3M Company (MMM) cut its dividend because of legal settlements and divestment of the Healthcare segment into an independent company, Solventum, and the need to maintain financial flexibility. It is the third Dividend King to do so in 2024.

The company’s legal challenges caused the share price to fall dramatically to the lowest value in a decade. The share price fell as investors sold this dividend stock because of worries about uncertain liabilities and the potential for a dividend cut. However, we do not expect another reduction in the foreseeable future.

Affiliate

Portfolio Insight is a leading portfolio management and research platform.

- 9,000+ stocks and ETFs in its database

- Access up to dozens of metrics, 20-years of financial data from S&P Global, fair value, margin of safety, charting, etc.

- Avoid dividend cuts with the Dividend Quality Grade and screening tools.

Click here to try Portfolio Insight for free (14-day free trial).

Overview of 3M Company

3M Company is a diversified conglomerate with global operations. The firm mainly acts as a supplier to other industrial and manufacturing companies. It operates through three segments: Safety and Industrial, Transportation and Electronics, and Consumer. It sells many things like abrasives, adhesives, granules, tapes, personal protective equipment, films, signage, stationery products, etc.

Total revenue was $32,681 million in 2023 and $32,614 million in the past twelve months.

Dividend Cut Announcement

After the market closed on Tuesday, May 14th, 3M Company (MMM) cut its dividend payout. The company’s quarterly dividend rate was $1.51 per share before the announcement. The dividend is now $0.70 per share, a 53.6% reduction. In the quarterly results on April 30th, the announcement stated,

“In addition, following the spin of Solventum, 3M’s dividend payout ratio is expected to be approximately 40% of adjusted free cash flow. The second-quarter dividend is expected to be declared in May 2024, and is subject to board approval.”

Later, in the actual announcement, the company stated,

“The 3M Board of Directors (today declared a dividend on the company’s common stock of $0.70 per share for the second quarter of 2024. The dividend is payable June 12, 2024, to shareholders of record at the close of business on May 24, 2024. 3M has paid dividends to its shareholders without interruption for more than 100 years.”

Effect of the Change

By executing a nearly 54% dividend cut, 3M sought to reset its dividend even though it was a Dividend King and Aristocrat. After spinning out Solventum (SOLV) and resolving several lawsuits, the company obviously valued its financial flexibility. These settlements will require large payments over many years. The cash flow from reducing the dividend will help in the matter.

Consequently, 3M Company (MMM) lost its 66-year dividend increase streak and is no longer a Dividend King. This is significant because a company rarely drops off the list because of reducing or omitting the dividend. That said, three Dividend Kings have fallen off the list in 2024. Leggett & Platt and Telephone and Data Systems (TDS) also cut their dividends. 3M is also no longer a Dividend Aristocrat. However, the firm still retains its streak of paying a dividend for 100+ years.

Challenges

3M Company faced several lawsuits dragging down results and requiring taking charges. The lawsuits had billions of dollars in liability. Although the firm litigated many cases, the expenses rose, and the outcome was uncertain. The lawsuits also pressured the share price. In a few of the past five years, the equity was one of the worst performing Dividend Kings. In addition, 3M divested its Healthcare segment.

Earplug lawsuit

3M settled a combat arms earplug lawsuit with ~300,000 claims in 2024. It will contribute $6 billion between 2023 and 2029, with $5 billion in cash and $1 billion in stock. The firm took pre-tax present value charges.

Public Water Supplier Lawsuit

A second lawsuit about PFAS in public water suppliers was settled a few months earlier. 3M will pay $10.3 billion pre-tax over 13 years to more than 11,000 public water systems.

Healthcare Segment Spinoff

3M also spun off its Healthcare segment into a standalone business called Solventum. This action removed $8 billion in sales and reduced revenue, earnings per share, and free cash flow.

Dividend Safety

3M’s dividend safety was declining because of the legal liabilities. We discussed these issues when we last updated 3M’s dividend safety analysis. I also exited my position at that time to avoid the risk of a dividend cut.

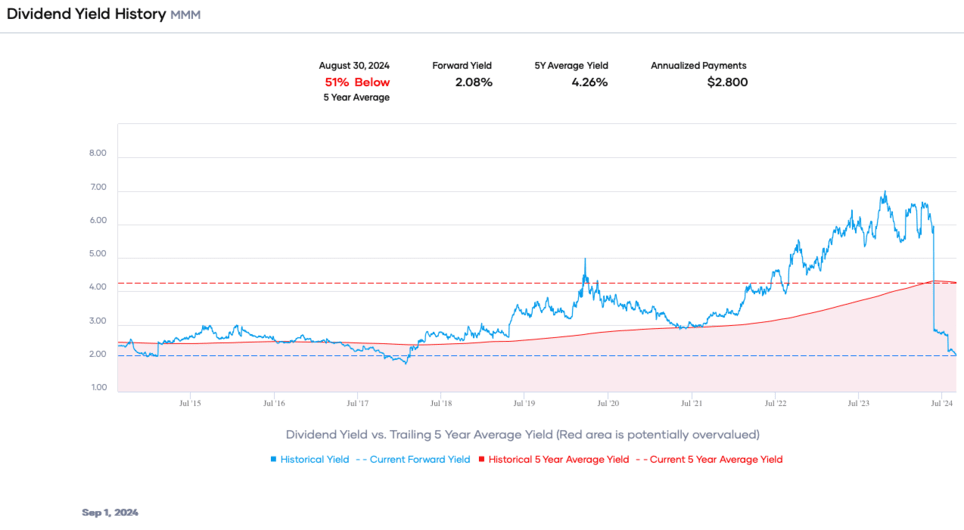

Moreover, some weak end markets were pressuring revenue and earnings per share. For a well-regarded Dividend King, the dividend safety was sub-optimal. Moreover, as seen on the chart below from Portfolio Insight*, the dividend yield had climbed to over 6% before the cut. Although not yet a sign of distress, it was greater than typical.

After reducing the dividend by approximately 54%, the forward dividend yield is around 2.1%. The quarterly rate is $0.70 per share. However, the yield is more than the S&P 500 Index’s average.

The annual dividend now requires about $1.54 billion ($2.80 yearly dividend x 549 million shares), compared to $3.31 billion in 2023. In addition, based on consensus 2024 estimates of $7.27, the dividend payout ratio will contract to around 55.3%. We expect the annual difference in cash flow requirements to be used to pay settlement liabilities.

The dividend is clearly in a better position now, and we do not expect 3M Company (MMM) to execute another cut soon. However, the diversified conglomerate receives a dividend quality grade of F’ from Portfolio Insight. Hence, it is in the bottom percentile of dividend stocks tracked.

Final Thoughts on the 3M Company (MMM) Dividend Cut

Related Articles on Dividend Power

- 3M (MMM) – A Toxic Dividend King to Avoid

- Brandywine Realty Trust (BDN) Dividend Cut as Hybrid Work Grows

3M’s legal liabilities were uncertain and significant. A company rarely has two major lawsuits simultaneously. Even a company of 3M’s size faced difficulties. The legal issues and the Solventum spinout required the firm to slash the dividend because of future settlement payments, lower revenue EPS, and FCF. Surprisingly, the stock market responded positively. However, 3M Company (MMM) cut its dividend, losing Dividend King and Aristocrat status.

Here are my recommendations:

Affiliates

- Simply Investing Report & Analysis Platform or the Course can teach you how to invest in stocks. Try it free for 14 days.

- Free Dividend Kings Spreadsheet from Sure Dividend, complete with Buy/Hold/Sell recommendations, dividend histories, and much more. It is an excellent resource for DIY dividend growth investors and retirees.

- Stock Rover is the leading investment research platform with all the fundamental metrics, screens, and analysis tools you need. Try it free for 14 days.

- Portfolio Insight is the newest and most complete portfolio management tool with built-in stock screeners. Try it free for 14 days.

Receive a free e-book, “Become a Better Investor: 5 Fundamental Metrics to Know!” Join thousands of other readers !

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor, analyst, and writer on dividend growth stocks and financial independence. His writings can be found on Seeking Alpha, InvestorPlace, Business Insider, Nasdaq, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial sites. In addition, he is part of the Portfolio Insight and Sure Dividend teams. He was recently in the top 1.0% and 100 (73 out of over 13,450) financial bloggers, as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.