dividend Aristocrats have returned -4.47% while the S&P 500 has returned 2.77%

As a group, the Dividend Aristocrats 2020 have exhibited similar returns with lower volatility compared with the S&P 500 resulting in higher Sharpe ratios. Over the past ten years, the Dividend Aristocrats have had an annualized return of 12.79% and a standard deviation of 12.24%, while the S&P 500 has had an annualized return of 13.01% and a standard deviation of 13.27%.

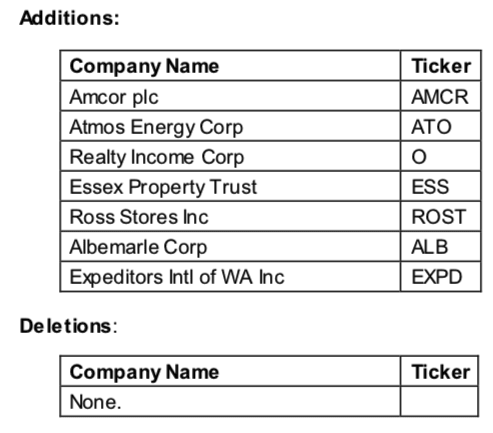

Changes in 2020 to the List of Dividend Aristocrats

The list is updated at least annually and was most recently done so on January 24, 2020. There were seven additions and no deletions as seen in the table below, which will be effective on February 3, 2020.

On March 31, 2020 the S&P Dow Jones Indices announced that the list will change due United Technologies Corp. (UTX) merging with Raytheon. The new company is called Raytheon Technologies Corp. (RTX). As part of the transaction Otis Worldwide Corporation (OTIS) and Carrier Global Corporation (CARR) were spun off. All three companies will remain in the index. See the announcement below.

On June 23, 2020 the S&P 500 Dow Jones Indices announced that Ross Stores (ROST) will be deleted from the index. The change was effective July 1, 2020.

Other Dividend Stock Lists

Note that it is possible for a company to be a Dividend Aristocrat and also a Dividend King. Dividend Kings have raised the dividend for at least 50 consecutive years. The other lists of U.S. stocks are below.

- List of Dividend Kings in 2020

- List of Dividend Champions in 2020

- List of Dividend Contenders in 2020

- List of Dividend Challengers in 2020

- Dogs of the Dow in 2020

For Canadian stocks I have recently updated my article on

For UK stocks I have an article on

Some Details on the Dividend Aristocrats 2020

The list of Dividend Aristocrats 2020 is a fairly select list since there now are only 65 companies. This is out of the over 4,300 companies listed on stock exchanges at end of 2018. These companies have survived periods of inflation, stock market crashes, global crises and deep recessions. They may not have grown revenue and earnings per share every year, but they annually raised the dividend without fail for 25 years straight. Hence, this list serves as a starting point for small investors seeking to research potential ideas.

Stocks from the industrials sector have the greatest representation on the list of Dividend Aristocrats 2020 at about 25.8%. This class of stocks tend to have somewhat more volatile earnings and cash flows but many have low payout ratios letting them grow the dividends during recessions and economic downturns. The second sector with high representation is consumer staples at approximately 19.9%. This is likely due to relatively stable earnings and cash flow characteristics of these stocks. In addition, these companies tend to slowly grow earnings over time permitting annual dividend increases. The third sector on the list is the Materials sector at 12.6%. Combined these three sectors make up the majority of the Dividend Aristocrats at 58.3%.

The sector breakdown for the Dividend Aristocrats 2020 is seen in the chart below as of October 30, 2020. The sector composition has changed with time due to changes in the S&P 500 index composition. Additionally, the Great Recession caused many previous Dividend Aristocrats to freeze or even cut their dividend. These mostly financial stocks were dropped from the list of Dividend Aristocrats affecting the sector composition. A few industrial stocks were also dropped from the list. In fact, between 2009 and 2010 nineteen companies were dropped from the list of Dividend Aristocrats.

The sector weight as a function of time is seen in the chart below. One can clearly see the drop off in percentage of financials stocks during the Great Recession. The percentage of utility stocks also dropped off during this time, which may be surprising to some. But one must remember that most utilities have high payout ratios, and many entered the unregulated market. The economic downturn pressured revenue and earnings leading to dividend cuts for some utilities. The other interesting point is that consumers staples and industrials percentages are growing with time since end of 2005. Today, they constitute about 45% of the Dividend Aristocrats 2020.

The largest Dividend Aristocrat by market capitalization is Johnson & Johnson (JNJ) with a market capitalization of roughly $393,183 million. Combined the 65 Dividend Aristocrats have a total market capitalization of roughly $5 trillion. The smallest Dividend Aristocrat is Leggett & Platt (LEG) with a market capitalization of about $4,532 million. The total market capitalization of all the Dividend Aristocrats is approximately $4,532,436 at the moment.

The one with the highest yield is AT&T (T) and the one with the lowest yield is Roper Technologies Inc (ROP). Dover Corp (DOV), Genuine Parts (GPC), and Procter & Gamble (PG) are the Dividend Aristocrats with longest streak of consecutively increasing the dividend at 64 – 65 years.

On average the Dividend Aristocrats 2020 have a yield of about 2.9%, which is greater than the broader market average. The average 10-year dividend growth rate is approximately 8.9% and the average payout ratio is ~74%. The payout is currently elevated due to depressed earnings resulting from COVID-19.

The Dividend Aristocrat 2020 list serves as a screen for further investigating a stock for a dividend growth portfolio. It is a list of companies with stable businesses that have competitive advantages and have returned cash to shareowners consistently through dividends and in some cases buybacks.

List of Dividend Aristocrat Stocks in 2020 – Updated October 30, 2020

| Company Name | Ticker | No. Years | Dividend Yield (%) | Payout Ratio (%) | 10-Yr Dividend Growth Rate (%) | P/E Ratio | Market Cap ($) |

|---|---|---|---|---|---|---|---|

| AbbVie | ABBV | 8 | 4.96 | 100.0% | n/a | 19.05 | $ 163,924 |

| Abbot Laboratories | ABT | 7 | 1.32 | 74.0% | -1.81 | 57.61 | $ 202,793 |

| Archer Daniels Midland | ADM | 45 | 2.92 | 51.0% | 9.26 | 16.41 | $ 26,857 |

| Automatic Data Proc. | ADP | 45 | 2.14 | 63.0% | 10.35 | 24.11 | $ 71,282 |

| AFLAC Inc. | AFL | 38 | 2.70 | 17.0% | 7.08 | 5.70 | $ 25,920 |

| Albemarle Corp. | ALB | 26 | 1.32 | 42.0% | 10.82 | 24.86 | $ 11,947 |

| Amcor Plc | AMCR | 1 | 3.90 | n/a | n/a | 23.55 | $ 18,069 |

| A.O. Smith Corp. | AOS | 27 | 1.96 | 49.0% | 21.90 | 27.00 | $ 7,386 |

| Air Products & Chem. | APD | 38 | 1.71 | 60.0% | 10.43 | 27.83 | $ 67,753 |

| Atmos Energy | ATO | 36 | 2.35 | 47.0% | 5.55 | 20.38 | $ 11,551 |

| Becton Dickinson & Co. | BDX | 48 | 1.31 | 115.0% | 7.88 | 84.63 | $ 68,589 |

| Franklin Resources | BEN | 40 | 5.29 | 67.0% | 11.51 | 12.53 | $ 9,610 |

| Brown-Forman Class B | BF-B | 36 | 0.91 | 35.0% | 8.10 | 34.35 | $ 36,013 |

| Cardinal Health | CAH | 25 | 3.51 | 58.0% | 10.08 | 14.10 | $ 15,444 |

| Carrier Global Group | CARR | 0 | 0.41 | n/a | n/a | 17.21 | $ 33,757 |

| Caterpillar Inc. | CAT | 27 | 2.41 | 68.0% | 9.26 | 24.54 | $ 87,622 |

| Chubb Limited | CB | 27 | 2.12 | 60.0% | 9.11 | 22.94 | $ 62,149 |

| Cincinnati Financial | CINF | 60 | 2.80 | 48.0% | 4.06 | 15.91 | $ 11,947 |

| Colgate-Palmolive Co. | CL | 57 | 2.15 | 56.0% | 6.02 | 24.58 | $ 71,171 |

| Clorox Company | CLX | 43 | 2.28 | 47.0% | 7.66 | 23.00 | $ 27,489 |

| Cintas Corp. | CTAS | 37 | 0.97 | 29.0% | 18.18 | 37.77 | $ 35,670 |

| Chevron Corp. | CVX | 33 | 6.50 | -82.0% | 6.10 | n/a | $ 136,967 |

| Dover Corp. | DOV | 65 | 1.65 | 42.0% | 6.42 | 23.35 | $ 16,776 |

| Ecolab Inc. | ECL | 28 | 0.87 | 45.0% | 11.73 | 48.11 | $ 56,915 |

| Consolidated Edison | ED | 46 | 3.86 | 75.0% | 2.48 | 19.18 | $ 26,052 |

| Emerson Electric | EMR | 63 | 2.65 | 62.0% | 4.09 | 20.24 | $ 41,903 |

| Essex Property Trust | ESS | 26 | 3.27 | 89.0% | 7.08 | 21.91 | $ 15,333 |

| Expeditors International | EXPD | 26 | 1.19 | 27.0% | 10.09 | 24.03 | $ 14,950 |

| Federal Realty Inv. Trust | FRT | 53 | 4.63 | 118.0% | 4.74 | 23.83 | $ 5,266 |

| General Dynamics | GD | 29 | 2.99 | 38.0% | 10.24 | 12.48 | $ 39,981 |

| Genuine Parts Co. | GPC | 64 | 3.21 | n/a | 6.75 | 303.48 | $ 13,657 |

| W.W. Grainger Inc. | GWW | 49 | 1.58 | 50.0% | 11.33 | 30.38 | $ 20,964 |

| Hormel Foods Corp. | HRL | 54 | 1.88 | 53.0% | 16.04 | 29.03 | $ 26,926 |

| Illinois Tool Works | ITW | 57 | 2.13 | 66.0% | 13.10 | 29.14 | $ 66,286 |

| Johnson & Johnson | JNJ | 58 | 2.77 | 61.0% | 6.65 | 22.58 | $ 374,479 |

| Kimberly-Clark Corp. | KMB | 48 | 3.23 | 61.0% | 5.09 | 21.36 | $ 46,320 |

| Coca-Cola Company | KO | 58 | 3.12 | 84.0% | 6.54 | 25.09 | $ 212,508 |

| Leggett & Platt Inc. | LEG | 49 | 3.83 | 94.0% | 4.30 | 24.12 | $ 5,389 |

| Linde Plc | LIN | 27 | 1.50 | 89.0% | 7.96 | 56.45 | $ 131,382 |

| Lowe’s Companies | LOW | 58 | 1.56 | 29.0% | 19.20 | 19.84 | $ 127,357 |

| McDonald’s Corp. | MCD | 45 | 2.42 | 79.0% | 8.56 | 28.95 | $ 161,143 |

| Medtronic plc | MDT | 43 | 2.05 | 68.0% | 10.31 | 29.32 | $ 139,227 |

| McCormick & Co. | MKC | 21 | 1.39 | 43.0% | 12.03 | 36.09 | $ 25,169 |

| 3M Company | MMM | 62 | 3.60 | 68.0% | 10.87 | 18.62 | $ 94,034 |

| Nucor Corp. | NUE | 47 | 3.17 | 115.0% | 1.12 | 32.97 | $ 14,618 |

| Realty Income Corp. | O | 27 | 4.56 | 232.0% | 4.92 | 50.59 | $ 20,354 |

| Otis Worldwide Corp | OTIS | 0 | 1.26 | n/a | n/a | 30.97 | $ 27,543 |

| People’s United Financial | PBCT | 28 | 5.64 | 62.0% | 1.52 | 8.92 | $ 4,455 |

| PepsiCo Inc. | PEP | 48 | 2.95 | 78.0% | 7.84 | 27.36 | $ 191,236 |

| Procter & Gamble Co. | PG | 64 | 2.29 | 57.0% | 5.24 | 25.66 | $ 355,155 |

| Pentair Ltd. | PNR | 1 | 1.44 | 35.0% | 0.00 | 21.23 | $ 9,008 |

| PPG Industries Inc. | PPG | 49 | 1.52 | 46.0% | 6.67 | 26.78 | $ 32,776 |

| Roper Technologies Inc. | ROP | 27 | 0.53 | 13.0% | 18.46 | 26.36 | $ 40,734 |

| Raytheon Technologies | RTX | 27 | 2.92 | n/a | 6.02 | n/a | $ 88,936 |

| Sherwin-Williams Co. | SHW | 42 | 0.78 | 25.0% | 13.63 | 33.85 | $ 66,856 |

| S&P Global Inc. | SPGI | 47 | 0.77 | 26.0% | 10.74 | 35.95 | $ 85,259 |

| Stanley Black & Decker | SWK | 53 | 1.58 | 44.0% | 7.61 | 25.60 | $ 28,656 |

| Sysco Corp. | SYY | 50 | 2.53 | n/a | 3.45 | n/a | $ 31,000 |

| AT&T Inc. | T | 36 | 7.35 | 136.0% | 2.17 | 18.72 | $ 195,537 |

| Target Corp. | TGT | 53 | 1.76 | 38.0% | 13.35 | 18.07 | $ 80,850 |

| T. Rowe Price Group | TROW | 34 | 2.63 | 39.0% | 12.56 | 14.25 | $ 30,283 |

| VF Corp. | VFC | 47 | 2.52 | n/a | 12.33 | n/a | $ 27,304 |

| Walgreens Boots Alliance Inc. | WBA | 45 | 4.70 | 355.0% | 12.09 | 73.33 | $ 32,307 |

| Wal-Mart Inc. | WMT | 47 | 1.50 | 34.0% | 6.18 | 20.50 | $ 413,076 |

| ExxonMobil Corp. | XOM | 38 | 9.42 | 448.0% | 7.30 | 44.15 | $ 138,601 |

| 39.1 | 2.7 | 71.2% | 8.5 | 32.1 | $ 73,546 | ||

| 43.0 | 2.4 | 57.5% | 7.9 | 24.5 | $ 35,670 |

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more. It is an excellent resource for DIY dividend growth investors and retirees.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

- Portfolio Insight is the newest and most complete portfolio management tool with built-in stock screeners. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor, analyst, and writer on dividend growth stocks and financial independence. His writings can be found on Seeking Alpha, InvestorPlace, Business Insider, Nasdaq, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial sites. In addition, he is part of the Portfolio Insight and Sure Dividend teams. He was recently in the top 1.0% and 100 (73 out of over 13,450) financial bloggers, as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.

20 thoughts on “The List Of Dividend Aristocrats In 2020”